Demand for housing was strong in early 2020, before the COVID-19 crisis hit. Mandated shut-down measures and the fear of what COVID would do to our economy temporarily immobilized the housing market, evinced by nine weeks of declines in the weekly purchase applications data on a year-over-year basis. Then it was as if the Housing Demographic God exerted her chronokinetic powers to snap demand back to pre-COVID levels of growth. The frozen market thawed and resumed its steady pace of growth, even making up for lost time.

Instead of a housing crash, as many others predicted would be the lasting consequence of shut-down policies and massive job losses across the nation, the opposite happened as the 2020 U.S. housing market has been the most out-performing economic sector in the world.

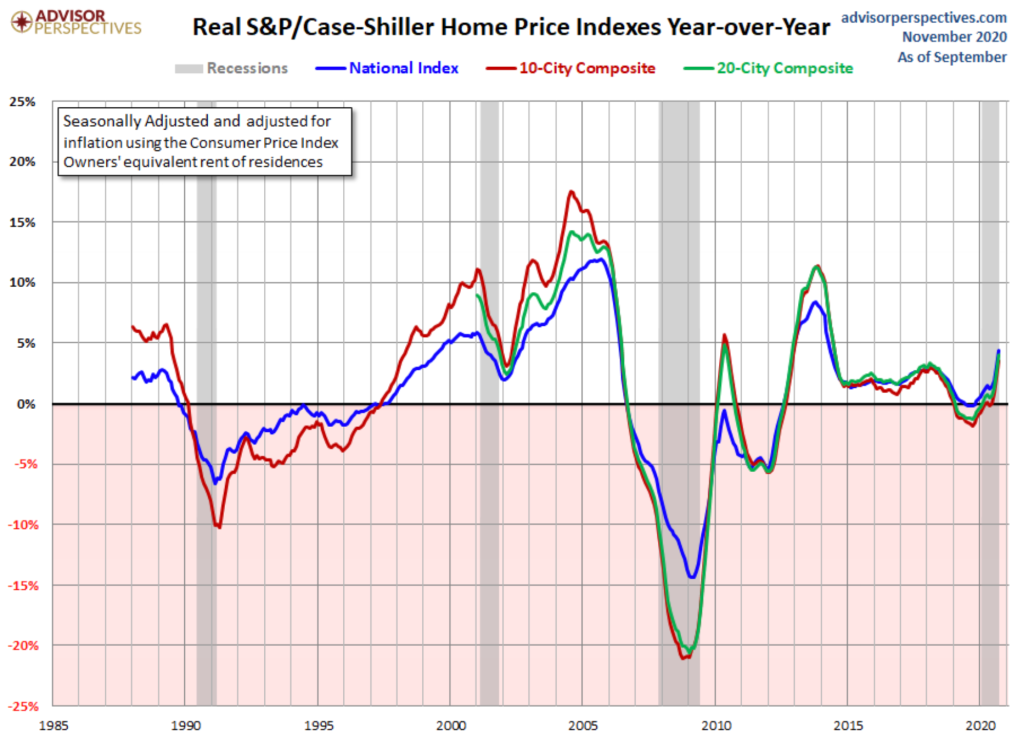

However, we now have another issue to worry about — that home prices will accelerate too quickly, unrestrained by an increase in mortgage rates. As you can see below, we have deviated from the normal price growth that had been the trend in recent years.

My biggest fear for the housing market in years 2020-2024 was never a lack of demand, as the housing bubble boys have been trolling about the last eight years — it was an unhealthy rate of price growth due to demographics and low mortgage rates.

When demographics are good for housing, meaning we have a large number of our populace at home-buying age, demand — and thus home prices — can be moderated by higher interest rates. We were witness to this in 2018 when mortgage rates increased to 4.75%-5%, demand fell and the rate of growth of real home prices went negative, year over year.

That was then and we can clearly see this isn’t the case anymore.

Today, we have the best housing demographic patch ever recorded in U.S. history with a huge number of Americans ages 26-32 on the brink of 33 years, the median age for first-time homebuyers. I think of this group as our built-in replacement buyers. Add to this homeowners buying up and downsizing and our continuing higher-than-average number of cash buyers as a percentage of sales, and you can see how housing demand should remain stable in years 2020-2024.

We can add a new segment to this group, as some Americans are taking advantage of living in cheaper areas of the country and working from home.

The second mighty force of housing economics, mortgage rates, will likely stay low for the next several years. By “low,” I mean under 5% during the period from 2020-2024. I can’t see the 10-year yield getting above 3% for any duration during this period, unless a massive fiscal stimulus plan is implemented when people can operate freely without COVID-19 concerns. With the split House and Senate, this seems unlikely.

Lastly, I would be remiss not to mention housing tenure as a factor that can influence home prices. Longer housing tenure can facilitate lower inventory, which can drive home prices up. From 1985 to 2007, housing tenure was running at five years. Today, it is double that.

On a bright note, I do believe in years 2020-2024 we should get more move-up buyers when their current homes are not big enough for their growing families. We can add the COVID-19 variable of people wanting a bigger home to add an office space or make room for an elderly relative.

