Mortgage rates continue to surge and have now reached their highest levels since 2014 following the news of higher-than-expected inflation levels, according to Freddie Mac’s Primary Mortgage Market Survey.

“Wednesday’s Consumer Price Index report showed higher-than- expected inflation; headline consumer price inflation was 2.1% year-over- year in January, two tenths of a percentage point higher than the consensus forecast,” said Len Kiefer, Freddie Mac deputy chief economist.

“Inflation measures were broad-based, cementing expectations that the Federal Reserve will go forward with monetary tightening later this year,” Kiefer said. “Following this news, the 10-year Treasury reached its highest level since January 2014, climbing above 2.9%.”

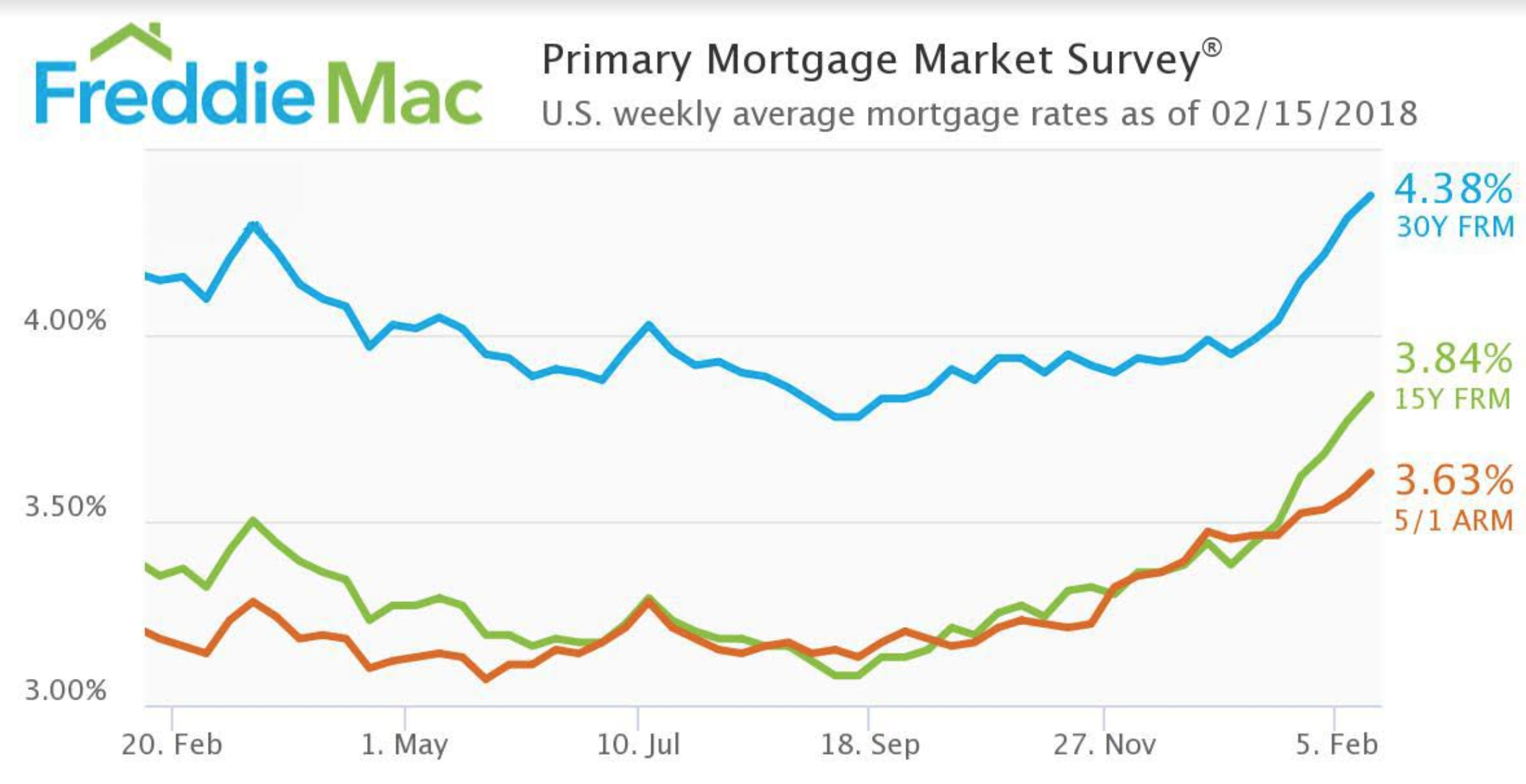

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 4.38% for the week ending February 15, 2018. This is up six basis points from last week’s 4.32% and up from 4.15% last year.

The 15-year FRM also increased, rising to 3.84%. This is up from 3.77% last week and from 3.35% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.63%, up from 3.57% last week and 3.18% last year.

“Mortgage rates have also surged,” Kiefer said. “After jumping 10 basis points last week, the 30-year fixed-rate mortgage rose six basis points to 4.38%, its highest level since April 2014.”