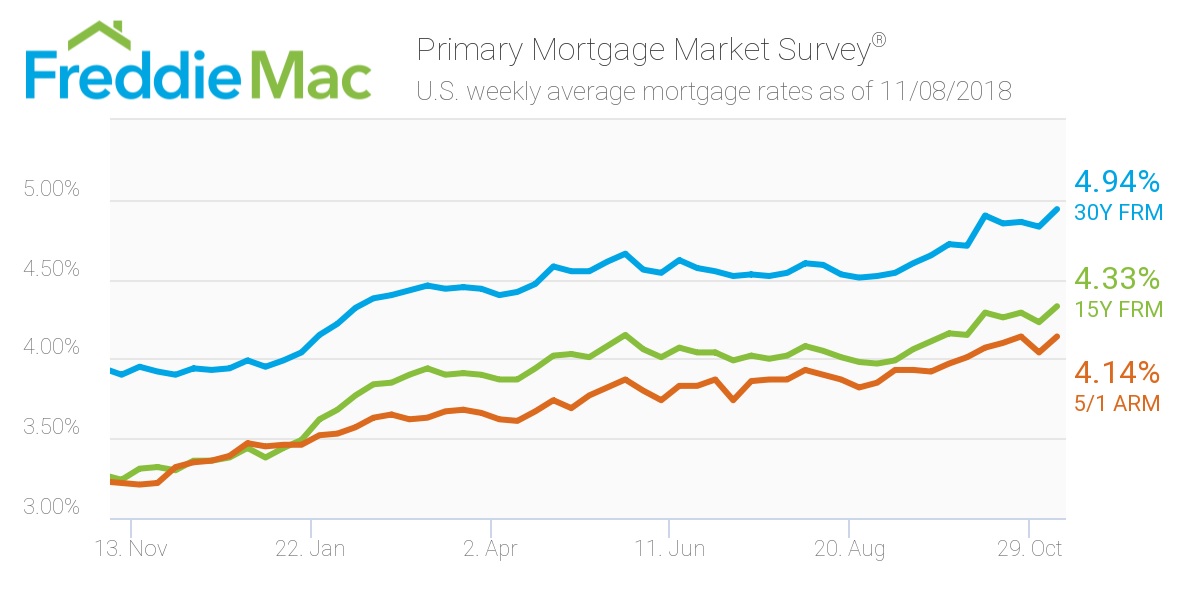

Mortgage rates have now reached a seven-year high, according to Freddie Mac’s latest Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage averaged 4.94% for the week ending Nov. 8, 2018, rising from 4.83% last week, which is still an increase from last year’s rate of 3.9%.

“The economy continued to show resilience as strong business activity and growth in employment drove the 30-year fixed mortgage rate to a seven-year high of 4.94% – up 11 basis points from last week,” Freddie Mac Chief Economist Sam Khater said.

“Higher mortgage rates have led to a slowdown in national home price growth, but the price deceleration has been primarily concentrated in affluent coastal markets such as California and the state of Washington,” Khater continued. “The more affordable interior markets – which have not yet experienced a slowdown home price growth – may see price growth start to moderate and affordability squeezed if mortgage rates continue to march higher.”

(Source: Freddie Mac)

The 15-year FRM averaged 4.33% this week, moderately increasing from last week's 4.23%. This time last year, the 15-year FRM was 3.24%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage rose to 4.14% this week, increasing from 4.04% last week. However, this is still much higher than this time in 2017 when it averaged 3.22%.

Realtor.com Chief Economist Danielle Hale said mortgage rates ticked back up this week as the October stock slowdown that made bonds attractive seems to have ended.

"The Fed meeting announcement later today could spark a dip in rates if it indicates a potential slowing in rate increases ahead,” Hale continued. “More likely, however, the statement will focus on the risk of inflation and the need to continue tightening at a measured pace meaning no relief on the horizon for buyers.”

“While higher mortgage rates are certainly not surprising for homebuyers, they are dampening enthusiasm and causing homebuying sentiment indicators turn lower, diverging from overall consumer sentiment indicators which are at or near record highs,” Hale concluded.