Before Thursday, March 4, John was an unabashed fan of United Wholesale Mortgage. His West Coast brokerage shop sent tens of millions of dollars in loans to the wholesale mortgage giant in recent years. He loved their turn times, found their pricing to be competitive, and had good things to say about his account executive. He also believes UWM President and CEO Mat Ishbia is sincere when he says the ultimatum was issued to protect the broker channel from existential threats, specifically from Rocket Mortgage and Fairway Independent Mortgage.

“It’s honestly an excellent company,” he said of UWM.

But as of Monday, he will no longer do business with the lender, which originated over $182 billion in mortgages last year and is easily the biggest producer within the space.

“The reason I do this, the reason I’m a broker, is because I believe in choice – it’s that simple,” said John, whose real name is being withheld by HousingWire so he can speak openly about his decision. “So Mat can talk about how he’s doing this to protect brokers and all, but I just felt like what he did is anti-choice, anti-consumer and it isn’t aligned with our values. So yeah, we’re not going to sign.”

Ishbia, whose company went public in January and is valued at $16.58 billion, made arguably the biggest hardball play in the history of the broker channel in issuing his ultimatum on Facebook Live. At stake is the business of about 3,000 brokers who use UWM, Rocket and/or Fairway.

In Ishbia’s estimation, these two companies, which both have retail operations, are trying to cut the broker out of the mortgage equation. Rocket is training real estate agents to originate loans, and Fairway is trying to poach loan officers, he claims. And if such moves go unchecked, brokers could find themselves an endangered species in a decade, Ishbia believes.

“A lot of people think NAR [National Association of Realtors] should have protected real estate agents from Zillow,” the UWM chief said in a message to brokers this week. “In the same type of way, we’ve got your back and always will…This decision was made for the greater good of the broker channel…we’re not telling you what to do. It’s your choice, your option. We’re basically stating our business plan, our philosophy, which is ‘don’t help the enemy of the channel.'”

But interestingly, Ishbia’s plan hasn’t merely divided loyalties among brokers who prefer one firm or another. Rather, it’s exposed two different philosophical bents that are now on a collision course: the notion that brokers face an existential threat from Rocket and are in effect being saved from themselves, or that the whole reason for being a broker is to be completely independent and provide the customer the most competitive options possible.

In the time since Ishbia issued his ultimatum, HousingWire has spoken to dozens of brokers and their LOs, from big shops that originate billions in volume, to five-man shops that spread their small bounty of loans to a few preferred shops. This story is about the decision they’ve been forced into making, and what happens when the clock strikes midnight on Tuesday.

How did we get here?

In some ways, it would have been easy for Ishbia, 40, to have kept the status quo. His firm currently has about one-third of the broker channel’s market share, is the largest purchase lender in America, and has earned considerable goodwill with large segments of the broker network over the years. Though he has his share of detractors, it’s not an exaggeration to say that some brokers believe he has single-handedly resurrected the broker channel, which lost standing – and market share – following the financial crisis.

“There are people in the AIME crowd who would take a bullet for Mat,” said one top East Coast broker who’s flown into Michigan and attended several training sessions with UWM. “He has a lot of power over a lot of brokers. He knows what he’s doing. Mat isn’t a short-sighted guy. This is part of a bigger ideology. He really believes this could happen if he doesn’t do something.”

Ishbia could have kept prices low, offered additional products brokers have clamored for (jumbo loans, for example), continued to pump money into recruiting retail LOs into wholesale firms, the broker said. He could have simply kept trucking along.

For brokers who say they’re “all in,” Ishbia issued the ultimatum because he believes he had no other choice. In their view, it’s not unlike a parent who tells their kids they can’t eat ice cream for dinner and watch TV until 1 a.m. on a school night. Perhaps it’s paternalistic, but he’s looking out for the best interests of the brokers, even if it hurts a few brokers in the short-term. Who cares if you’re missing a single meal now when extinction could be on the horizon? These are serious times.

