The landscape for home flipping across the country was challenging in 2023 as fewer single-family homes and condominiums were flipped and investment returns on these projects declined.

A total of 308,922 single-family homes and condos were flipped in 2023, down 29.3% from the 436,807 flips in 2022. This marked the largest annualized decline for the sector since 2008, according to recently released report from real estate data analytics company Attom.

Of the 65,656 homes flipped in fourth-quarter 2023, there were a total of 52,701 investors involved, translating to a ratio of 1.25 flips per investor.

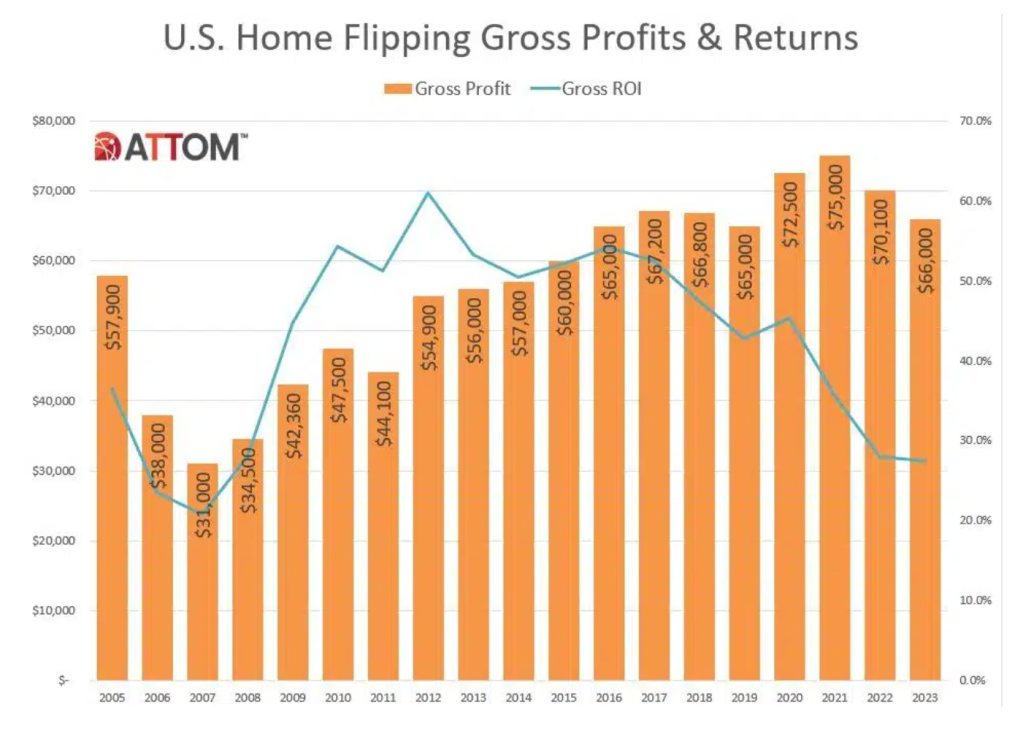

At the national level, homes flipped in 2023 were sold for a median price of $306,000 and generated a gross flipping profit of $66,000, a 5.8% decline from the typical profit of $70,100 in 2022.

Return on investment (ROI) was 27.5% in 2023, the lowest level posted since 2007. For comparison, ROI was 28.1% in 2022 and 35.7% in 2021, which was the highest level this century.

“Whether the overall market has soared or seen just modest gains in recent years, investors have missed out on the action,” Barber said.

“The sharp decline in the number of home flips likely reflected a combination of a tight supply of homes for sale as well as dwindling returns. Either way, it will take some significant reworking of the financials for home flipping fortunes to turn back around.”

The share of flips that were initially purchased with cash rose to 63.9% in the fourth quarter, up from 62.8% in the third quarter but down from 65.6% from Q4 2022.

For the entire year, about 63.5% of homes flipped were bought with cash, down from 64% in 2022 and from 63.8% in 2021.

Home flips as a portion of all sales transactions dropped in 112 of the 212 metropolitan statistical areas analyzed in Attom’s report.

The largest decreases came in the South and West regions. Gainesville, Georgia, witnessed the largest decline as flips represented 15.1% of all sales in 2022 but only 9.9% in 2023.

Phoenix followed closely behind as home flipping rate dropped from 16.3% to 11.9% of all sales during the year. It was followed by Prescott, Arizona (down 3.8 percentage points); Charlotte, North Carolina (down 3.6 percentage points); and Provo, Utah (down 3.4 percentage points).

Is a home bought and resold within a 12 month period considered a fix and flip (or the same calendar year)? What data/inputs are being used here?

TY!

plummet??? a 5.8% decline is considered plummeting?