The Consumer Financial Protection Bureau (CFPB) released a new report and analysis of data disclosed in 2021 by the Home Mortgage Disclosure Act (HMDA) in an effort to better understand the landscape of the mortgage market, featuring extensive amounts of mortgage information disclosed by financial institutions.

The new report features key information specifically relevant to the reverse mortgage industry and the Home Equity Conversion Mortgage (HECM) program, including a tabulation of the top 10 lenders based on HMDA data reporting, lending activity taking place in low-to-moderate income (LMI) neighborhoods and among minority populations.

Top 10 lenders, industry activity

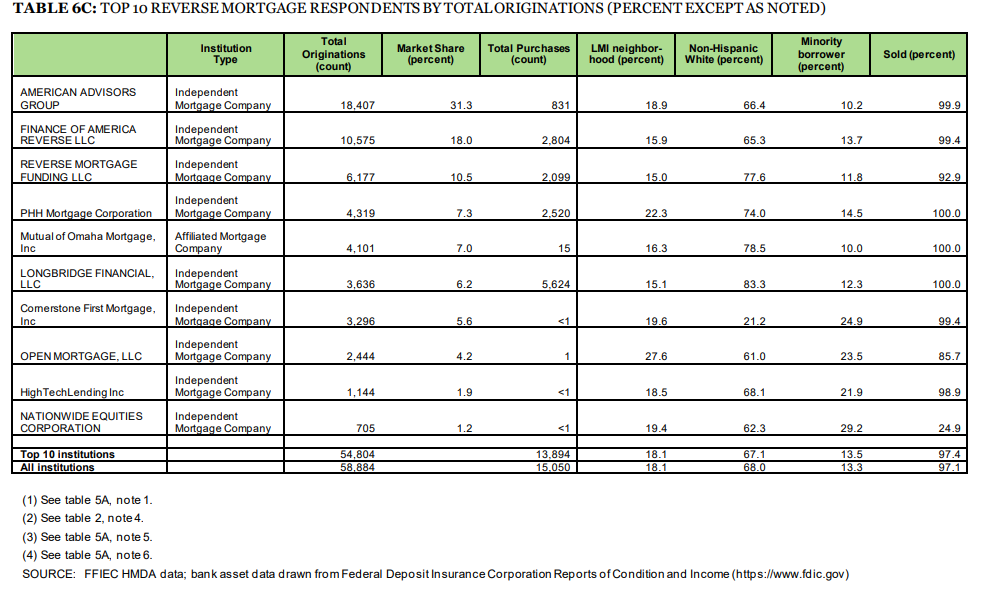

When tabulating the major reverse mortgage lenders in the space, the HMDA data does not present a significant change to the majority of recent top 10 lender rankings based on the information made available. Additionally, the top 10 lenders in the space accounted for the overwhelming majority of all reverse mortgage industry activity, the report details.

“In total, the top 10 reverse mortgage lenders accounted for a little under 55,000 reverse mortgage originations, or approximately 93.1%, of all reverse mortgage originations reported under HMDA in 2021,” the report reads. “American Advisors Group continued to be the largest reverse mortgage lender that reported HMDA data in 2021, accounting for approximately 31.3% of all reverse mortgage originations reported. It was followed by Finance of America Reverse LLC with an annual market share of 18.0%.”

The data also shows that in 2021, reverse mortgages for purchase accounted for 4,000 originations among the total share of reverse mortgages listed in the report, which would make for a noticeable though modest increase in this loan type for the industry.

In comparison to home equity line of credit (HELOC) volume, reverse mortgage activity increased more on a relative basis but is still largely dwarfed by HELOC volume for the year.

“Unlike the previous three years, the total number of HELOCs reversed its downward trend and increased from 869,000 in 2020 to 962,000 in 2021, a 10.7% increase,” the report says. “This number of HELOC originations is still lower than the number of HELOC originations in 2018 and 2019. Similar trends applied to the HELOC applications. The total number of reverse mortgage originations also increased from 43,000 to 59,000 from 2020 to 2021, an increase of over 36%.”

Other industry activity, the refi boom

2,000 reverse mortgage originations are also listed in the report as being originated for the purpose of home improvement. The reverse mortgage data also breaks down industry activity further, however, by looking at how much activity was focused on LMI neighborhoods and minority borrowers.

According to the data, both the top 10 lenders and industry-wide activity saw 18.1% of industry activity focused on LMI neighborhoods, with the largest single lender active in such areas being Open Mortgage at 27.6%. The largest server of minority borrowers in the space according to the data is Nationwide Equities, with 29.2%. The industry average for serving minority borrowers sits at 13.3%, according to the data.

As noted previously, reverse mortgage industry volume increased significantly in 2021 due to a sustained increase in HECM-to-HECM refinance activity, which depending on different tabulations accounted for nearly-to-just-over half of the industry’s total volume for the year. The refi boom now has largely dissipated according to recent data and analyst perspectives shared with RMD, with guidance from analysts, product educators and industry leaders largely focused now on encouraging the attainment of new customers that have never before had a reverse mortgage.

Additional HMDA data analyzing mortgage performance in 2021, including for reverse mortgages, may come from the CFPB in the future. Read the 2021 Mortgage Market Activity and Trends report at the CFPB.