To protect against that possibility, he’s taking a stand against Rocket and Fairway before they’re too big to stop, the thinking goes.

“We decided to stay with UWM because Quicken/Rocket is the sleeping giant,” said Joseph Shalabi, CEO of E Mortgage Capital, which funded about $4 billion in mortgages last year. “The broker community continues to empower Rocket by expanding their wholesale channel, thereby increasing the likelihood that their Rocket professional platform will gain more traction and create the potential of eradicating our past, present and future business relationships.”

“I am partnering with UWM because they have proven to be all-in on helping brokers win,” United Wholesale Lending owner Peter Galvez said in a statement. “The mortgage and real industry is changing. We have seen how Zillow and Redfin have leveraged technology in an attempt to slowly eliminate the need for local real estate agents.

“Similarly, we are seeing the same trend with certain lenders who are aggressively pursuing our past clients while simultaneously marketing directly to our Realtors. UWM genuinely cares about the success of their partners and understands that the clients that we bring to them, are indeed ‘our’ clients,” Galvez continued. “They have done so much for brokers in terms of technology, resources, underwriting speeds and providing tools to maximize broker productivity and help us stay in front of our clients. UWM is focused on the long term success of the broker community, which is the reason that our company has made the decision to avoid lenders that ultimately could be detrimental to our business.”

Ishbia, who has invested heavily in technology, has made it clear that he wants to control 50% of the broker channel. He estimates the broker channel could grow from just under 20% of the overall market to 33% by 2025. That expected growth is the cornerstone to his business.

Of course, there are skeptics who say Ishbia’s act wasn’t some principled act. It’s business, plain and simple – cut a competitor down at the knees.

“One of the big questions the broker community is asking is, why are they forcing brokers to make a choice? It’s not because of morals, in my opinion, it’s not because of a principled stance like they’re claiming,” said Austin Niemiec, head of Rocket Pro TPO. “It’s because of fear.”

According to Niemiec, Rocket last year originated $97 billion in the broker channel (overall, Rocket originated about $320 billion in mortgages, the vast majority through its consumer-direct platform). While UWM may be the biggest player in wholesale, Rocket’s operation is the second-largest, and it’s growing at a much faster clip, according to Niemiec, at over 400% since 2017. Rocket also says UWM’s claims are false, mere scare tactics.

In Rocket’s view, Ishbia’s maneuver has backfired – Rocket Pro TPO saw broker loan registrations increase 40% the week that followed Ishbia’s announcement, the rival firm said. Three of Rocket Pro TPO’s top 10 days in company history happened after the ultimatum, according to the lender.

“Brokers are incredibly savvy businesspeople who are choosing to work with us because they value what is best for their company and their clients,” the company, headed by Dan Gilbert, said in a prepared statement. “They don’t need anyone to tell them who they can and cannot work with. The broker community knows that Rocket Pro TPO was there to help them a year ago when other lenders, like UWM, turned them away because capital was tight at the start of the pandemic.”

This is ultimately a struggle about the identity of the independent mortgage broker, said one broker-owner on the East Coast.

“It comes down to, their big thing is they may feel like they’re protecting the broker channel from Quicken because they feel like Quicken is a threat to the broker channel,” he told HousingWire. “And what the broker channel thinks is a bigger threat than anything is the loss of our independence. We all look at Rocket as much less of a threat than the loss of independence of independent mortgage brokers.”

This broker-owner said he has spoken to a number of brokers who don’t believe UWM’s stated motivation. “It’s like, don’t piss on my leg and tell me it’s raining.”

But UWM supporters said a lot of brokers who aren’t “all in” fail to see the wolf at the door. They’re willfully ignorant or driven by short-term gains over the health of the ecosystem, some UWM-aligned brokers say.

“I’m telling you, man, these guys just don’t get it,” one broker-owner of a mid-sized shop in the Midwest told HousingWire. “They talk about independence, but it’s like, do you seriously think Rocket will do good by you? The first chance they get, they’ll flick you aside. If it were up to them, brokers would just be a cog in the Quicken wheel, making like $20 an hour in a call center somewhere. That isn’t an exaggeration. Especially the smaller brokers. They’re going to get crushed.”

