Fannie Mae is preparing to launch its fourth risk-sharing bond under its Connecticut Avenue Securities label in 2014.

Connecticut Avenue Securities 2014-C04 is backed by two pools of mortgages that carry a total unpaid principal balance of $53.8 billion.

Group 1 contains 154,842 mortgages with original loan-to-value ratios greater than 60% and less than or equal to 80%. Group 1, which carries a balance of $35.8 billion, also carries a weighted average FICO score of 757, a WA original combined LTV of 76.4% and a WA debt-to-income ratio of 33.2%. The average loan balance of group 1 is $231,502.

Group 2 has 80,662 mortgages with original LTV greater than 80% and lower than or equal to 97%. Group 1 carries a balance of $18 billion and a weighted average FICO score of 753. Group 2 also carries a WA original combined LTV of 92.2% and a WA debt-to-income ratio of 34%. The average loan balance of group 1 is $223,494.

Both groups consist of 30-year, fully amortizing, first-lien, fixed-rate mortgages underwritten to a full documentation standard. The two loan groups are not cross- collateralized. Payments to the group 1 and group 2 notes will be determined by the credit performance of each reference pool separately, according to DBRS, which issues a presale on the deal.

DBRS also said that cash flow from the pools will not be used to make any payment to the CAS 2014-C04 note holders. Instead, Fannie Mae will be responsible for making monthly interest payments at the note rate and periodic principal payments on the notes in accordance with the actual principal payments it collects from the pools.

Additionally, losses to the CAS 2014-C04 notes are not tied to the actual cumulative losses on the reference pool, DBRS said. “Rather, they are calculated based on the occurrence of credit events (generally defined as delinquency of 180+ days, short sale, deed-in-lieu, sale of mortgage during the foreclosure process and real-estate-owned) and a pre-determined set of loss severities within each loan group,” DBRS said in its presale report.

DBRS cited a well-diversified reference pool as a strength of the deal. The CAS 2014-C04 Reference Pool exhibits an extremely low concentration risk and the resulting asset correlation relative to recent private-label prime securitizations,” DBRS said.

DBRS also said that the deal carries strong structural protections. “Compared with a traditional shifting-interest structure in private- label securitizations, CAS 2014-C04 employs structural features that prevent leakage of credit support and allow the rated notes to be repaid at a faster pace,” DBRS said.

“Unlike PLS, where all subordinate bonds are generally allocated a pro rata share of scheduled principal (except in instances where the subordination floor is breached), this transaction allocates the subordinate share of principal first to the rated notes before more subordinated tranches.”

DBRS said the high LTVs in group 2 are a challenge for the deal. Additionally, both groups have loaned that have been 30 days late in the past 12 months, but notes that all the loans that were delinquent have been cured.

DBRS also noted the deal’s “unique” representation and warranty framework. “Each lender makes loan-level R&W to Fannie Mae when they sell loans to Fannie Mae, and such R&W will not be passed through to the CAS 2014-C04 trust or holder of the notes,” DBRS said. “Rather, Fannie Mae is responsible for enforcing breach of R&W made by the lenders on the loans in the reference pool that may result in the removal of the loans from the reference pool and subsequent payments to note holders.”

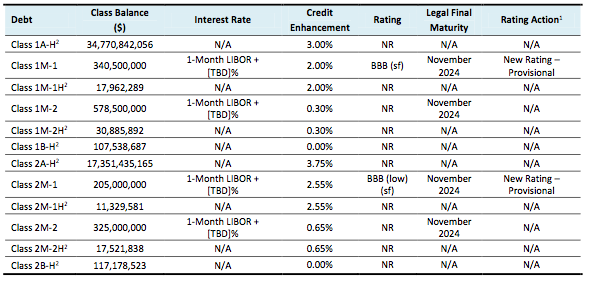

Click the image below to see DBRS’ ratings of CAS 2014-C04.