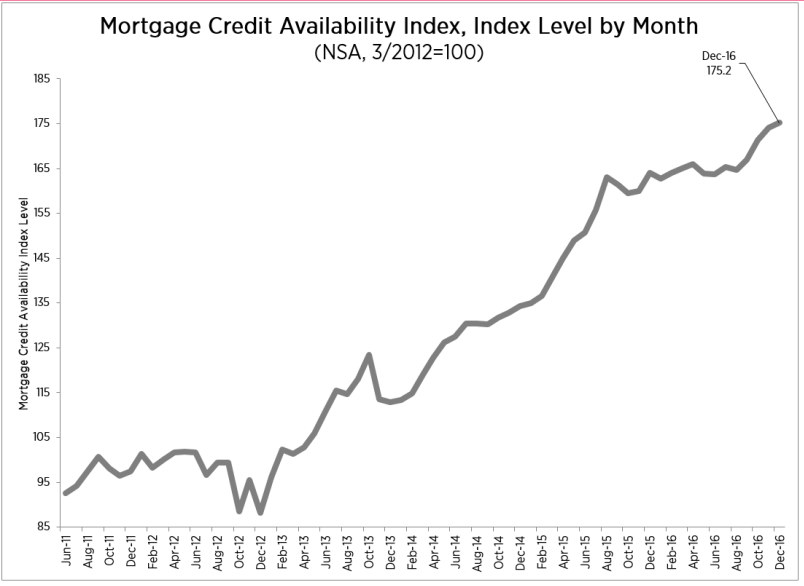

The recent upward trend in mortgage credit availability didn’t let up in December, according to the latest report from the Mortgage Bankers Association.

The newest Mortgage Credit Availability Index shows a 0.6% increase to 175.2 in December, marking the fourth consecutive month of credit loosening.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

The MCAI is a report from the MBA that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

The chart below shows the monthly changes in the index, dating back to June 2011.

Click to enlarge

(Source: MBA)

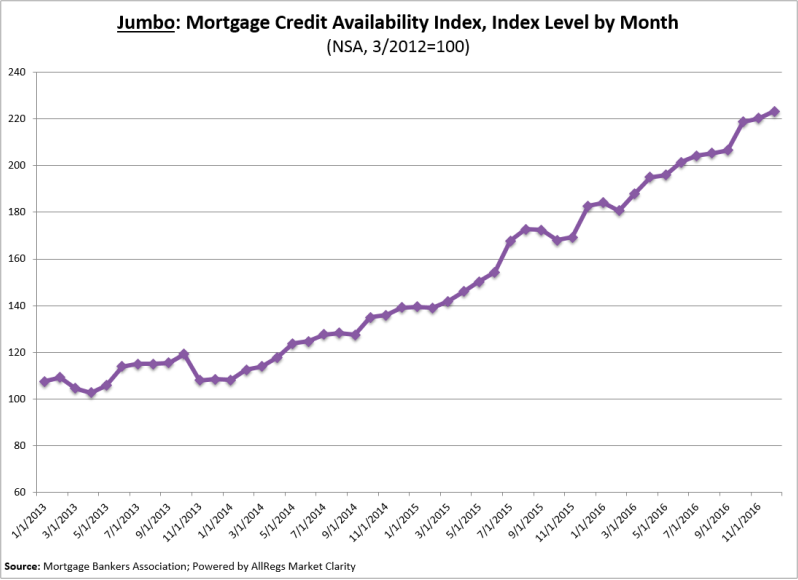

Lynn Fisher, MBA’s vice president of research and economics, attributed the loosening to jumbo loan programs as well as loan programs for borrowers with lower credit scores and low down payments.

Freddie Mac’s 3% down mortgage is one example of this. Donald Layton, Freddie Mac CEO, noted in an interview last year that while its 97% LTV product isn’t large enough to be driving an increase yet, it has significantly attractive characteristics for first-time homebuyers and is rapidly growing in demand.

The chart below shows only the changes in the Jumbo MCAI, which recorded the greatest increase in availability over the month (up 1.3%).

Click to enlarge

(Source: MBA)