Housing Market Update: May 1

Fed holds rates steady for the 6th straight time“It’s unlikely that the next policy rate move will be a hike. In order to hike the rates, we would need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we are seeing at the moment.”

– Jerome Powell, Federal Reserve Chair

Housing Market Videos

April 29, 2024

April 22, 2024

April 15, 2024

April 8, 2024

Top Stories

Receive updates when we release new Housing Market content.

By subscribing you agree to the terms of HW Media’s Privacy Policy. You may receive updates and special offers from HW Media affiliates and can unsubscribe at any time.

Housing Market Tracker

-

April 27, 2024

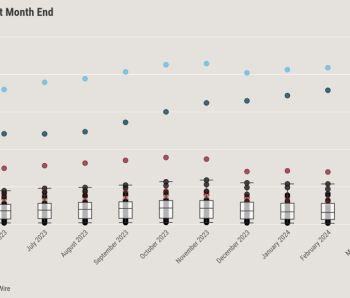

Active weekly housing inventory growth slowed slightly last week, but it’s still running at a healthier clip than in 2023. I have a simple model with mortgage rates being above 7.25%: weekly inventory data should grow between 11,000-17,000 per week. Last year, we never hit that target. We have now seen it for two weeks as inventory grew by 13,247.

-

April 20, 2024

Housing inventory finally hit my target level of growth last week with mortgage rates now over 7.25%, something I couldn’t get all last year. Of course, what is different this year versus last year is that new listing data is growing yearly instead of trending at the lowest levels recorded in history.

-

April 13, 2024

Mortgage rates headed higher last week after the CPI inflation report, but now, with news of a wider war in the Middle East, should we expect even higher rates? Some argue that money will go into the safety of the bond market, while others say a wider war can lead to higher inflation and higher rates. The week ahead will answer some of those questions early on.

-

April 6, 2024

Weekly housing inventory data — both active inventory and new listings — are prone to one-week moves that deviate from a trend, especially if people are going Easter egg hunting. So, the fact that active inventory and new listings data fell last week isn’t a big deal. Although I expect some of the weekly data to rebound next week as a result, growth in active and new listings is still trending slower than I thought would happen in 2024.

- Historical

Housing Market Tracker

Spring housing market gets more inventory

Apr 27, 2024We’ve now had back-to-back weeks of healthy housing inventory growth, making spring 2024 much healthier than spring 2023.

Frequently Asked Questions About

the Real Estate Housing Market

-

How does the housing market work?

The housing market is driven by the law of supply and demand. The housing market involves a purchase transaction between a homebuyer and home seller in which the two parties, often represented by real estate agents, negotiate a sales price and contract terms before closing on a home sale.

During periods of high buyer demand, home prices and home sales tend to increase. When homebuyer activity is lower, housing supply tends to grow and home sellers are more likely to reduce their asking price to obtain offers. However, today, many sellers are hesitant to put their homes on the market and trade in their current low mortgage rates for higher rates. As a result, inventory hasn’t grown as we’d normally see when buyer demand wanes but, due to lower inventory, home prices are still remaining elevated.

Housing demand is typically driven by housing market conditions as well as changes in the economy, job market and household income. The lower housing affordability is, due to higher mortgage rates and/or home prices, homebuyers tend to wait out those conditions for lower rates and home prices. However, timing the real estate housing market is tricky. -

How does the real estate housing market affect buyers and sellers?

The housing market impacts buyers and sellers differently. With higher mortgage rates, high home prices and low housing inventory, many homebuyers, especially first-time buyers, have been sidelined due to affordability issues. This is because many first-time homebuyers often don’t have large cash reserves and are usually financing their home purchase through a mortgage lender, which entails various up-front and ongoing costs.

Meanwhile, homeowners who would normally sell their homes to downsize or move up have a stronger financial starting point to work from thanks to record growth in home equity in recent years. However, with higher mortgage rates, many homeowners might not see a financial incentive to buy another home or refinance because they’ll incur higher borrowing costs and home prices today than when they purchased or refinanced during record-low rates during the COVID-19 pandemic in 2020 and 2021. As of June, 62% of homeowners with mortgages had rates below 4%, and 92% had rates below 6%. -

How is the real estate housing market performing in 2023?

In 2023, the real estate housing market saw high mortgage rates, climbing to 8%, low housing inventory, high home prices and suppressed mortgage demand. This has led to an overall decline in home sales and lower-than-normal mortgage origination volumes.

Refinance volume has ground to a halt during 2023 after many homeowners refinanced during a period of record-low mortgage rates during and immediately after the COVID-19 pandemic in 2020. The bright spot in the housing market this year has been new-home sales, which are currently up 17.7% year over year as of October. -

Will the housing market crash in 2024?

The short answer is, no, the housing market is not expected to crash in 2024. A housing market crash is characterized by a dramatic price correction that usually occurs when supply outweighs demand and homeowners are underwater on their mortgages. From 2022 to 2023 as mortgage rates spiked and affordability sank, homebuyer demand in the U.S. fell dramatically, from a pace of 6 million home sales in 2022 to under 4 million in 2023, according to Altos Research.

