The national delinquency rate quickly came off its seven-year low, reversing course and instead surging to the highest level in 10 months, Black Knight Financial Services’ November “First Look” mortgage report said.

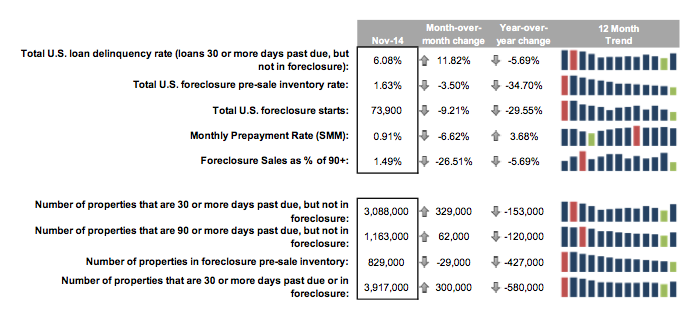

The nation’s delinquency rate (anything 30 or more days delinquent, but not yet in foreclosure) jumped 12% from October, bringing it above 6% for the first time since February.

While delinquencies have increased in six of the last seven Novembers, there hasn’t been an increase of this magnitude since 2008.

On the other side, the foreclosure inventory continued to decline, reaching its lowest level since January 2008.

In addition, foreclosure starts are down 9% month-over-month: the lowest level since May 2006.

Click to enlarge

Source: Black Knight