Some of the best performing stocks in America this year are from large, national homebuilders – strong consumer demand, limited competition from the existing home sales market, and an improving supply chain have boosted their outlooks.

On Monday, homebuilder confidence moved into positive territory for the first time in nearly a year, while Census data on new residential construction showed housing starts rose 21.7% from April, and up 5.7% from May 2022, to 1.63 million. In fact, the number of units under construction in the United States right now approaches the highest levels recorded in the last 50 years at 1.69 million.

But BTIG/Homesphere‘s latest survey from small- and mid-sized homebuilders casts a light shadow on this bright overview. The monthly BTIG Survey indicates that building activity among smaller homebuilders cooled slightly from April to May, though sentiment remains much higher than last year.

The survey solicits the perspective of approximately 75-125 small- and mid-sized tract homebuilders nationally about sales, customer traffic, and pricing trends (117 responses this month).

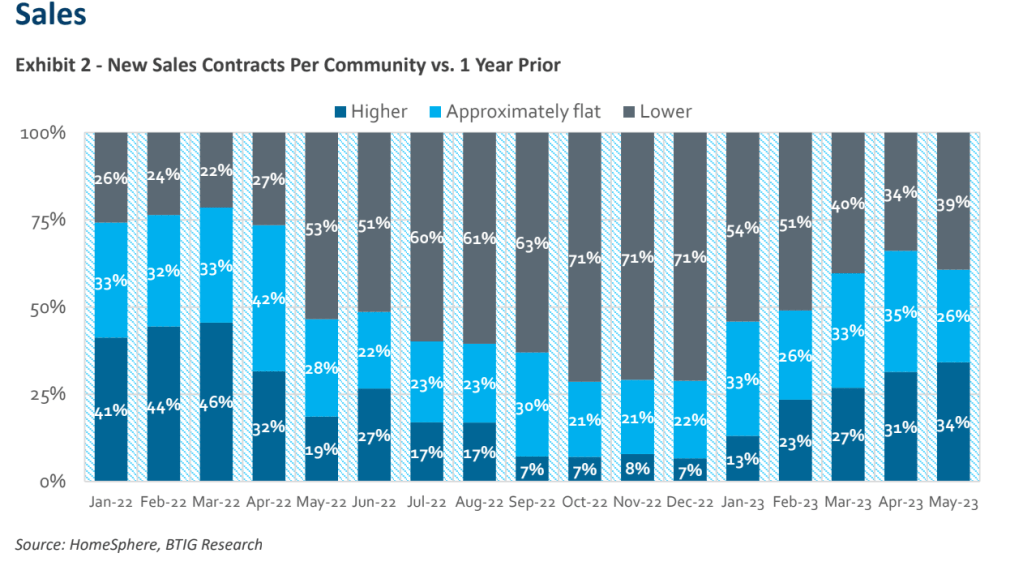

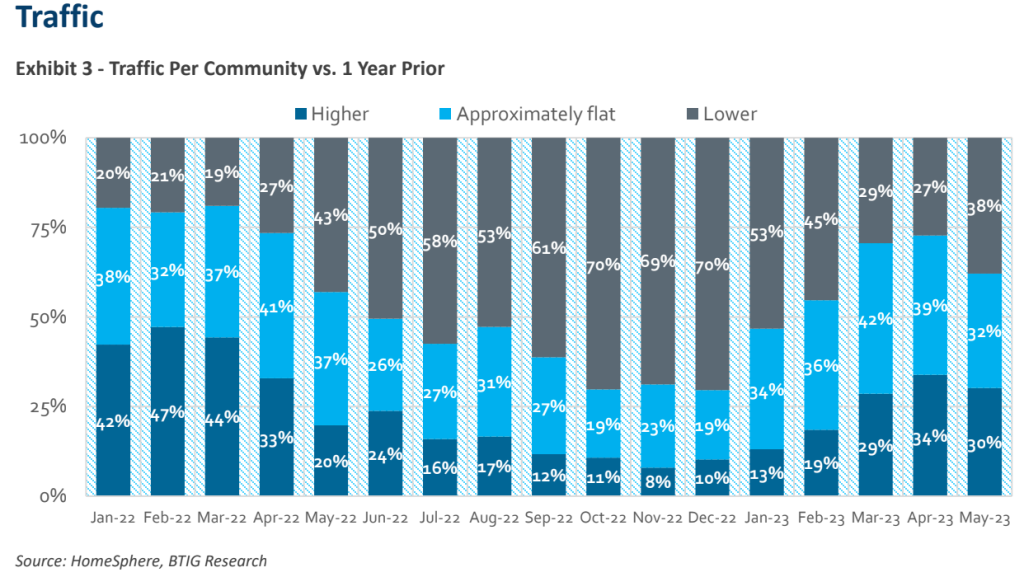

Sales and traffic trends were a mixed bag in May. After big jumps in sales trends since the winter slump, the number of builders reporting year-over-year growth was 34% in May, up from 31% in April 2023. Traffic was down slightly, with 30% of builders reporting higher community traffic year-over-year compared to 34% in April 2023. Both metrics are considerably better than May 2022. Meanwhile, 39% saw a drop in orders vs. 34% in April and 53% in May 2022.

“Our survey suggests new home demand momentum slowed in May. We had expected stronger results this month given easing comparisons and positive anecdotal public builder commentary…the May uptick in 30-year mortgage rates may have also impacted trends,” commented Carl Reichardt, an analyst at BTIG.

Sales and traffic relative to expectations weakened a bit as well, with 37% of respondents seeing sales as better than expected vs. 38% last month. Meanwhile 26% saw sales as worse than expected, vs. 20% last month. On traffic, 35% saw better-than-expected traffic, with 23% reporting worse-than-expected traffic (compared to 42% and 15%, respectively, last month).

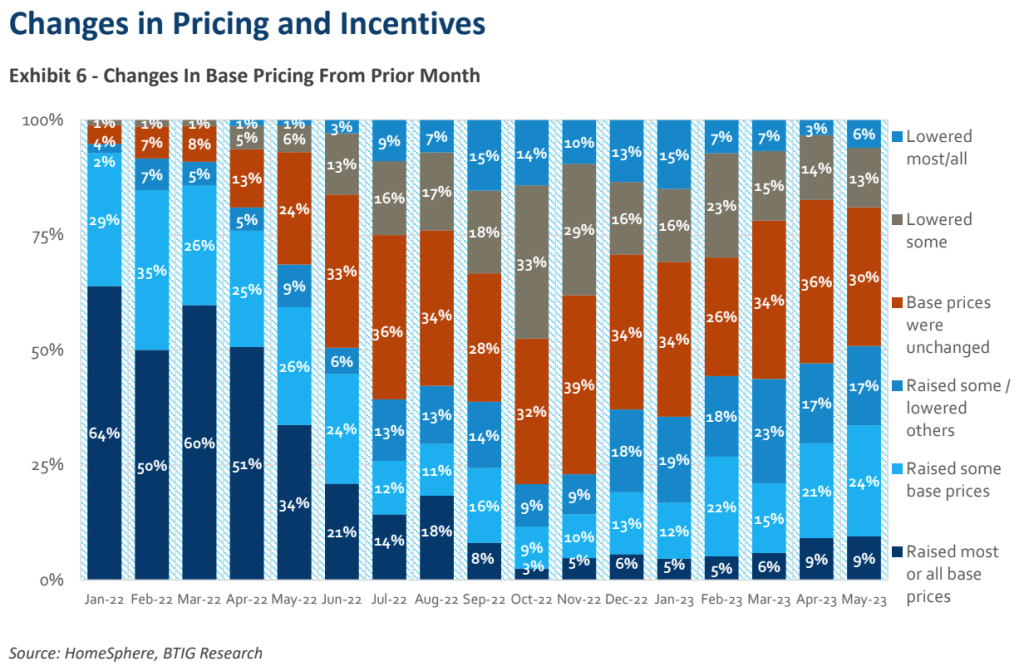

Builder pricing activity remained mixed. One-third of builders reported raising either “most/all” or “some” base prices, up from 30% in April. And 19% of builders lowered “most/all” or “some” base prices compared to 17% in April. Per the survey, 27% of respondents reported increasing “most/all” or “some” incentives, versus 22% in April. Only 3% reported decreasing “most/all” or “some” incentives compared to 7% in April. No builder reported decreasing “most/all” incentives in May.

“We believe builders have likely kept a careful eye on prices and incentives as they tracked traffic and buyer interest during the key spring selling season (typically February through May),” Reichstadt wrote. “We believe this is likely particularly true for private builders with more focus on mid level price points as opposed to low-end, volume-oriented public builders, who we believe have generally been very aggressive on pricing/incentives.”