Certain home sales of $400,000 and under may soon not need an appraisal, as federal regulators are close to approving a proposal to increase the threshold at which residential home sales require an appraisal for the first time since 1994.

In November, the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Board of Governors of the Federal Reserve released a proposal that would increase the appraisal requirement from $250,000 to $400,000, meaning that certain home sales of $400,000 and below would no longer require an appraisal.

Now, the proposal is just one step away from being finalized and adopted as proposed.

Earlier this week, the FDIC published the final rule on the matter, stating that the rule is approved as proposed.

That led some to conclude that the rule is finalized, but a representative from the FDIC told HousingWire that the Federal Reserve has not yet signed off the proposal.

The proposal has been approved by both the FDIC and OCC, but without Fed approval, the rule cannot move forward.

But considering that the FDIC and OCC have approved the rule, and gotten sign-off on the matter from the Consumer Financial Protection Bureau, it’s likely only a matter of time before the Fed approves the rule, it’s entered into the Federal Register, and enacted as the law of the land.

Now, it’s important to note that the new rules do not apply to loans wholly or partially insured or guaranteed by, or eligible for sale to, a government agency or government-sponsored agency.

That means that loans sold to or guaranteed by the Federal Housing Administration, Department of Housing and Urban Development, Department of Veterans Affairs, Fannie Mae, or Freddie Mac would still require an appraisal, per each agency’s rules.

But despite that fact, the change would have a sizable impact on the real estate market, as according to the OCC, the new rules would apply to approximately 40% of home sales.

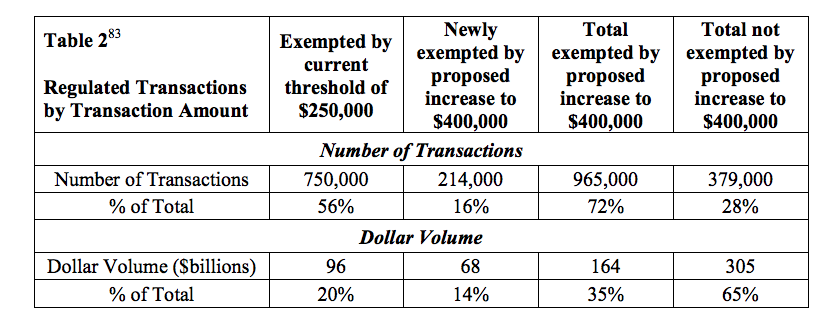

According to data provided by the FDIC, the agencies estimate that increasing the appraisal threshold from $250,000 to $400,000 would have exempted an additional 214,000 residential mortgages from the agencies’ appraisal requirement in 2017, representing 3% of total HMDA originations.

On a percentage basis, under the current rules, in 2017, there were 750,000 transactions that were exempted from the appraisal requirement (56%). By increasing the threshold to $400,000, there would have been an additional 214,000 sales exempted from the appraisal requirement (an additional 16%).

Therefore, under the proposed rules, 72% of the eligible transactions would be exempted from the appraisal requirement, while 28% would require an appraisal.

(Click to enlarge. Image courtesy of the FDIC)

According to the FDIC final rule, which was published this week, the agencies received over 560 comments on the proposal to raise the appraisal threshold.

As one might expect, financial institutions, financial institution trade associations, and state banking regulators “generally supported” the proposal. Meanwhile, appraisers, appraiser trade organizations, individuals, and consumer advocate groups “generally opposed” the proposal.

According to the FDIC, those commenting in support of the rule stated that an increase would be appropriate given the increases in real estate values since the current threshold was established in 1994. Other commenters stated that the increase would provide “burden relief for financial institutions without sacrificing safe and sound banking practices.”

On the other hand, commenters opposed to the rule change stated that the proposal would “elevate risks to borrowers, financial institutions, the financial system, and taxpayers.”

According to the final rule, many commenters opposed to an increase in the threshold argued on behalf of appraisers, stating that appraisers are “the only objective and unbiased party in a transaction and bring checks, balances, and oversight to the mortgage lending process.”

Other commenters noted that the rule could have an outsized impact on certain consumer groups, such as low-income individuals, members of certain minority groups, or first-time homebuyers, because those borrowers are more likely buy homes in the lower price range, and would therefore be more likely to buy a home without an appraisal.

Despite those comments, the agencies issued the final rule as initially proposed, and are now waiting for the Fed to sign off on the rule.

As noted above, the agencies state that the CFPB was involved in the process throughout and concurred with the proposal, stating that the new residential real estate appraisal threshold being adopted provides “reasonable protection” for consumers who purchase 1-4 unit single-family residences.

The appraisal threshold was last increased in 1994 when regulators increased the threshold from $100,000 to its current level of $250,000.

The regulators argue that increasing the threshold now will actually have less of an impact on the market than the 1994 change did.

“When the threshold was raised in 1994, the agencies estimated that the aggregate dollar volume of exempted transactions due to the threshold increase was 85% of all new home sales, and 82% of all existing home sales,” the agencies previously said in the official notice. “Thus, the agencies expect the proposed threshold level to have a much smaller impact on the dollar volume of transactions and, therefore would be less likely to pose a safety and soundness risk than the current threshold level did when it was introduced in 1994.”

According to the final rule, the change will take effect immediately after the rule is published in the Federal Register, meaning once the Fed approves the rule, it will become law likely within days.

To read the final rule in full, click here.