With the banking crisis spurring more talk of a recession, the question now is: What would housing credit look like in a recession? Many people predicted that the U.S. housing market would crash during the pandemic. One of the main reasons for that fear was that housing credit was about to get tight, meaning fewer people could buy homes with mortgages.

Even though housing data recovered by May 2020, people didn’t want to believe the data and assumed housing was going to fall more, especially with forbearance on the horizon.

How can we be sure not to make the same mistake that millions of people made by calling for housing to crash in 2020 and 2021? We can do it by understanding the credit channels in the U.S. today and why they’re so different than the period of 2002-2008.

Credit getting tighter

What we traditionally see going into recession and during a downturn is credit getting tighter. What does tighter credit mean for housing? It means certain mortgage products might not be offered, FICO score requirements might be raised, and it can mean pricing for certain loans goes up to account for the risk.

However, the current housing market is much different than the credit boom-and-bust cycle of 2002-2008, and it’s vital to understand why.

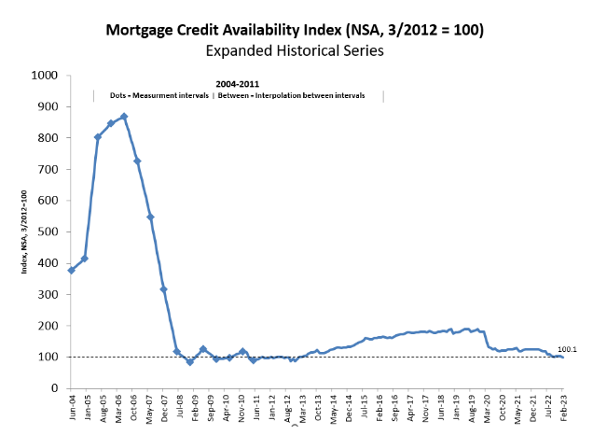

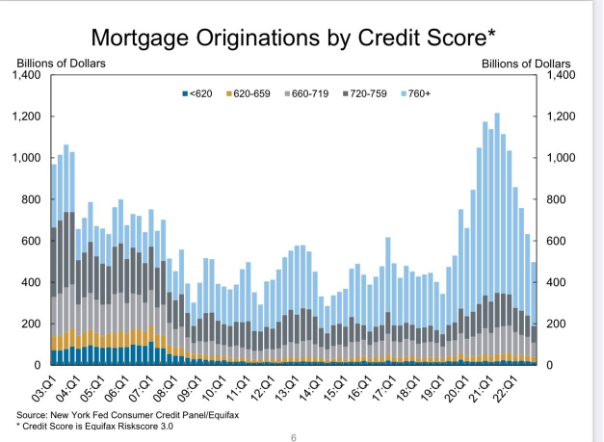

Credit availability was booming during the housing bubble years, then collapsed epically. The MBA chart below shows what a vast collapse it was then. Now, with new regulations in place since the financial crisis, that credit expansion and collapse will be a once-in-a-lifetime event.

Why is this so important? Over the years, one of my big talking points has been that we didn’t have a massive credit housing boom in the U.S. during the last few years, nor can we ever. Because of the qualified mortgage laws of 2010, we are lending to the capacity to own the debt, which means speculative credit cycles from primary resident homebuyers or even investors can’t occur in the same fashion as from 2002-2005.

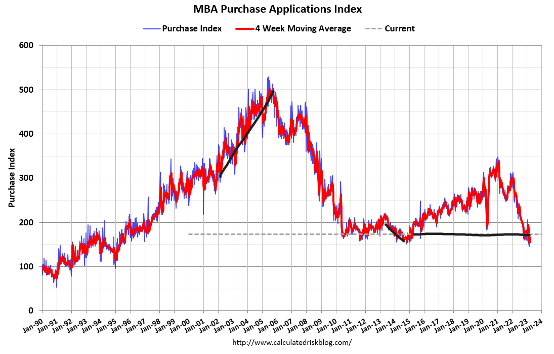

The purchase application data below clearly shows this. We had many years of much higher credit growth during the bubble years and not that much credit in the past few years.

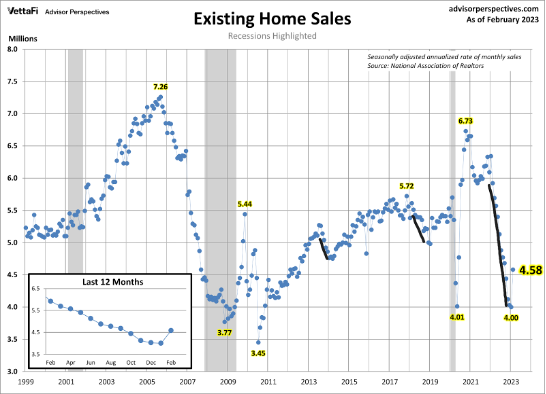

This is important because the existing home sales market was booming during the 2005 peak; that market needed credit to stay loose to keep demand high and growing. That is not the case today. We had a massive collapse in demand in 2022, not because credit was getting tighter but because affordability was an issue.

After rates fell recently, working from a shallow level, we saw one of the most significant month-to-month sales prints in history with the last existing home sales report.

This big bounce in demand came from a waterfall dive, and we needed at least 12 weeks of positive, forward-looking data to get this demand increase, but it happened as mortgage rates fell. Mortgage credit can get tight for jumbo loans, non-QM loans and home equity lines, but general conforming Freddie Mac and Fannie Mae loans, FHA, and VA loans should be steady during the next recession.

Spreads are getting wide again

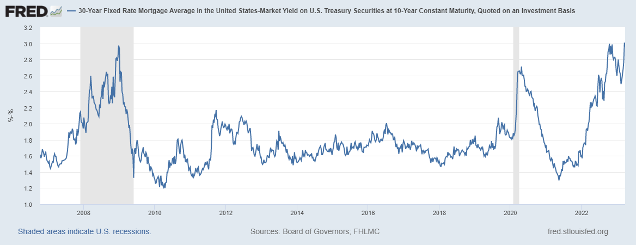

What has happened recently with the banking crisis is that the mortgage-backed securities market has gotten more stressed, so rates are higher than they should be as the spreads between the 10-year yield and mortgage rates have widened again.

As you can see below, the spreads got much broader during the great financial crisis and COVID-19 recessionary periods. There is usually a 1.60%- 1.80% difference between the 10-year yield and 30-year mortgage rate, but now we are at 3%.

The chart below tracks the stress in the mortgage-backed securities market: the higher the spread between the 10-year yield and 30-year mortgage gets, the higher the line goes. This means the dance partners, while still dancing, are creating some space between each other.

The Federal Reserve doesn’t care about the U.S. housing market. The Fed is complaining mortgage rates are returning to 6% and people buying homes might make their job harder. The Fed will rush to save a bank, but won’t whisper a word for an entire housing market to improve spreads.

So, the risk here is that when we have a job-loss recession, spreads get even worse, as the Federal Reserve doesn’t care. I would usually think the Fed might assist the economy, but with this Federal Reserve, you never know what they will and won’t do. I talked about this Wednesday on CNBC.

We need to be mindful of this when the recession hits. The housing market might not get any assistance, even though we are getting closer to the one-year call when I put the housing market in a recession on June 16, 2022.

Homeowner balance sheets look awesome this time around

As I said above, credit getting tighter in relationship to demand is not a thing because we didn’t have a massive credit boom like that from 2002-2005 to then have a bust from 2005-2008 due to credit getting tighter.

The mortgage market can get stressed because the spreads can get wider, meaning rates can be higher than at ordinary times. However, we aren’t going to see the credit availability collapse in the same way we did in 2008.

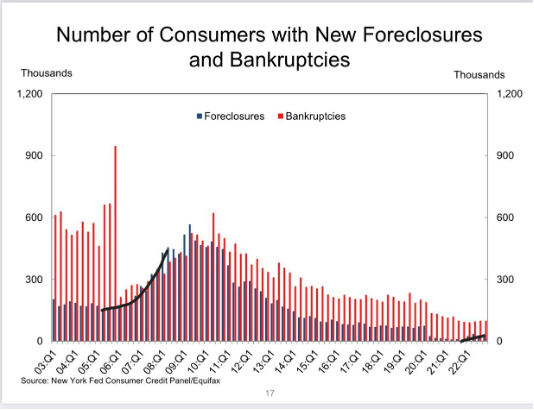

The most significant difference between 2008 and the last 13 years after the qualified mortgage laws were implemented is that we don’t see a surge in housing credit stress before a job-loss recession. If there is one chart I would show every day, it’s the one below: housing credit stress was easy to spot years before the job-loss recession happened. Today it’s much easier to see that we don’t have similar credit stress with homeowners.

Because the U.S. has no more exotic loan debt structures, we don’t have large-scale risk tied to homeowners and banks. Over time, the foreclosure data should get closer to pre-COVID-19 levels, but nothing like the credit stress we saw from 2003-2008.

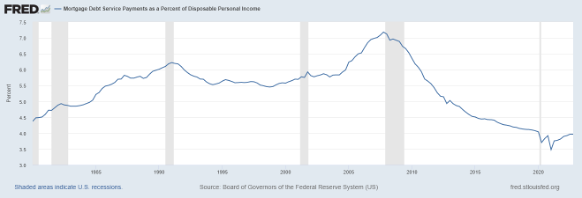

Homeowner financial data looks awesome; fixed debt cost, rising wages, and cash flow look better and better over time. As you can see below, mortgage debt service payments as a percent of disposable personal income look excellent, much better than in 2008.

This means the cash flow looks excellent! Do you want to know why people aren’t giving up homes? A U.S. home with a 30-year fixed mortgage is the best hedge on planet earth. As inflation comes down, homeowners’ cash flow gets better. During inflationary periods, your wages grow faster, but as a homeowner, your debt costs stay the same.

Unlike 2008, we don’t have a major risk of loans recasting with payments that the homeowner can’t afford even if they were still working. We will see a rise in 30-day delinquencies, and over 9-12 months, we will see a foreclosure process work. However, in terms of scale, nothing like what we saw in 2008.

Hopefully, this gives you three different credit takes on the credit question when we go into recession.

Credit tightening concerning most loans being done today isn’t a significant risk because government agencies back most loans done in the U.S. However, the mortgage-backed securities market can stay stressed longer than most people imagine when the next recession happens.

We don’t have a rise in foreclosures as we did from 2005-2008 before the job-loss recession. However, we do have traditional risk, meaning that late-cycle homebuyers with small down payments can be a future foreclosure risk if they lose their jobs.

So, we have a different economic backdrop now than in 2008 and 2020. Both recessions were very different from each other, but this gives you an idea of some of the significant dynamics around housing credit, debt and risk whenever we go into the next recession.

As always, we will take the data one day, week, and month at a time and walk this path together.