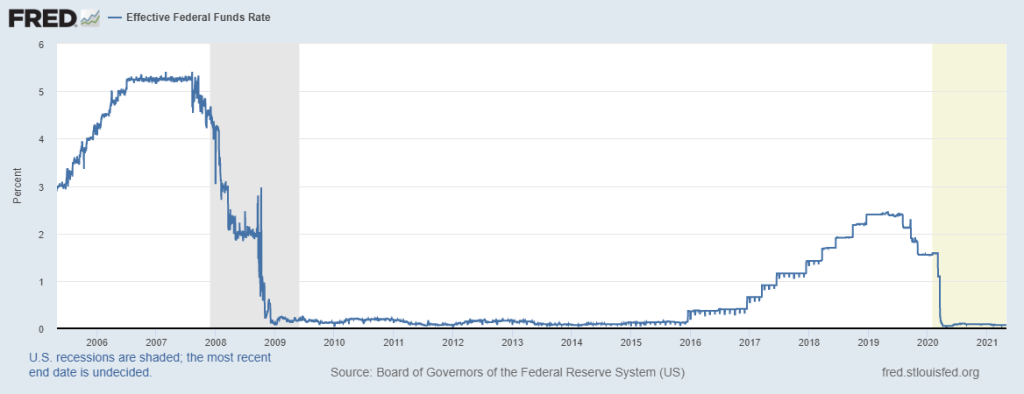

I propose adding a new pastime to our gold standards of baseball, barbecues, and Thanksgiving dinner. This new pastime I call Fed-Watch or When Will the Fed Raise Rates? Since the financial crisis of 2008, this pastime has gained popularity to the point where this guessing game has become an obsession and started to drive some folks a little batty. Insanity and Gold Bugs go together like a horse and carriage, peanut butter and jelly and salt and pepper, or so I’ve been told.

But now that the U.S. economy is about to have one of the most impressive comeback plays ever in history, this pastime question becomes relevant: When will the Fed raise rates?

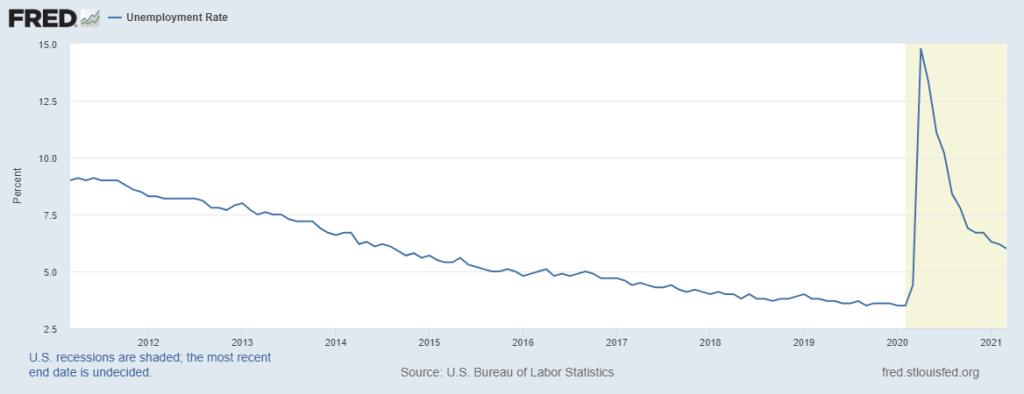

Part of the fun of this Fed guessing game is deciphering the clues dropped by members of the Federal Reserve. In the past many months, the Fed has indicated through their standard channels of smoke signals and voodoo chants that they won’t raise rates in 2021 no matter how hot the economic data looks. They are using the jobs data to guide their next steps and will not raise rates while we still have over 8 million Americans unemployed.

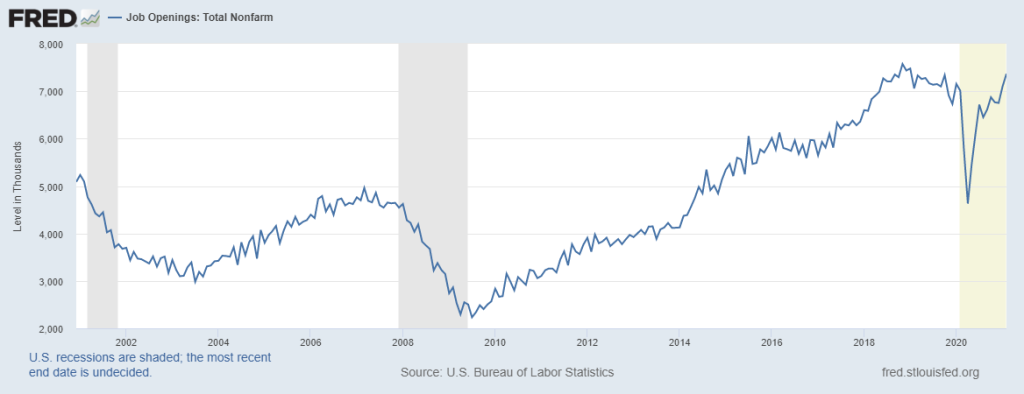

Since we are now on the verge of being free to walk the earth without the existential fear of a deadly virus, 2021 promises to be a big job-gains year. Consumer demand this year is just fine, even considering that COVID-19 continues to limit some industries from working at full capacity. Still, we have never had many job openings (7,367,000), with the unemployment level at 6% — something to think about.

3 Milestones to watch

Despite the Fed’s “We will stay where we are” stance, here are three economic milestones I believe we will surpass soon:

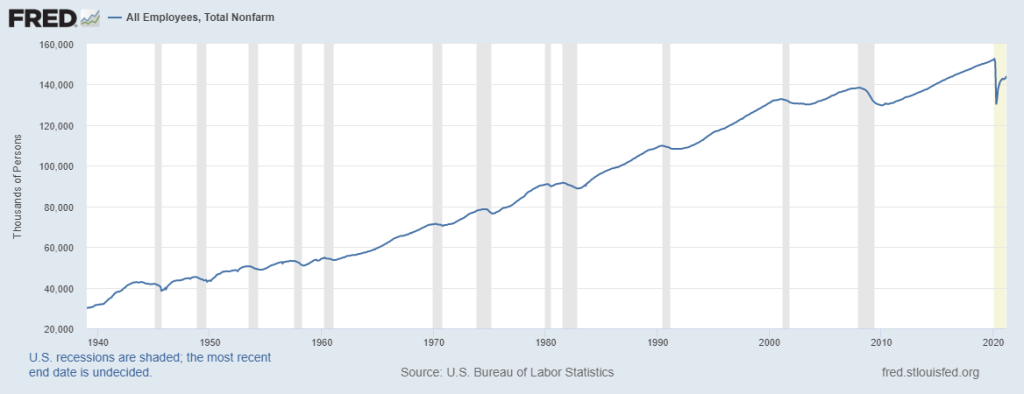

1. All the jobs lost to COVID-19 will be regained by September of 2022 or earlier. I consider this a conservative estimate.

2. Soon, there will be more job openings than unemployed people.

3. Job openings should reach 10 million in this new economic expansion as each expansion does need workers. Additionally, as Baby Boomers leave the workforce every month, those workers will need to be replaced. Robots haven’t come close to killing all the jobs, or as I always point out, will someone please show me on the chart below where robots killed all the jobs?

The mindset of the Federal Reserve has changed from previous expansions. They no longer believe that having a low unemployment rate means we will have breakaway wage inflation that will, in turn, lead to increased price inflation at an unhealthy rate. Before 2019, the Fed would raise rates when unemployment rates fell to a certain level as a means to cool the economy and get ahead of inflation that, it was believed, could spiral out of control like it did in the 1970s.

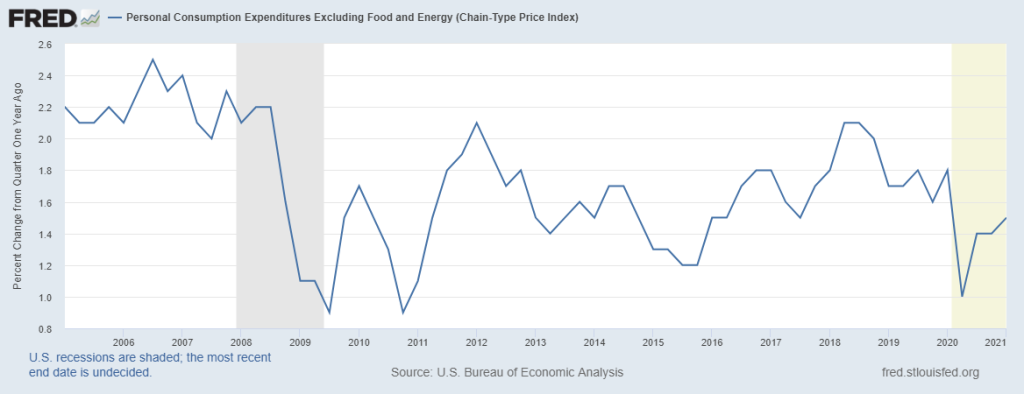

As you can see below, the breakaway inflation they feared never happened, even with the previous expansion being both the longest economic and job expansion ever recorded in history. Last year in an article for HousingWire, I examined if the Federal Reserve should stick with its zero-interest policy.

What is the Fed really watching?

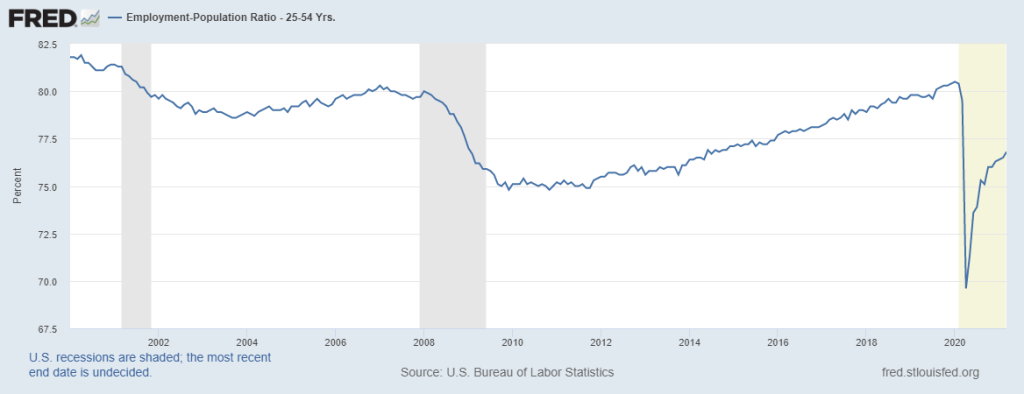

Instead of focusing on the unemployment rate to guide Fed rate hikes, I believe that the Fed is focusing on the employment-to-population ratio for prime-age labor force (Ages 25-54). The Fed needs to see real wage inflation pressures before raising rates. This means we can still have a zero interest rate policy when unemployment rates are below 4% because the prime-age employment ratio data is not high enough to justify raising rates.

For some perspective, before COVID-19 hit, the prime-age employment-to-population ratio was at a healthy 80.4%. Before the financial crisis of 2008, its metric was at 79.7%, and back in April 2000, it was at 81.9%, an all-time high. If wage inflation takes off and increases the price of goods and services, then the Fed may hike rates even if the prime-age-to-population ratio has not reached 80%.

Think of the economy as a boiler controlled by a master value (interest rates) that regulate the pressure (inflation). The master value, in turn, is regulated by several secondary gauges that measure the pressure in various boiler parts. The prime-age employment-to-population ratio is one of those secondary gauges. When that gets high, the operator looks at other secondary gauges like wage inflation to determine if the overall pressure of the system needs to be tamped down.

I believe that the prime-age employment-to-population ratio, like all other jobs data, will go up faster than people originally thought. What the Fed will do when this happens will depend on what else is going on in the economy. Don’t be one of those folks who think we will have a zero-interest policy forever. I understand the appeal of that, but until we see the employment/population ratio over 80%, it might be wishful thinking.

A lot of labor market followers have been stuck in a 2008 mindset, believing that the COVID crisis would lead us to a long recession/depression with persistent high unemployment. But it is not the same as it ever was. History doesn’t always repeat itself. The American economy started its recovery back in April 2020, and the recovery has been faster than most people anticipated.

The housing bubble boys were stuck in 2008 mode hoping that America and the housing market would crash to justify their trolling of the United States since 2012. My best recommendation is: don’t believe it will take forever for all the jobs to come back. My theme a few months ago was that the short period of not much jobs growth was “The calm before the jobs storm” Jobs Friday is coming up soon.

