As the role of Freddie Mac and its government sponsored enterprise counterpart, Fannie Mae, have grown in the housing market, both enterprises have looked to various methods to share some of the credit risk that stems from their support of the mortgage market.

Stretching back into 2013, both GSEs have offered up credit risk-sharing deals in various forms. Fannie has offered up four risk-sharing deals under its Connecticut Avenue Securities platform.

Freddie has also offered up credit risk-sharing deals in the form of its Structured Agency Credit Risk transactions, called STACR for short.

Until breaking new ground in August, the previous Freddie STACR offerings were all supported by loans that carried loan-to-value ratios of between 61%-80%, with an average LTV of roughly 75%.

In the August deal, called STACR 2014-HQ1, Freddie offered up a deal supported by loans with LTV ratios of somewhere between 80% and 95%. The average LTV was 92% and the pool carried a balance of $9.975 billion, spread across 45,112 loans.

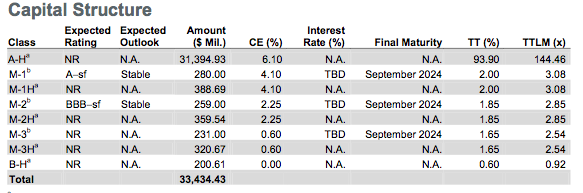

Now, Freddie is prepping another high-LTV ratio deal, but this one is much larger than the first high-LTV offering. STACR 2014-HQ2 carries an unpaid principal balance of $33.43 billion and a weighted average LTV of 91.6%.

According to Fitch Ratings, which issued its presale report on Monday, the pool consists of loans acquired by Freddie in the first three quarters of 2013. Fitch notes that the higher LTV loans are subject to the same underwriting, quality control, and servicing practices as those with original LTVs below 80%.

“While the transaction structure simulates the behavior and credit risk of traditional RMBS mezzanine and subordinate securities, Freddie Mac will be responsible for making monthly payments of interest and principal to investors based on the payment priorities set forth in the transaction documents,” Fitch writes in its report.

According to Fitch’s report, there are 147,771 “prime-quality” loans that make up the $33.43 billion in the pool. The borrowers carry an average debt-to-income ratio of 33.2% and have an average credit score of 757.

In its presale report, Fitch said that it expects to rate the M-1 and M-2 notes in the deal. Click the image below for Fitch’s expected ratings.

“Given the structure and counterparty dependence on Freddie Mac, Fitch’s rating on the M-1 and M-2 notes, along with their corresponding MAC notes, will be based on the lower of: the quality of the mortgage loan reference pool and credit enhancement available through subordination and Freddie Mac’s issuer default rating,” Fitch said in its presale report.“The notes are issued as uncapped LIBOR-based floaters and have 10-year legal final maturities.”

Fitch noted that only 850 of the underlying loans were reviewed by a third-party diligence provider, but that “the results indicated limited findings or were deemed as nonmaterial by Fitch.”

According to Fitch’s data, 53.96% of the loans carry an original collateralized loan-to-value of greater than 90.01%. But despite the high LTV ratio, Fitch cites the borrowers high original credit score as a positive of the deal.

“The collateral pool consists of borrowers with strong credit profiles, demonstrated by the high original WA FICO score of 757,” Fitch said in its report. “Approximately 30.8% of the borrowers have credit scores of 780 or higher. Borrowers with high credit scores generally experience a lower probability of defaulting on their debt.”