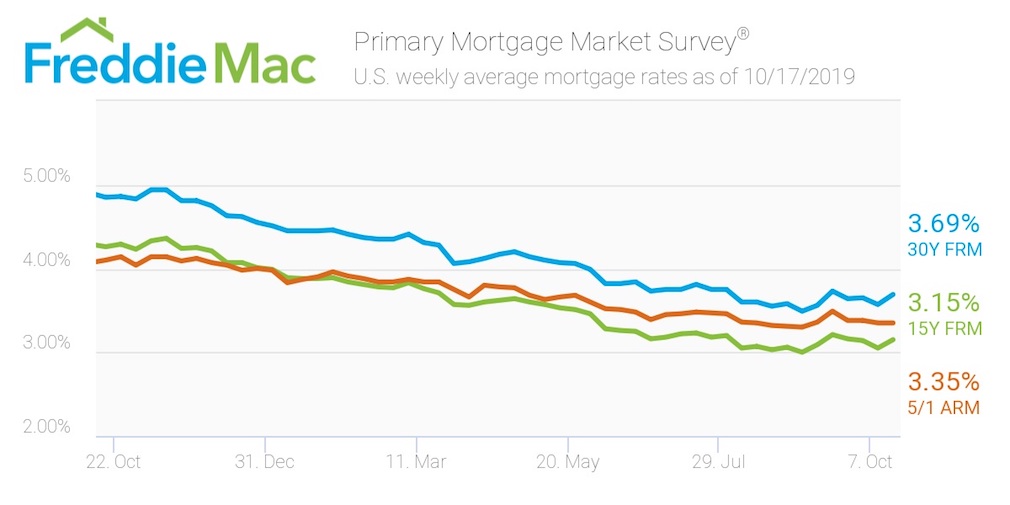

This week, the average U.S. fixed rate for a 30-year mortgage jumped to 3.69%. That’s 12 points above last week’s 3.57% but still more than a percentage point lower than the 4.85% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“Despite this week’s uptick in mortgage rates, the housing market remains on the upswing with improvement in construction and home sales,” said Sam Khater, Freddie Mac’s chief economist. “While there has been a material weakness in manufacturing and consistent trade uncertainty, other economic trends like employment and homebuilder sentiment are encouraging.”

The 15-year FRM averaged 3.15% this week, rising from last week’s 3.05%. This time last year, the 15-year FRM came in at 4.26%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.35%, holding steady from last week’s rate. Unsurprisingly, the percentage is still well below 2018’s rate of 4.10%.

The image below highlights this week’s changes: