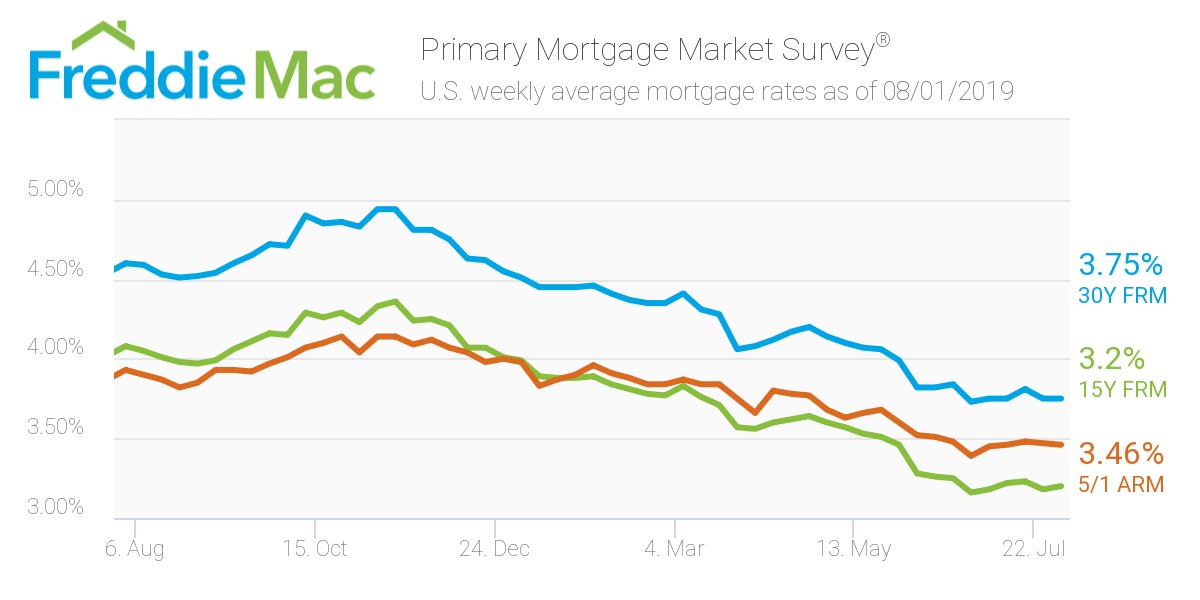

This week, the 30-year, fixed-rate mortgage averaged 3.75%, matching last week. A year ago, the rate averaged 4.60%, according to the Freddie Mac Primary Mortgage Market Survey.

“Mortgage rates have essentially stabilized over the last two months, which reflects the recovery and improvement in the economy from the malaise earlier in the year,” Freddie Mac Chief Economist Sam Khater said. “Going forward, the combination of low mortgage rates, tight labor market and high consumer confidence should set up the housing market for continued improvement in home sales heading into the late summer and early fall.”

The 15-year FRM averaged 3.20% this week, slightly rising from last week’s 3.18%. This time last year, the 15-year FRM came in at 4.08%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.46%, sliding backward from last week’s rate of 3.47%. This rate is much lower than the same week in 2018 when it averaged 3.93%.

The image below highlights this week's changes: