Even though the inflation growth rate has cooled a good deal, single-family home prices remain quite stubborn.

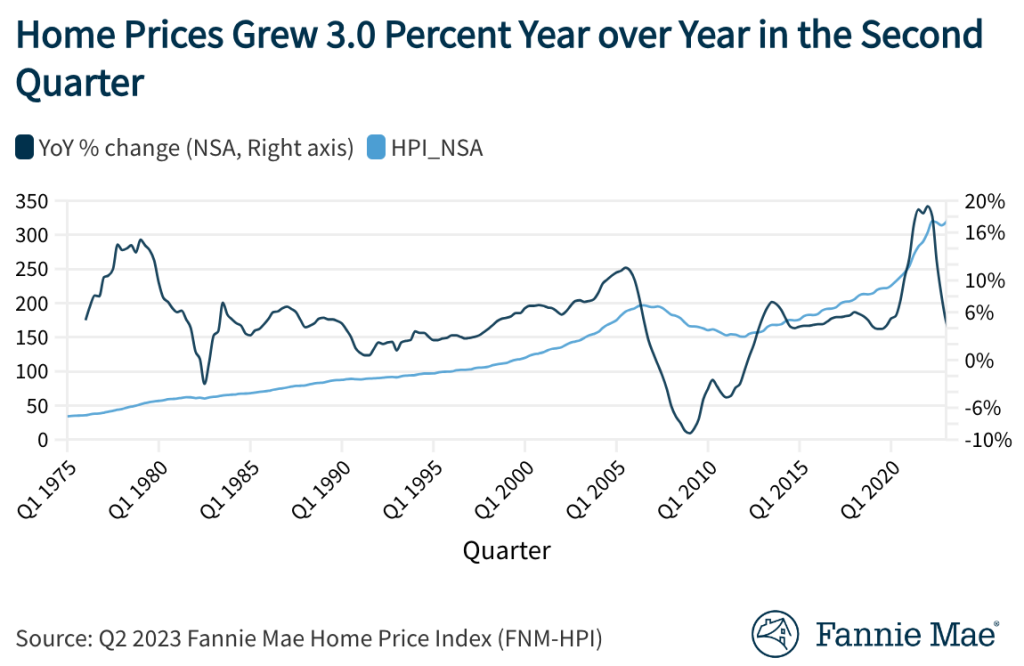

Fannie Mae’s Home Price Index increased 3.0% year over year in Q2 2023, a decline from Q1 2023’s revised annual growth rate of 4.9%. On a quarterly basis, the national index – which measures the average, quarterly price change for all single-family properties (no condos) in the U.S., rose a seasonally adjusted 1.9% in Q2 2023. It was an acceleration from a 1.3% growth rate in the first quarter.

The consumer-price index, which tracks prices for everything from used cars to groceries, increased 3% in June, down from the peak of 9% in Jun2 2022, and is now at the slowest year-over-year pace in more than two years. Meanwhile, the yield on the 10-year U.S. Treasury note, ended Friday at 3.818%, down from 4.047% the previous week.

“Once again, home price growth surprised to the upside,” said Doug Duncan, Fannie Mae‘s senior vice president and chief economist. “Housing demand remains resilient, which continues to butt up against the near-historically limited supply of existing homes for sale. Moreover, the ‘lock-in effect,’ in which homeowners are disincentivized to list their homes for sale because of how high mortgage rates have risen, is seriously inhibiting the supply of existing homes available for sale. At nearly 8% on a seasonally adjusted annualized basis, this past quarter’s home price growth was well above the historical average.”

Duncan continued: “With the 30-year mortgage rate once again approaching 7%, it’s yet to be seen whether mortgage demand will finally cool in response, or whether higher rates will simply further suppress supply. If the latter, we expect additional near-term home price appreciation. One consequence of the stronger home price environment is that new home construction is well-supported. Unfortunately, any hopes of a better-balanced home supply situation may rest on the ability of homebuilders to meet ongoing demand.”

According to Altos Research, there were 470,458 active single-family listings as of Friday, July 14. That’s down from about 509,000 on July 15, 2022. It’s also about half as much as the pre-pandemic rates – on July 12, 2019, there were over 951,000 single-family listings.

The median price of a single-family home on July 14 was $450,000, per Altos, essentially unchanged from a year ago.

This week, investors will get a glimpse of fresh data such as housing starts on Wednesday and existing home sales on Thursday.