Mortgage rates dipped slightly as investors moved into safer assets due to trade tensions, causing the 10-year Treasury yield to drop, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

“Treasury yields fell from a week ago helping to drive mortgage rates modestly lower,” said Len Kiefer, Freddie Mac deputy chief economist. “The yield on the 10-year Treasury dipped below 2.8% for the first time since early February of this year. The decline in Treasury yields comes as investors move into safer assets amid increased trade tensions.”

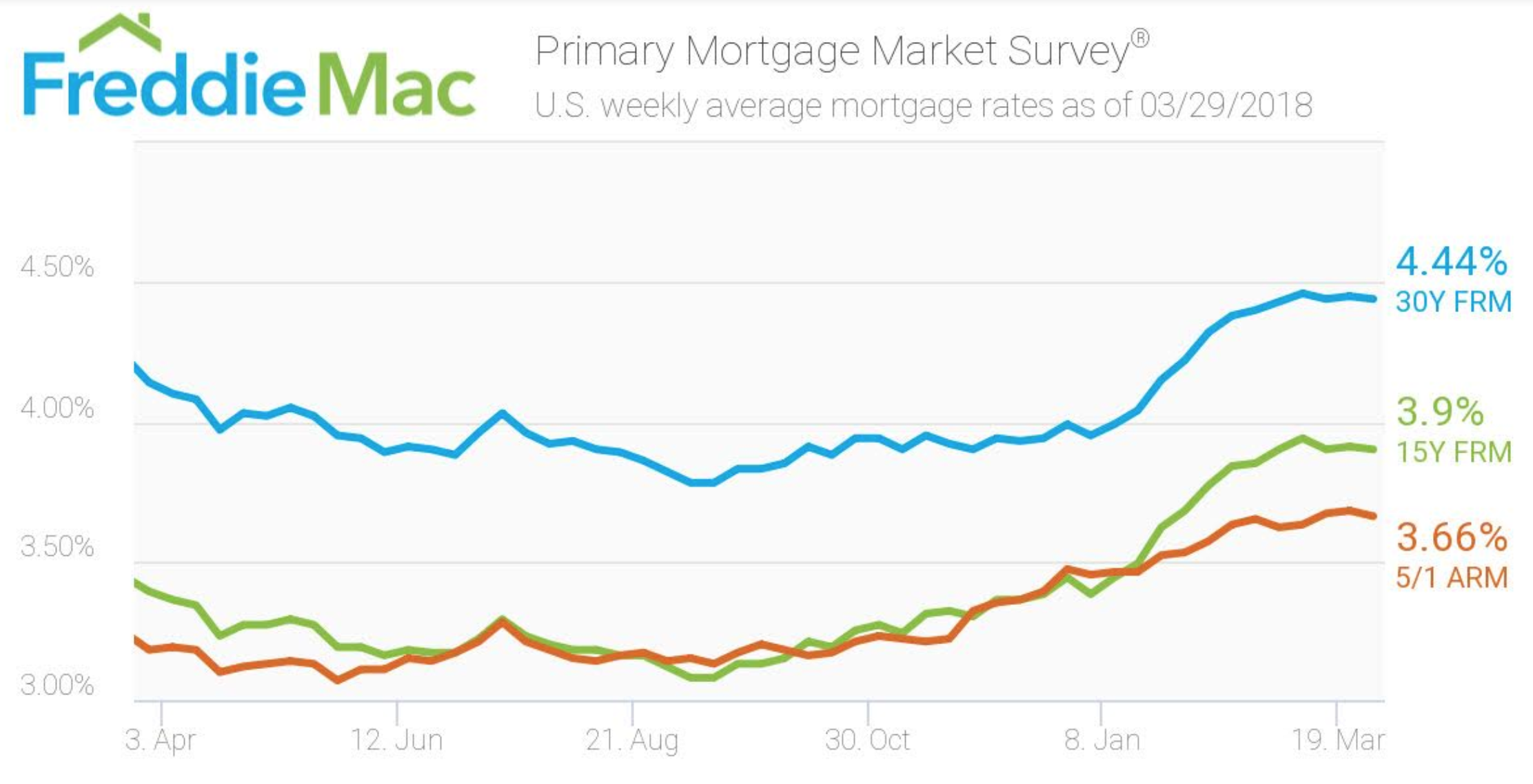

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage decreased slightly to 4.44% for the week ending March 29, 2018. This is down from last week’s 4.45% but still up from 4.14% last year.

The 15-year FRM also saw a slight drop, falling from 3.91% last week to 3.9% this week. This is up from 3.39% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased to 3.66%, down from 3.68% last week but up from 3.18% last year.

“Following Treasurys, mortgage rates fell slightly,” Kiefer said. “The U.S. weekly average 30-year fixed mortgage rate fell one basis point to 4.44% in this week’s survey.”