The UWM addendum

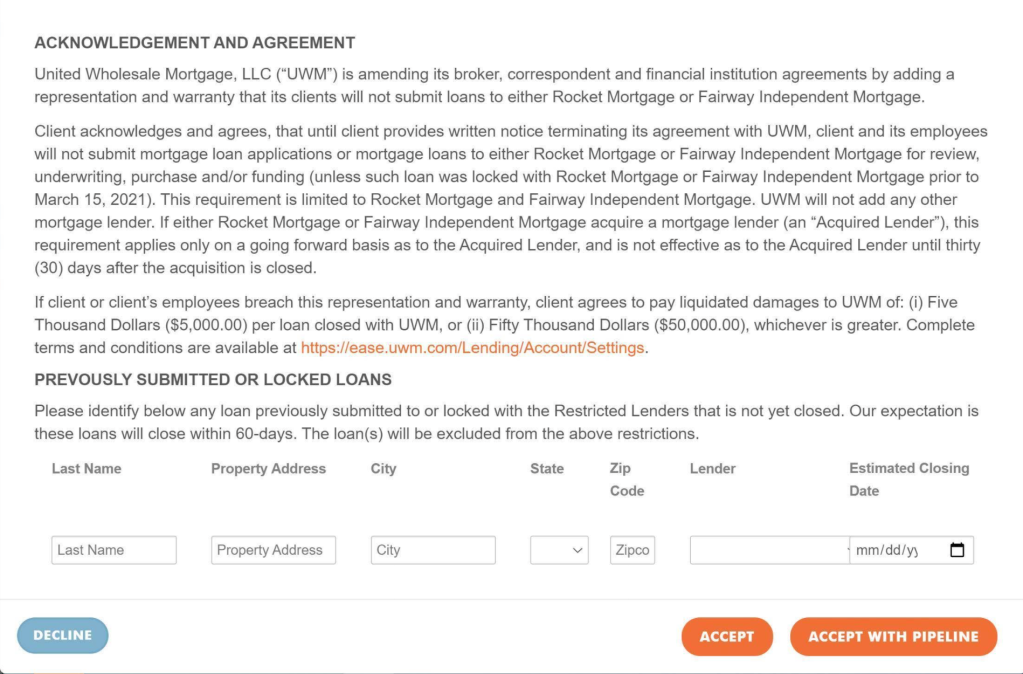

When broker-owners log into UWM’s system to check their pipeline, they immediately receive a prompt. It states that UWM has amended its broker, correspondent and financial institution agreements by adding a representation that its clients will not send loans to Rocket and Fairway, effective March 15. It notes that the agreement is limited to Rocket and Fairway. “UWM will not add any other lender,” the addendum says.

The agreement then informs the broker that it will fine violators $5,000 per loan closed, and up to $50,000 per month, whichever is greater. Brokers are then prompted to identify loans in the pipeline with Rocket and Fairway. Starting at midnight on Tuesday, if they haven’t agreed to the addendum, it’s not possible to push new loans into the system on Blink Plus. The broker-owner can accept UWM’s agreement, accept the pipeline, or decline.

Most brokers who spoke to HousingWire over the last week said their account executives at UWM were helpful and responsive in what was undoubtedly a stressful week. But a few brokers showed HousingWire testy exchanges they had with their AEs. In one, an AE told a broker who refused to sign the addendum, “don’t expect me to lift a finger to help any of your LOs with loans they have in process.”

In Ishbia’s mind, he’s not restricting choice: he says there are 74 lenders to choose from. You just can’t choose two lenders that are actively doing you and other brokers harm and still work with UWM, he says.

The decision is ultimately up to brokers, he said.

