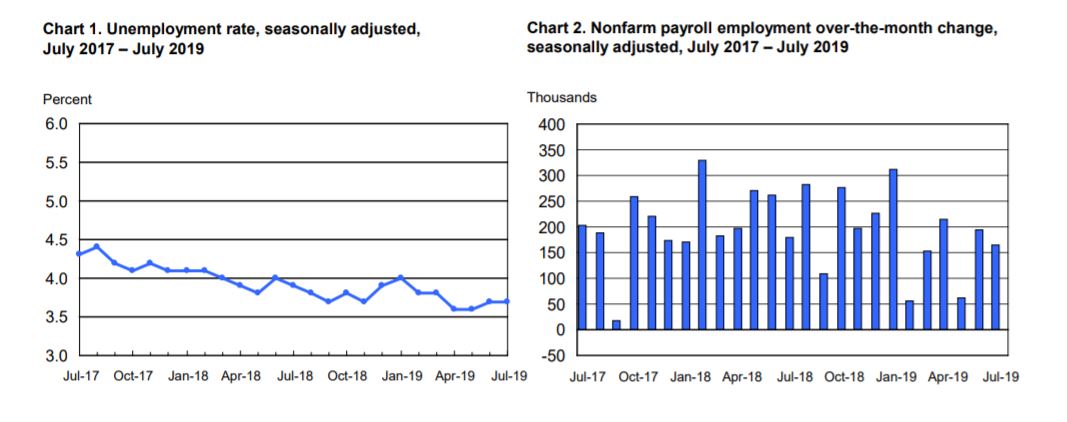

The U.S. economy added 164,000 jobs in July, fewer than June’s downwardly revised 193,000 hirings, according to the Bureau of Labor Statistics. The unemployment rate was 3.7%, matching last month’s rate.

Economists expected the so-called nonfarm payroll number to rise by 165,000 and the unemployment rate to drop to 3.6%, as measured by a Bloomberg poll, which would have tied the 50-year low set in April and May, but the addition of 370,000 new workers to the labor force brought the participation rate up to 63%, the highest in four months. July’s hiring pace was close to the monthly average for 2019, though slower than last year’s 223,000 a month.

“If job growth stabilizes at the current pace, we’re OK, but if it doesn’t, if it continues to slow, the chance of a recession rises,” said Mark Zandi, chief economist of Moody’s Analytics.

Professional and business services led the job gains with the addition of 31,000 positions, while health care added 30,000, according to the BLS report. Industries that saw little change during the month included construction, manufacturing, retail trade, transportation and warehousing, leisure and hospitality, and government.

"The economy continued to create jobs, but at a pace that's a little slower than it has been," said Robert Dietz, chief economist of the National Association of Home Builders. The numbers in the report were "consistent with our forecast that economic growth is going to continue to decelerate a little bit, which is why we saw the Federal Reserve reduce its rate this week."

Average hourly earnings in July rose by 8 cents to $27.98, matching the gain in June, the report said. Over the past 12 months, wages rose 3.2%. The average workweek contracted by six minutes to 34.3 hours.