Along with important details about the health of the Home Equity Conversion Mortgage (HECM) book of business inside the Mutual Mortgage Insurance (MMI) Fund, the Federal Housing Administration (FHA) annual report to Congress also offers a breakdown of the product types most used and demographic trends associated with HECM business activity.

The annual report highlights an uptick in HECM volume but also details how claims against the MMI Fund from the HECM program fell in FY 2022; the growth of the HECM maximum claim amount (MCA) driven by higher appraised values of homes; racial and gender divides between segments of reverse mortgage borrowers and changes in their average ages; and a breakout of HECM loan types including traditional, refinance and purchase loans.

Breakout between HECM loan types: H4P is down, H2H is up

According to FHA data, FY 2022, which ended on Sept. 30, saw a total of 64,437 endorsed HECM loans, up from 49,207 loans in FY 2021.

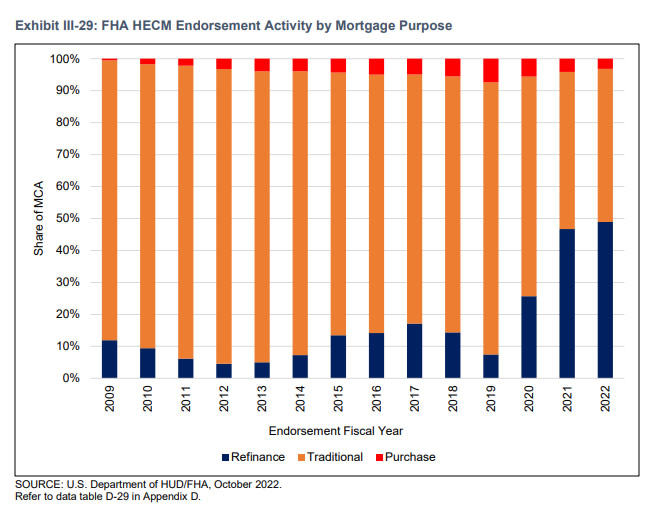

For as much as the HECM-to-HECM (H2H) refinance boom defined reverse mortgage volume one year ago, total H2H activity actually increased in FY 2022. H2H share of total reverse mortgage volume in FY 2022 accounted for 48.88% of all recorded endorsements in the year, a slight increase on the 46.72% figure recorded in FY 2021.

However, 2022 also saw the definitive end of the H2H refi boom as higher levels of HECM for Purchase (H4P) combined with a significant increase in mortgage rates, diminishing the utility of such a refinance for borrowers.

Continuing a trend observed since 2015, FHA also recorded a sharp increase in consumer preference for adjustable rate mortgages (ARMs) in the HECM sphere. Compared to the period between 2016 and 2020 where borrowers far and away preferred fixed-rate products, FY 2022 saw 95.06% of all FHA HECM endorsements favor ARMs instead.

“This change in composition is, in part, a result of policies implemented in FY 2014 related to the insurability of fixed-rate HECMs, including eliminating the option of future draws and a reduction in the amount of principal made available to the borrower,” the report reads regarding the ARM data.

As popular as it appears to be among a segment of devoted reverse mortgage professionals, the rate of H4P loans went down once again in FY 2022, continuing the downward trend observed in the last two fiscal years. H4P endorsements made up only 3.2% of all HECMs in FY 2022. H4P penetration reached an all-time high in FY 2019 when it made up 7.4% of all HECM endorsements, but dropped to 5.58% and 4.17%, respectively, in FY 2020 and 2021. Still, the loan type has gained ground since FY 2009, where it made up only 0.47% of all HECM endorsements that year.

In terms of payment plan options, borrowers continue to overwhelmingly prefer the line of credit (LOC) draw option, with FY 2022 seeing 92.77% of all HECM endorsements falling under it. This trend has been in place since 2009, where it has fluctuated between 85-93%.

Demographic, geographic reverse mortgage activity

While HECMs are only available to borrowers aged 62 or older, there is some notable variation in the types of people within the age group that are seeking out reverse mortgages. In terms of gender differences among single borrowers, women continue to outnumber men with 22,702 single female seniors taking out HECMs in FY 2022.

Single men composed 12,555 reverse mortgage borrowers in the same period. Loans with multiple borrowers continue to outnumber both, however, with 27,318 endorsements including two people.

In terms of the racial composition of reverse mortgage borrowers, they are broadly far more likely to be white. White borrowers made up 45,829 borrowers in FY 2022, though shares of Black and Hispanic borrowers made up more endorsements this year than in FY 2021.

In FY 2022, 71.12% of HECM endorsements served white borrowers, 6.07% served Black borrowers, 5.03% served Hispanic borrowers, 1.08% served Asian borrowers, and 0.31% served Native American borrowers.

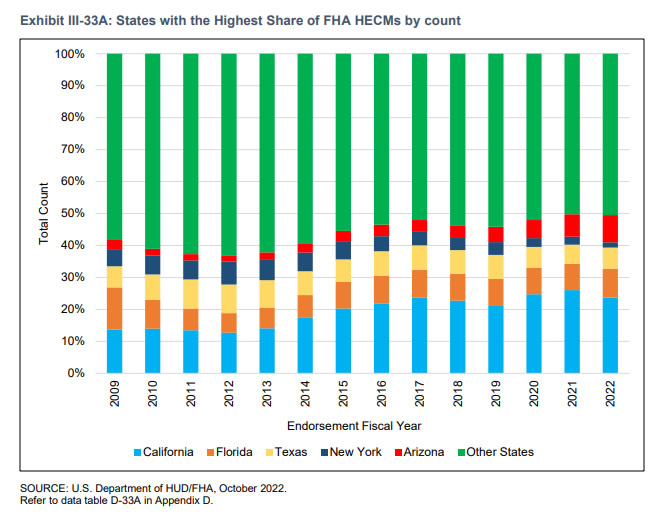

Geographically, HECM activity remains concentrated in a few key states. California remains the single largest state for HECM production in the nation, with 23.69% of all raw HECM volume 31.88% of all HECM MCA coming from there. This is also likely one of the reasons that the HECM program is so sensitive to changes in HPA levels, according to the report.

“The top five states represented 49.49% of new HECM endorsements in FY 2022, illustrating that the geographical risk profile for the HECM program has become more concentrated in recent years,” it reads. “As a result, future HECM performance will most likely be more reliant on economic factors such as house price appreciation in these specific states, particularly in California where the share of HECM counts is 2.6 times greater than that for Florida, the state with the second highest share of HECMs.”

As detailed earlier this week, the HECM book of business inside the MMI Fund reached a positive capital ratio for only the second time since 2015, according to an annual actuarial review of the fund’s finances and the FHA’s Annual Report to Congress, which were released Tuesday. The value of the MMIF is approximately $15.1 billion for 2022 — a sharp annual increase compared to $3.8 billion valuation in 2021.

Read FHA’s Annual Report to Congress for the fiscal year 2022 at HUD.