Last year I wrote this: “I believe the months of April and May are going to tell an epic story of America’s start in defeating this virus. If we do this right and document the cause and effect of our efforts, future generations will be able to look to this period in time for how to handle a global pandemic…”

The economy bottomed last April and we were working our way to get America Back!

With the improving economy we will see headlines of tapering of bond purchases from the Federal Reserve, inflation picking up and a heating-up economy over the next year. I believe 2021 will be the big growth year, with growth that can’t be sustained in the long term because much of it is due to make-up demand or rebound from the suppressed demand due to COVID-19 in 2020.

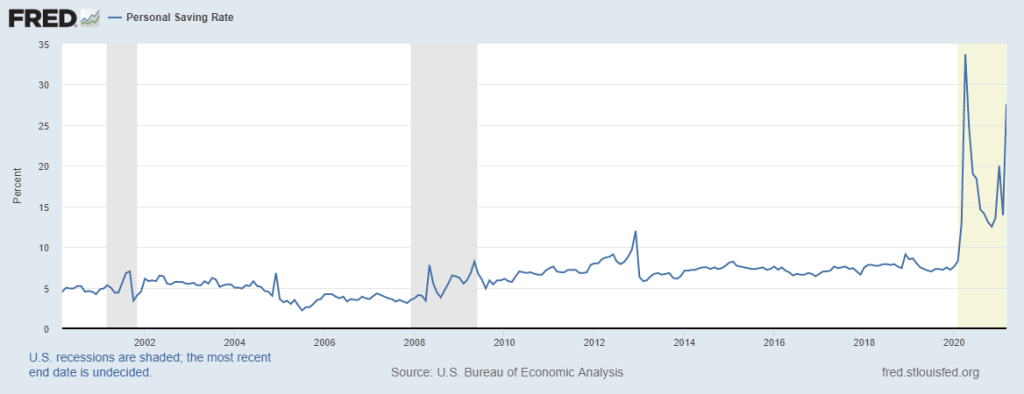

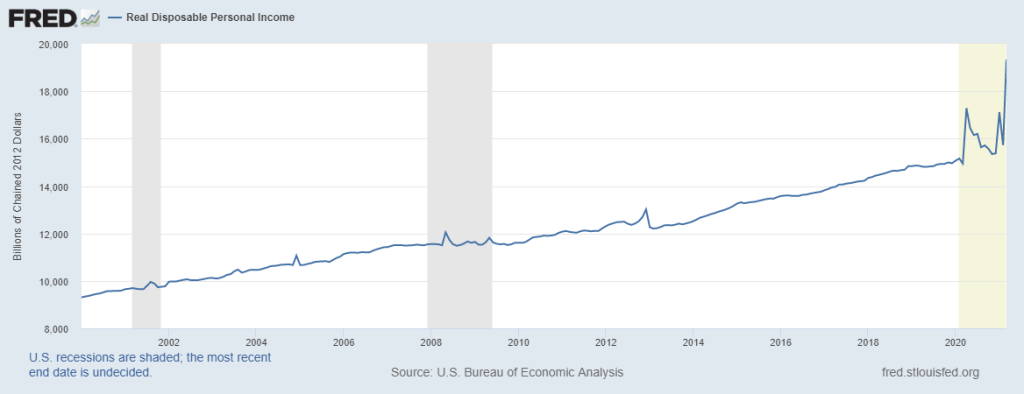

Likewise, the rate of growth in GDP in 2022 won’t be sustained over the future years, like the current red-hot manufacturing data. The fiscal stimulus plan proposed by the White House will not take effect on the economy until 2022 on a bigger scale. The fiscal disaster aid checks to Americans are done and the extended unemployment benefits will probably end by September 2021. We do have a massive excess in savings now due to all this fiscal disaster relief. Also, disposable income got boosted by the checks and extended unemployment benefits.

Mortgage rates can rise going forward. We have seen an example recently of rising mortgage rates when Fed funds rate were at zero. In 2013 we saw a 1% increase over a short period when the 10-year rose from 1.60% to 3%. Don’t be shocked if that happens again. The U.S. economic data has been much better than other countries and the world won’t be dealing with COVID-19 forever. Once other countries get control of that beast and we are all free to walk the earth, I will be shocked if mortgage rates remain below 4%.

However, regarding the Federal Reserve and the first Fed rate hike, forget the unemployment rate and focus on that employment-to-population ratio for ages 25-54.