Nationally, home prices increased 3.5% year over year in October, according to CoreLogic‘s latest Home Price Index Report.

To be more specific, prices rose on lower-priced homes. A big trend seen in the 2019 housing market was tight inventory in both single-family and multifamily, creating an increase in prices.

The lowest priced home tier increased 5.5% year over year in October 2019, compared to 4.7% for the low- to middle-price tier, 4% for the middle- to moderate-price tier, and 3.1% for the high-price tier, according to CoreLogic.

Going forward, CoreLogic expects home prices to increase 5.4% from October 2019 to October 2020.

Over the last six months, home prices have been increasing from between 3.2% to 3.5%, which means the rate of home price growth is leveling off.

In September this year, home prices rose 3.5% compared to September last year. At the time, CoreLogic predicted home prices will increase by 5.6%, come September 2020.

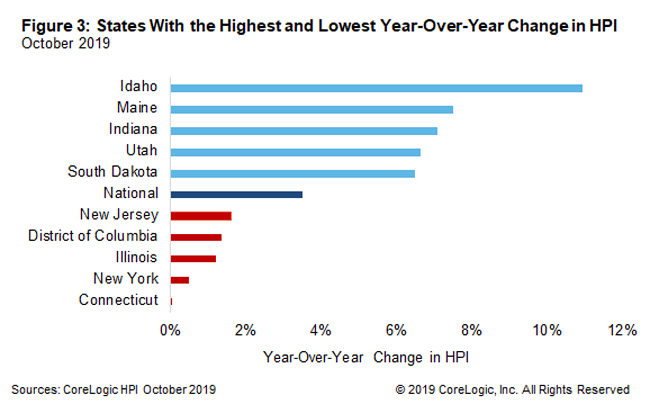

Idaho saw the largest and highest amount of price increase, with annual home price appreciation of 10.9% in October 2019.

Connecticut saw the lowest price appreciation increase, hovering just around zero. Connecticut home prices in October 2019 were also the farthest below their all-time HPI high, still 16.5% below the July 2006 peak.

Overall, home prices in 41 states (including the District of Columbia) have risen above their nominal pre-crisis peaks, CoreLogic states.

While annual price increases slowed in 38 states compared to 2018, prices in Nevada increased by 3.2% year over year in October 2019, an 8.7-percentage-point tick down from the 11.9% annual increase in October 2018, signaling a slow down.