“A broker can accept, and in six months can change their mind and say we don’t want to work with UWM, we want to go work with Fairway and Rocket. I say good luck to you. We wish you nothing but the best, go close out your pipeline,” Ishbia told HousingWire on Friday. “And the reverse can happen, too: they can decline and then in six months, they’re like, ‘We get it now, we’re all in. We want to come work with UWM.’ Then you just click accept on the addendum and you start working with UWM. It’s very simple.”

The broker conundrum

John, the West Coast broker-owner, said UWM is the top lender by volume at his mid-sized shop. Number two is Rocket. Some of his 80 loan officers prefer UWM, others prefer Rocket. They also have a series of one-off lenders they use on occasion, he said. No matter which mortgage titan he chooses, it’s going to hurt his business.

“We have loan officers out there who love to use Rocket,” he said. “And we employ some of them, and I’ve never told my loan officers where to send deals. And so this is really hurting my business. I’m probably going to lose some people. If I lose two people, that’s probably 10 deals a month. That’s about 180 grand in revenue.”

After Ishbia’s announcement on Facebook Live, John sent a survey to the loan officers at his shop. About 56% of his loan officers said they would choose UWM over Rocket if they had to, according to the survey, which he shared with HousingWire. But they didn’t like being forced to make the decision. Of UWM’s ultimatum, 63% said: “It’s complete BS, hurts brokers, clients and our company.”

John and his business partner were planning to suck it up and sign the addendum. Later in the week, they changed their minds.

“I went to my business partner and I was like, ‘Look, I think we’re making the wrong decision. We started talking about it like, everybody thinks this decision sucks, and most people think it’s complete BS. And so if we cave right now…the outcome we want is for this to go away, just end this thing. So if we cave now, we’re asking other people to do our dirty work.”

He described UWM as “having a gun to our head.”

“If we all say, ‘You know what, we’d love to do business with you, but we’re not signing it.’ If a good chunk of people do that his, [Ishbia’s] submissions crater. The only people who sign, are the people who are so gung-ho he’s already getting 60% of their pipe, so he can’t go that much deeper with them.”

Several broker-owners said they would stick with UWM, but resented being forced to make a decision:

“If I get an ultimatum from UWM, I will stay at UWM just because they do everything to make sure I don’t lose my client base,” said one West Coast broker. “And that is worth a lot more than the processing help from Quicken on the .125% better pricing. However, I don’t like that I am being forced to choose. I think that’s wrong. I don’t think UWM should tell me where to send my loans. The bottom line is that it is the brokers responsibility to keep their client base and to make sure we stay relevant and profitable. My business does not depend on Mat Ishibia’s marketing plan.”

A number of mortgage brokers from across the country told HousingWire they were concerned about a slippery slope, although UWM has insisted that Rocket and Fairway are the only ones who will appear on the blacklist.

“We do not need anyone looking out for us, nor do we like someone giving us an ultimatum,” said Velinda Shirley, of Alliance Mortgage Group in Texas. “It is too much ‘big brother’ and socialistic! What’s next? Are they then going to decide that we have to do all brokered loans and not correspondent? Also, UWM runs far behind other lenders in what they pay. I don’t care they have other tools, my LOs are going to look at the YSP or SRP and generally go with who pays more. UWM AE’s are nothing more than a secretary, they cannot do anything to help. They have too many people employed and I don’t need to be paying for their new building or bridge to connect them. We want comparable commissions that other lenders pay.”

Shirley added that although she was unhappy with UWM’s decision, she didn’t exactly have a reservoir of good feelings toward Rocket. “I am signed up with Quicken…but I can tell you there are mistakes on every loan and none of my LOs like them,” she said. “I am fed up with them too. It is horrible that they charge the same amount for wholesale as correspondent – no other investor does that. Plus, they left out important docs for a Texas cashout and my attorney has refused to work with them. I am tempted to sign up with Fairway just to show Mat that he is not going to control who I deal with.”

Top broker shops all-in with UWM?

Though the edict was issued on March 4, the plan was a closely-guarded secret at UWM’s Pontiac headquarters for months, sources said. It caught many brokerages by surprise, big and small.

