While mortgages rates posted the first drop in four weeks due to the recent Federal Reserve meeting, this low-rate environment could start to come to a close once future rate hikes start to happen, Freddie Mac’s Primary Mortgage Market Survey found.

On March 16, the Federal Open Market Committee, which sets the benchmark interest rate for bank lending, said it would not be raising rates in the short term, with the current rate set at between 0.25% and 0.5%.

The Freddie Mac mortgage rate survey last week came out directly after the Fed announcement and posted that mortgage rates increased for the third week straight.

However, this week rates reversed course and dropped. “The Federal Reserve’s decision last week to maintain the current level of the Federal funds rate combined with the reduction in their forecast for growth triggered a 3-basis point drop in the 10-year Treasury yield,” said Sean Becketti, chief economist with Freddie Mac.

As a result, Becketti said that pushed the 30-year mortgage rate lower by 2 basis points.

Looking ahead, Becketti said, “Comments this week by several members of the Fed, including the presidents of the Richmond, San Francisco, and Atlanta banks, indicated that a June rate hike is still on the table.”

But an April rate hike is still on the table as well. An article in Bloomberg by Jana Randow and Steve Matthews stated that two Federal Reserve officials said interest-rate increases may be warranted as soon as the central bank’s meeting next month.

“There is sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April,” Federal Reserve Bank of Atlanta President Dennis Lockhart was quoted saying in the article.

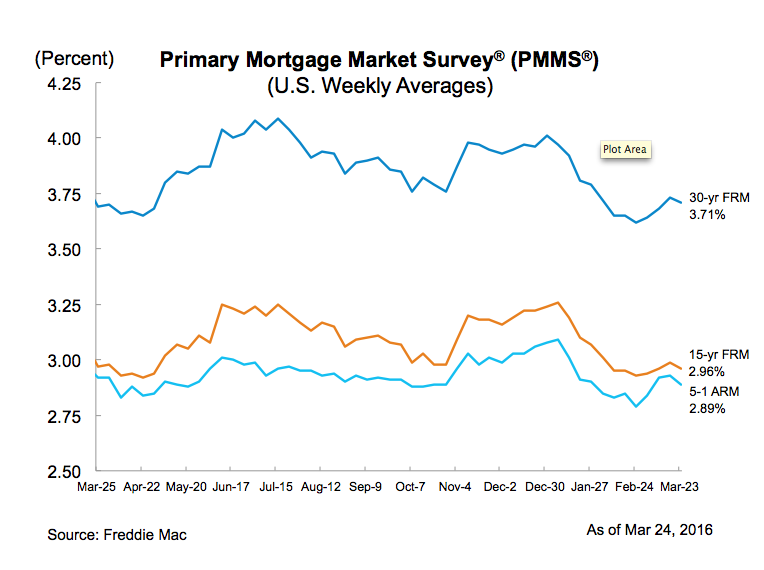

This chart shows mortgage rates over the past year.

Click chart to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage averaged 3.71% for the week ending March 24, 2016, down slightly from 3.73% last week. A year ago at this time, the 30-year FRM averaged 3.69%.

Also falling, the 15-year FRM averaged 2.96%, down from last week’s 2.99%. In 2015, the 15-year FRM averaged 2.97%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.89% this week, dropping from previous week when it averaged 2.93%. A year ago, the 5-year ARM averaged 2.92%.