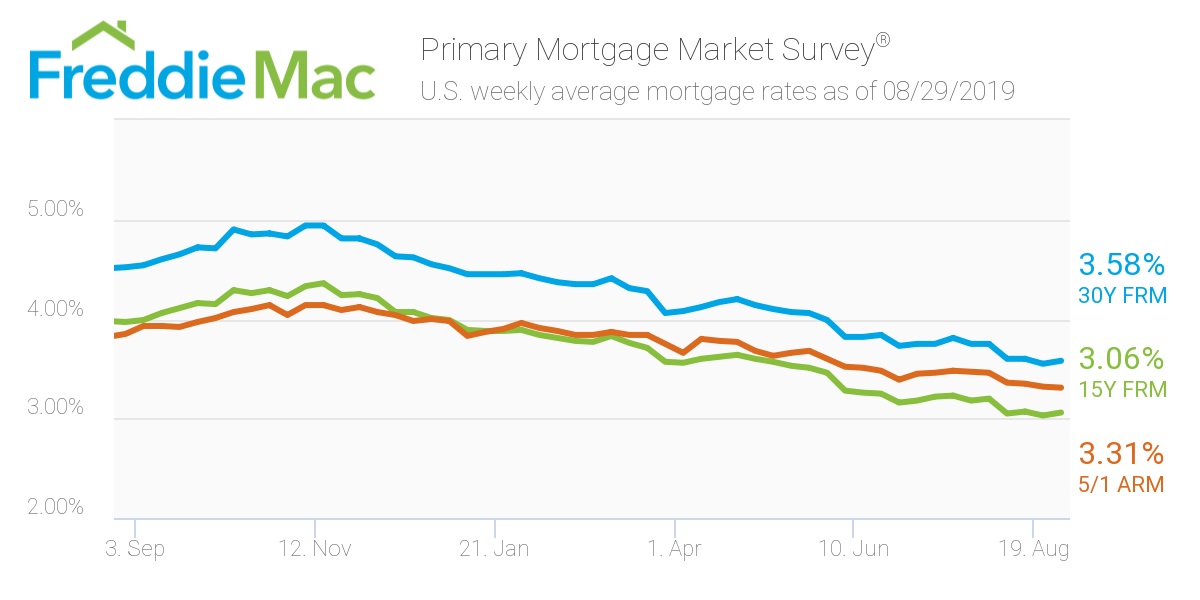

Although the average U.S. rate for a 30-year fixed mortgage rose this week, the rate still managed to hover near last week’s 3-year low, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the company’s data, the 30-year fixed-rate mortgage averaged 3.58% for the week ending August 29, 2019, up from last week’s rate of 3.55%. A year earlier, the rate was 4.52%

“Mortgage rates inched up slightly this week, closing the month with the 30-year fixed-rate mortgage rate averaging 3.6% – almost a full percent from the same time last year,” Freddie Mac Chief Economist Sam Khater said. “Low mortgage rates along with a strong labor market are fueling the consumer-driven economy boosting their purchasing power, which will certainly support housing market activity in the coming months.”

The 15-year FRM averaged 3.06% this week, slightly rising from last week’s 3.03%. This time last year, the 15-year FRM came in at 3.97%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.31%, sliding from last week’s rate of 3.33%. Once again, this rate sits much lower than the same week in 2018 when it averaged 3.85%.

The image below highlights this week's changes: