In the fourth quarter of 2018, more than 14.5 million American properties were rich with equity, according to ATTOM Data Solutions’ Home Equity & Underwater Report.

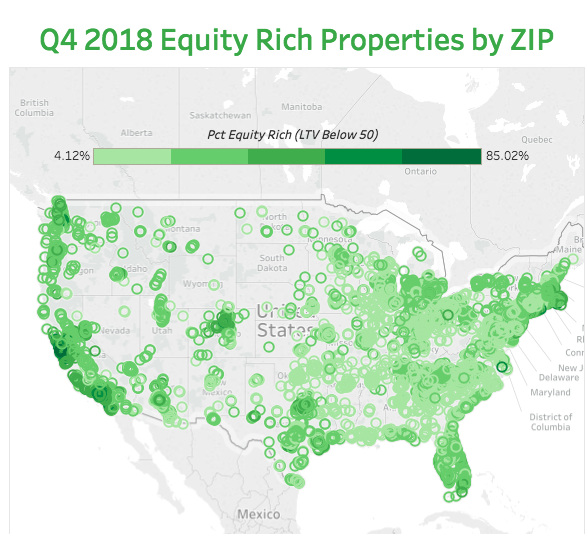

ATTOM defines equity-rich properties as those with secured loans that are 50% or less of the property's estimated market value.

According to ATTOM’s analysis, Q4’s total has risen by more than 834,000 year over year, marking the highest level since ATTOM began tracking data in Q4 of 2013.

Notably, these equity-rich properties represent 25.6% of all properties with a mortgage, increasing from last year’s total of 25.4%.

"With homeowners staying put longer, homeownership equity will most likely continue to strengthen,” ATTOM Data Solutions Chief Product Officer Todd Teta said. “Those that are seriously underwater may find themselves coming up for air as they continue to pay off excessive legacy mortgages or sell."

The report also revealed that more than five million American properties were underwater, meaning the combined estimated balance of loans was at least 25% higher than the property's estimated market value.

These underwater properties represent 8.8% of all American properties with a mortgage, falling from last year’s total of 9.3%.

Interestingly, the majority of underwater properties were located in South and Midwest markets, signaling homeowners in these markets are struggling to maintain their home's equity.

"This report helps to showcase a story of the West coast markets having the highest share of equity rich homeowners versus the South and Midwest markets, who continue to have stubbornly high rates of seriously underwater homeowners," ATTOM writes.

This image highlights equity-rich properties across the country:

(Click to enlarge; courtesy of ATTOM)

NOTE: ATTOM’s U.S. Home Equity & Underwater Report is based on record-level loan model estimating position and amount of loans secured by a property and an automated valuation model, according to the company.