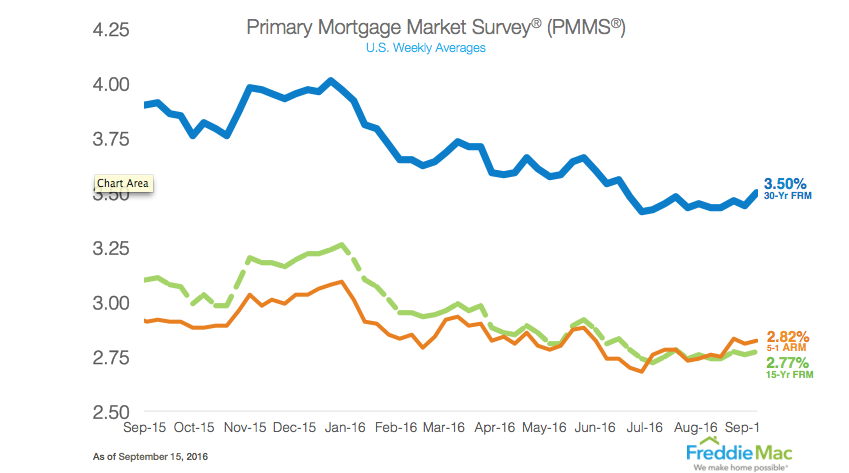

Mortgage rates jumped in the latest Freddie Mac report, with the 30-year mortgage breaking an 11-week trend. Meanwhile, the 10-year Treasury also reached its highest level since Brexit.

“The 10-year Treasury yield rose 18 basis points to 1.73%, its highest level since Brexit,” Freddie Mac Chief Economist Sean Becketti said. “The 30-year fixed-rate mortgage followed suit, rising 6 basis points to 3.50% this week.”

“This is the first week since June that mortgage rates were above 3.48%, snapping an 11-week trend,” Becketti continued.

Click to enlarge

(Source: Freddie Mac)

The 30-year, fixed-rate mortgage increased to 3.5% for the week ending Sept. 15, 2016. This is up from last week’s 3.44%, but still down from last year’s 3.91%.

The 15-year, FRM also increased, but only slightly to an average 2.77%. This is up from last week’s 2.76%. However, it is still down from 3.11% last year.

The 5-year, Treasury-indexed hybrid adjustable-rate mortgage increased slightly from 2.81% last week to 2.82%. This is down from 2.92% last year.

This comes shortly after household income posted its first significant increase in eight years, new data from the U.S. Census Bureau showed.

Could this mean market conditions are ready for a rate hike in September? Either way, they are now at a point that warrants a “serious discussion," according to Dennis Lockhart, Federal Reserve Bank of Atlanta president.