Soaring home prices in large U.S. markets are turning “home, sweet home” into “lease, sweet lease.”

According to research by Trulia, in 100 of the biggest markets in the U.S., buying a home is becoming more of a bum deal, while renting, though not ideal, is becoming more attractive.

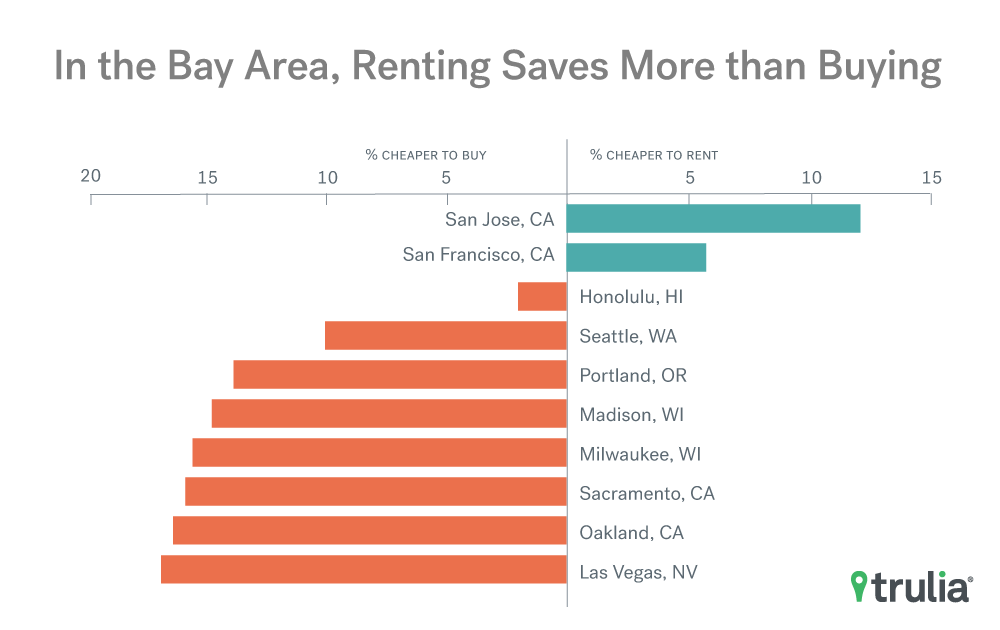

For the first time in five years, renting has usurped homeownership as the best economic value in San Jose and San Francisco. In both cities, which are two of the most expensive in the nation, home values have surged past $1 million, while rents have flattened or sunk.

Trulia defines financial advantage as the convergence of quality, a seven-year stay, costs (present and future), and net present value in the top 100 markets in the U.S.

Nationally, in July 2018, the financial advantage of buying a home as opposed to renting hit a six-year low. Buying still saves 26.3%, but cooling rents in 82 of the markets have made renting more competitive. This is a significant drop off from last year when buying had a cost advantage of 35.7%. During this period, rents fell 1.1% while home prices rose 8.1%.

Further driving down savings from buying, rising mortgage rates have contributed significantly to the decrease in the value of home buying.

Not surprisingly, the West Coast, particularly the Bay Area, is the region feeling the most pain in this category. San Jose, San Francisco, Seattle, Portland, Sacramento and Oakland are all near the top of the list in terms of how expensive it is to buy a home.

On the other end of the spectrum, Detroit is the best market to buy in as opposed to renting. This is despite an 18.3% increase in home values which is second only to San Jose’s appreciation.