Between them, the biggest mortgage brokerages that do business with both UWM and Rocket are responsible for billions in originations per year. These shops typically employ over 100 loan officers or more and have favorable deals with their preferred lenders.

They’re also predominantly located in California. It’s why Ishbia flew out to the Golden State this past week to make his pitch to some of the top mortgage brokers in the country. Though we will not know for sure until 12:01 a.m. on Tuesday, Ishbia claims the majority of Rocket’s top broker partners have signed the addendum – over 90%.

However, five of those top broker-owners told HousingWire that, as of Saturday morning, they had not signed the agreement.

For both Rocket and UWM, Monday is the day of reckoning. If UWM were to bring some of Rocket’s top broker partners – including Thuan Nguyen’s Loan Factory, Barrett Financial Group, LemonBrew Lending Corp., Preferred Financial Group – it would significantly damage Rocket’s ability to compete, especially considering that UWM already locked down C2 Financial Corporation and Nexa Mortgage, two of the biggest shops in the country, observers told HousingWire.

“You get Thuan, that’s like, what, $4 billion in originations?” one large West Coast broker-owner told HousingWire. “That alone would be worth it financially for UWM.”

As of the weekend, Nguyen said he had not made a decision.

A pricing war, and margins

While the machinations coming from Pontiac and Detroit have thrown the broker community into chaos, it’s had another interesting effect: it’s added sizzle to a volatile market, and will push down already-shrinking margins.

According to its disclosure in Securities and Exchange Commission filings, UWM posted a gain on sale margin of 305 basis points in the fourth quarter. Margins were up over the 110 bps from the same period in 2019. But the company predicts that margins will compress to 200 to 235 bps in the first quarter.

Rocket has followed the same trend line – its gain-on-sale margin checked in at 441 bps in Q4, which was a decline of 11 basis points sequentially. The Detroit giant expects margins to fall between 360 bps to 390 bps. But that was before Ishbia’s ultimatum, which has already resulted in Rocket cutting prices in wholesale, at least in the short-term.

In some ways, Homepoint, another Michigan-based lender, could benefit from the fallout. A number of brokers told HousingWire over the past week that they would be signing up with the lender. On the company’s earnings call this past Thursday, CEO Willie Newman confirmed it when he told analysts and investors that they’ve seen a sharp uptick in new broker signups. But there is collateral damage, too. Margins were already compressing and the pricing war will sap profits further.

“I wonder if Homepoint is going to make any money in the first quarter,” quipped one broker who uses the Ann Arbor-based lender. “They’re usually already among the lowest priced options, it’s gonna be tough for them. Their thing is price.”

Though Homepoint had a record year in 2020 with $62.4 billion in originations, grew its market share in the channel to 8.2% by the end of 2020 and managed to scoop up over $600 million in profits, it simply doesn’t have the firepower to keep up with UWM and Rocket, both of which are better positioned to win a war of attrition.

Homepoint executives elected not to share its forecast on originations or gain-on-sale margins during the earnings call, perhaps a tacit acknowledgement that it’s going to take a toll.

The current dynamics in the wholesale channel will keep the CFOs up at night in the short-term, but in some ways, it’s good for brokers. At least for now.

“They’re all going to keep prices as low as possible, to the extent they can, for the next few months, at least,” said one East Coast broker who said he’s decided to drop Rocket and Fairway and will tie his horse to UWM. “But as soon as they can, prices are going to go back up. That’s the life of a broker.”

Stay tuned for updates detailing what some of the bigger shops decided to do.

Good article. Balanced from both sides.

As the CEO of NEXA Mortgage we have indicated a long time ago that we understand how companies like Rocket are damaging to Brokers and individual Loan Officers across the industry. We stood by our morals then and we applaud UWM for their decision to do so as well. Although we were unaware of their decision as it was announced, we are grateful for their leadership in doing so.

It is important to note however, that NEXA did this for our Loan Officers, we did not do this for UWM when we decided to stop doing business with Rocket Mortgage.