Donald Layton, the chief executive of Freddie Mac, is feeling positive about the new 3% down payment mortgage option the government-sponsored enterprise is launching next month.

But, it’s not the type of positivity one might expect.

Speaking in an interview with HousingWire after today's earnings call with investors, Layton said the 97% loan-to-value option will be limited to borrowers who can prove a “very good income.”

Furthermore, he reinforced that underwriting standards are stronger than ever and that their regulator, the Federal Housing Finance Agency, will maintain the overall direction of the products, also becoming available at Fannie Mae.

Layton indicated that internal targets for the product in 2015 are likely not nearly as high as many expect. So, the expectation is for responsible, stable lending to extra-worthy borrowers, which is reflected in the slightly revised 2015 mortgage originations forecast.

Just today, Freddie raised its 2015 mortgage originations forecast to $1.3 trillion, up from $1.2 trillion last month. The forecast for the refinance share of originations in 2015 was also revised up from 35% to 40%.

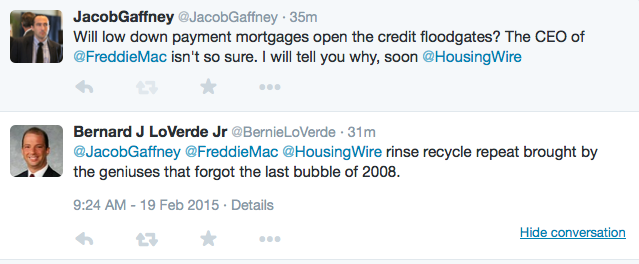

Nonetheless, the announcement was still met with criticism, most notably on social media platforms such as Twitter, as with the conversation below from 11:30 CST this morning.

“We don’t have outsized expectations,” Layton said of the program. He agreed to publicly release actual mortgage volume number on the initiative once the programs get going.

Layton also provided an update to the GSE's effort to look at options to using just FICO scores when assessing credit-worthiness. Read that HousingWire exclusive here.

He said his researchers continue to look at alternatives to see if there may be a “real, as opposed to hypothetical” benefit to using other credit scoring methods.

“Will you get more accurate scoring for more people?” he asked. “From our perspective, if not, it’s not worth it.”