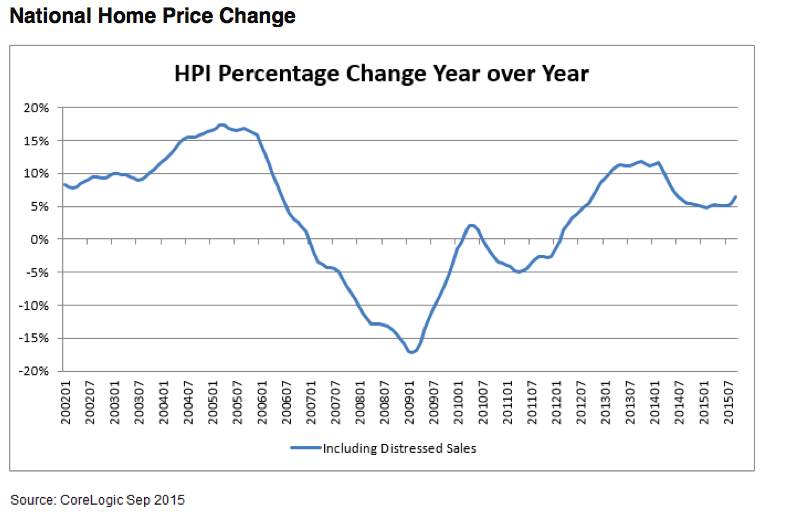

Home prices nationwide, including distressed sales, increased by 6.4% in September 2015 compared with a year ago, according to CoreLogic’s (CLGX) latest home price index. This is up 0.6% compared to August 2015.

Click to enlarge

(Source: CoreLogic)

Sam Khater, deputy chief economist for CoreLogic, explained that is once again good news for the company given past home price results.

“After nearly 10 years of very high home price volatility, home price increases have been remarkably stable for the last 15 months, ranging between a 4.8% and 6.5% year- over-year increase,” said Khater. “Home price volatility is now back to the long-term trend prior to the boom and bust which is a good barometer of the market’s stability and health.”

Looking ahead, the CoreLogic HPI forecast indicates that home prices are projected to increase by 4.7% on a year-over-year basis from September 2015 to September 2016, but could potentially dip slightly month over month from September 2015 to October 2015.

The CoreLogic HPI forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The continued growth in home prices is welcome news for many homeowners but more markets are becoming overvalued. In the near term, this trend is likely to continue and pose evaluated risks to the housing economy,” said Anand Nallathambi, president and CEO of CoreLogic. "More has to be done to expand inventories if we are going to address the emerging affordability crisis, especially in hot markets like California and Colorado.”