Homebuyer demand declined but home prices actually rose 2% to 5% higher by the end of 2023 versus a year ago. This is due to a low supply of available homes on the market. There were relatively few buyers, but even fewer sellers. Available inventory of unsold homes declined and prices nudged up. The signals for 2024 are for slightly improved inventory, more selection for buyers. But buyer demand is inching higher too, so the market balance seems like it will continue into the next year, meaning the housing market is unlikely to crash anytime soon. -

What are the top trends that will shape the housing market in 2024?

In 2024, the housing market will see higher mortgage demand, stabilizing home prices, lower mortgage rates and an uptick in housing inventory, according to official industry forecasts. For home prices, Zillow’s 2024 forecast predicts that home values will level off, falling 0.2%. With hints of mortgage rates holding steady in the new year, Zillow estimates that the costs of buying a home will stabilize and could move lower if mortgage rates fall. Meanwhile, Freddie Mac believes house prices will increase at a slower pace of 2.6% in 2024, down from 5.4% in 2023 versus the year prior.

When it comes to housing supply/inventory, Realtor.com predicts 14% fewer existing homes on the market nationally in the new year compared to 2023. It’s worth noting, however, that all real estate is local so inventory will heavily depend on conditions in local housing markets.

Meanwhile, the National Association of Realtors (NAR) projects that existing-home sales will jump 13.5% in 2024 after seeing an 18% decline in 2023. The outlook for newly built homes is promising, too. The National Association of Home Builders projects that single-family home building will increase to an annual pace of 925,000 next year, up from 744,000 units in 2023.

Mortgage rates are nearly impossible to forecast with absolute certainty, but industry organizations are optimistic overall that rates will move down next year. Realtor.com forecasts that mortgage rates for a 30-year, fixed-rate home loan will stay above 6.5% for most of the year. This means there will be a continued lock-in effect, which means there’s a gap between current rates and the rates homeowners already have on their outstanding mortgages. About two-thirds of outstanding home loans have a rate below 4%, Realtor.com data shows. What’s more, 90% of outstanding mortgages have a rate below 6%. As a result, potential home sellers may be less incentivized to give up their ultra-low mortgage rate for a higher one on another home, prompting them to stay put in their existing homes.

When looking at mortgage volume for next year, the Mortgage Bankers Association (MBA) forecasts total mortgage origination volume to climb to $1.95 trillion, up from the $1.64 trillion expected in 2023. The MBA also estimates 5.2 million total loans to be originated in 2024, an increase over 4.4 million expected this year.

-

Will there be foreclosures in the housing market in 2024?

Home foreclosures are at historically low levels today compared to the Great Recession, and it is unlikely that the housing market will see foreclosures in 2024. The 2008 housing crisis resulted from predatory subprime lending, high levels of consumer debt, unemployment, market deregulation and plummeting home prices. These factors led to a housing market collapse in most parts of the country in which homeowners, unable to make their monthly loan payments, ended up in foreclosure.

It takes four variables to simultaneously be true for foreclosures to happen:

- Negative equity. This is when a homeowner is upside-down in their mortgage, meaning they owe more on the house than it’s worth (underwater).

- Bad mortgage terms. Interest rates that are too high, payments too high or rising variable-rate loans.

- Prolonged unemployment. The homeowner loses their job and doesn’t have the cash on hand or is unable to make the income required to make their mortgage payments.

- Inability to sell a house. If housing market conditions decline, some homeowners simply opt to walk away from their homes and let the lender or bank retake ownership, known as a real estate-owned property, or REO.

It’s important to note that in 2023 none of these are true. Americans have record levels of home equity, with the most favorable borrowing terms in the history of modern housing finance. Employment remained very strong through 2023 in spite of recession expectations all year. And time to sell homes remains very fast. Even if the economy slows dramatically in 2024, for example, and if unemployment rises, none of these other factors are true. Unemployed homeowners who no longer can make their mortgage payment can simply sell their home in a few weeks. As a result, it is unlikely that we’ll see any flood of distressed sellers or foreclosures in 2024.

-

How do mortgage rates affect the housing market?

Mortgage rates play a key role in the housing market, because mortgage rates directly impact the cost of borrowing for a homebuyer. When mortgage rates move higher, monthly mortgage payments go up, which can limit how much home a homebuyer can afford in their monthly budget and how much they can get preapproved to borrow from a mortgage lender. When rates move up, this stifles homebuyer demand, which results in a slowdown in the housing market and home sales.

The 30-year fixed mortgage rate reached 8.2% in October 2023, up from roughly 3% 18 months earlier, according to Altos Research. This affordability crisis hit millions of Americans and stopped potential homebuyers in their tracks. Mortgage rates are unpredictable. If mortgage rates were to move higher in 2024, that would have an immediate chilling effect on homebuyers and we would see home prices correct down very quickly, which would cause the housing market to come to a standstill.A rule of thumb for mortgage rates is that consumers are more sensitive to changes in rates than to the absolute level. Housing demand in 2022 slowed so dramatically because rates rose dramatically. This means that even if mortgage rates stay in the 7% range, where they are now, then homebuyer demand will actually increase a bit. But if rates jump, that could be a trigger for big home-price declines.