In the first month of the year, the nation’s home-sale prices increased by 6.7% from 2019 levels, coming in at a median of $306,400, according to Redfin.

Of the 85 largest housing markets Redfin tracks, only three saw a year-over-year decline in the median sale price in January, including San Jose, California; Baton Rouge, Lousiana; and Greenville, South Carolina, which dropped 4.3%, 4.1%, and 1.4%, respectively.

During the month, home sales increased by 6.7% year over year, marking the sixth consecutive month of increases.

Despite this gain, sales were still down 1.1% from December on a seasonally adjusted basis and homes spent two fewer days on the market than they did in 2018.

Redfin attributes this decline to the nation’s lack of housing inventory, which is causing a crunch in housing markets across the country, even in the nation’s most expensive coastal cities.

In January, the active listings of homes for sale fell 11.4% year over year, marking the biggest drop since March 2013 and the sixth consecutive month of declines.

Not only were there fewer homes available for sale than any time since January 2013 but also none of the 85 largest metros tracked by Redfin posted a year-over-year increase in the count of seasonally adjusted active listings of homes for sale, according to the company.

This has led to an uptick in bidding wars, which is significantly benefiting American home sellers.

“Typically, we don’t see this many buyers in January, but with mortgage rates at a 3-year low, there are plenty of early-birds hoping to secure a home and lock in an affordable mortgage payment,” said Redfin chief economist Daryl Fairweather. “Home sellers, on the other hand, see that the market is clearly heating up and have no reason to rush to list their homes or to make price cuts in order to secure a sale.”

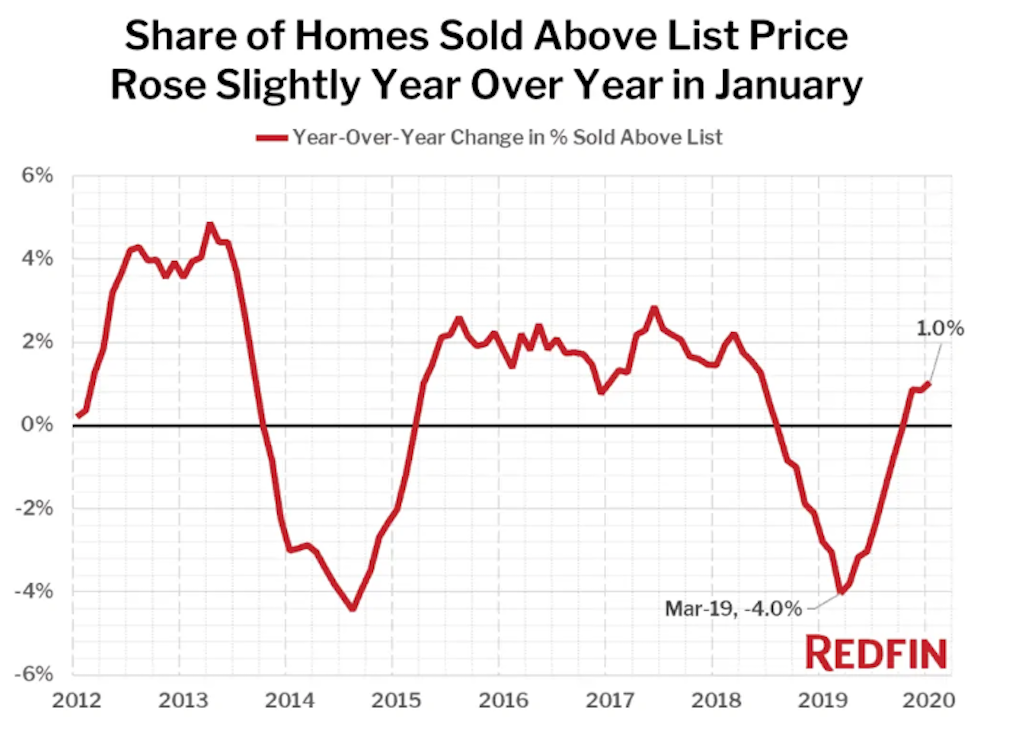

Throughout January, the share of homes that sold above list price increased 1.1 percentage point year over year, coming in at 18.7% compared to 17.6% a year earlier.

“Buyers are getting pretty upset about the lack of inventory,” said Seattle Redfin agent Pauline Corbett. “There’s a growing sense of desperation as bidding wars stretch out their home searches.”

The image below highlights the share of homes sold above listing price in January: