Economic reports since the Federal Open Market Committee met in October suggest that the nation is expanding at a moderate pace, the latest release from the FOMC meeting said.

The committee chose to reaffirm its view that the current 0% to .25% target range for the federal funds rate remains appropriate after announcing the official end to quantitative easing at its last meeting in October.

“Based on its current assessment, the committee judges that it can be patient in beginning to normalize the stance of monetary policy,” the release said.

“The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0% to .25% target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2% longer-run goal, and provided that longer-term inflation expectations remain well anchored," the release continued.

Since the last meeting, labor market conditions have continued to improve, with solid job gains and a lower unemployment rate.

In addition, household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow.

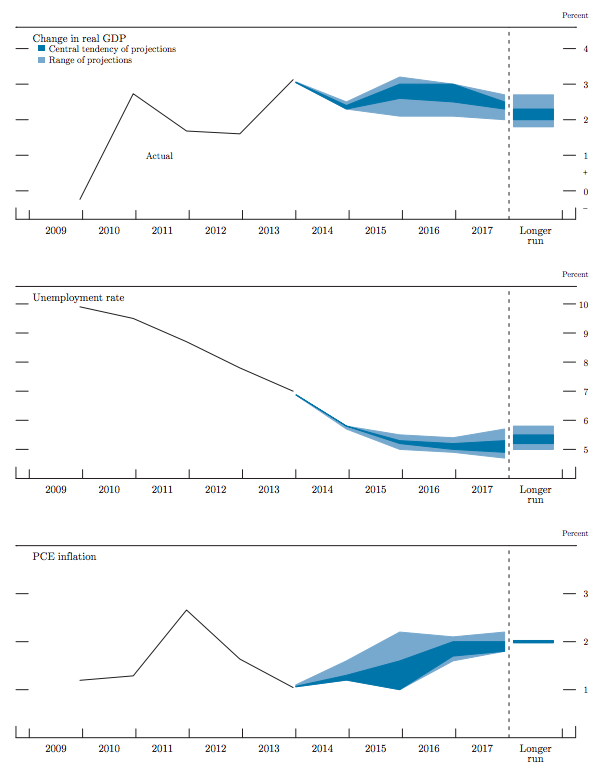

Along with the release, the Federal Reserve Board and FOMC released their updated economic projections for changes in real GDP, unemployment rate and PCE inflation.

These three charts give an inside look into what the FOMC forecasts for the U.S. economy.

Click to enlarge

Source: the Federal Reserve