Interest rates increased this week across the globe, and the U.S. followed suit with a jump in the 10-year Treasury.

“Global interest rates turned up sharply over the last week,” Freddie Mac Chief Economist Sean Becketti said. “The 10-year Treasury yield was no exception, increasing 10 basis points in a holiday-shortened week.”

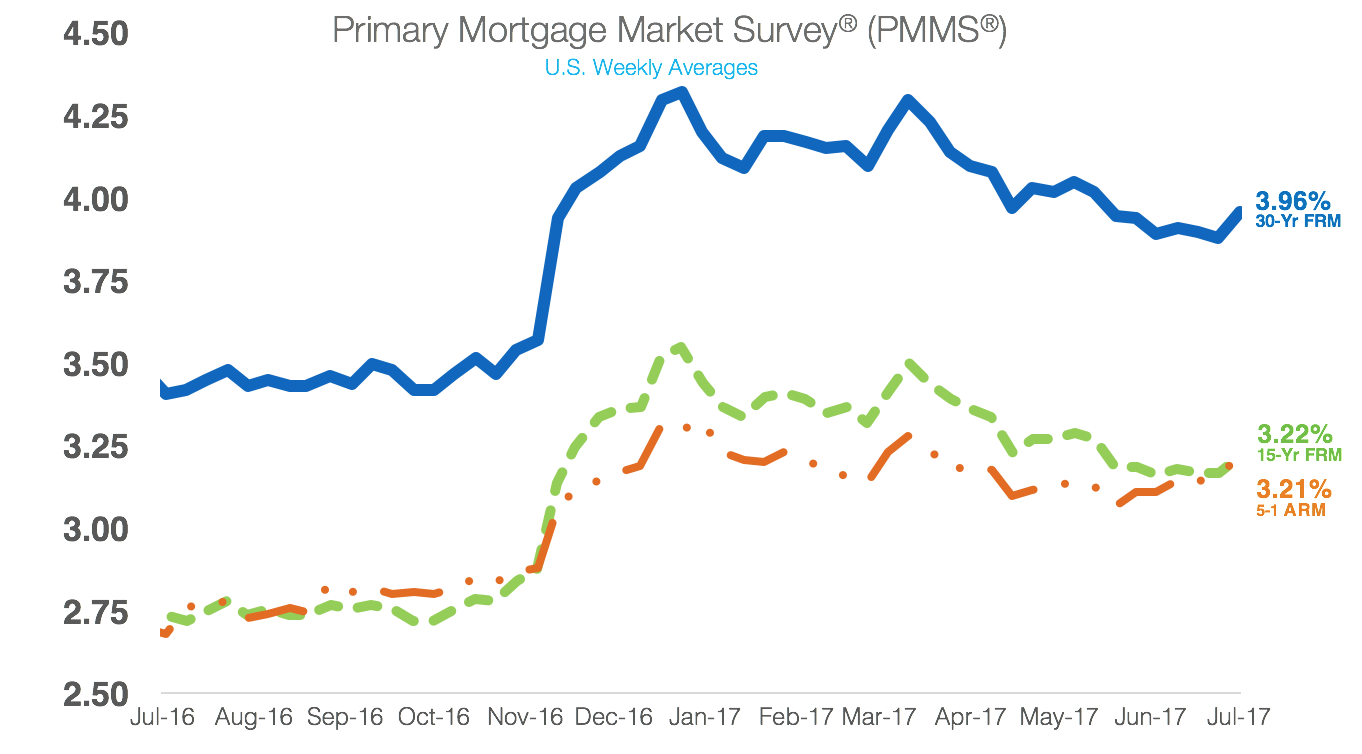

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 3.96% for the week ending July 6, 2017. This is a significant increase of eight basis points from last week’s average of 3.88%, and is up from last year’s 3.41%.

The 15-year FRM also increase, hitting an average 3.22% for the week. This is up from last week’s 3.17% and last year’s 2.74%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.21%, up from 3.17% last week and 2.68% last year.

“The 30-year mortgage rate followed suit, rising eight basis points to 3.96%,” Becketti said.