In 2020, we had a deflationary crisis here and around the world that kept bond yields and mortgage rates lower for longer than what would have happened in a typical year. When the economy improves, bond yields should rise. When rates go up, we should see a cool down in housing demand and in the rate of growth of home prices. The 10-year yield did get to 0.98% a few weeks ago after the vaccine news came out, but based on the previous cycle this yield is nowhere near the level needed to dampen demand.

When the 10-year yield went above 2.62% and reached 3.24% in the previous cycle, demand became so soft that builders paused construction until the excess inventory was sold off in 2019. Housing starts were roughly flat in 2019.

I wrote earlier this year that I would keep a watchful eye on whether the 10-year yield goes over 1.94%. Right now the 10-year is at 0.84% as I write this because we still have an economy that is hampered by COVID-19.

The economy overall is not functioning anywhere near full capacity, certainly not enough to warrant a much higher 10-year yield.

This mismatch in the COVID deflationary impact toward the economy overall and the strength of the 2020 housing market due to demographics makes for a troubling formula for home price growth, which we are seeing. The recent National Association of Realtors existing home sales report showed 15.5% year-over-year growth in prices.

I am wishing for higher mortgage rates next year because this will mean the economy is improving as we finally defeat COVID-19 and we can start working to get those last 10 million unemployed Americans back to work. Higher rates will also mean cooling in the rate of growth in home prices, which we desperately need now. It isn’t good for the housing market to have real home price growth take off in an unhealthy way, ever.

The housing market is about demographics and mortgage rates. When both demographics and mortgage rates are at the best levels ever, demand is not the problem, but unhealthy home price growth can be. During this period of strong housing demographics, only two things can dampen price growth: higher rates or applying stricter lending guidelines, such as increasing the down payment to buy a home.

The chances of increasing down payment requirements are close to zero. If anything, look for the housing industry to try pass a first-time home-buyer tax credit (adding more fuel to the fire) if the 10-year yield stays below 1%. Also, look for a push to cancel student loan debt, another fiscal policy that would likely stimulate housing demand.

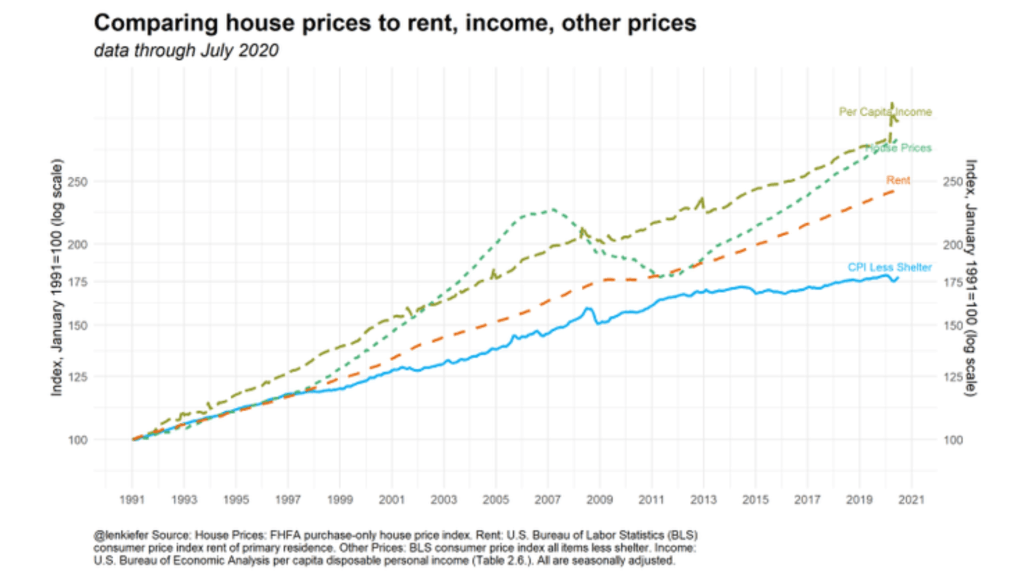

There is no easy fix to the recent housing price growth outside of defeating COVID-19 and getting the economy back to normal. Housing inflation is sticky and hard to get rid of when you don’t have speculation demand in the mix. We had a lot room left for home prices to catch up to per-capita income in the past few years but that is over now, as Len Kiefer, deputy chief economist at Freddie Mac so elegantly shows here.

Appropriate lending standards will prevent credit speculation from swamping the housing market, but King Demographics may make pricing too hot for many homebuyers if mortgage rates stay too low for too long. Hopefully, if I am right, once the vaccine can be distributed to more and more Americans, then bond yields will rise for the right reason as America is back and free from COVID-19.

Great job, Logan. I will need to work ‘chronokinetic’ into conversation one of these days.

I am a realtor, not in the mortgage industry and not an economist. Housing Wire has taught me so much and confirmed some of my own developing knowledge and analysis. Thank you!

Thanks for this feedback! I’ve let the entire team at HousingWire know.