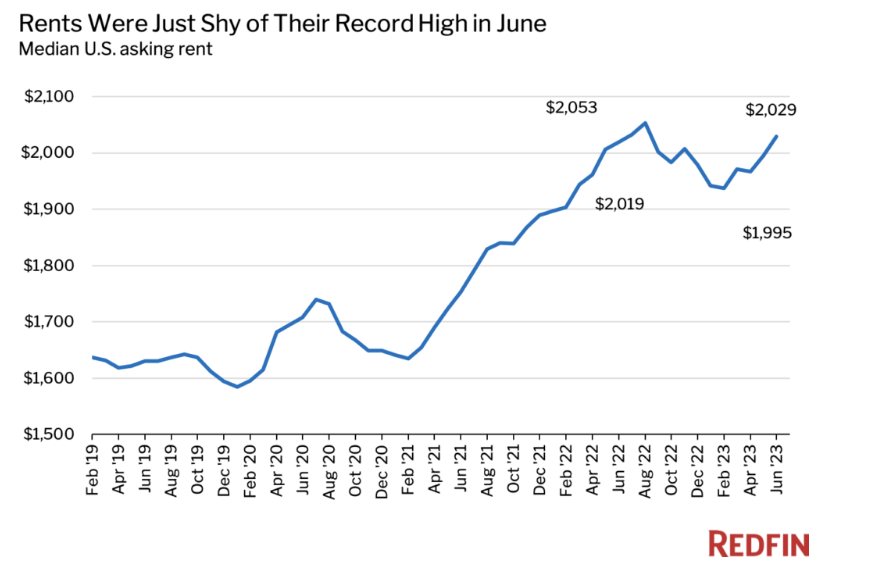

The U.S. rental market has been slowing for more than a year, but the median asking rent is still not far off record highs, according to a new report from Redfin.

The median asking rent hit $2,029 in June, up from $1,995 in May, the listings platform and brokerage said Wednesday. The median asking rent was $2,019 in June 2022 and $2,053 in August 2022, which was recorded as the all-time high.

“The housing market tends to be ‘downside sticky,’ which means rents don’t typically fall much even when renter demand pulls back,” Redfin Deputy Chief Economist Taylor Marr said in a statement. “Instead of lowering rents when business is slow, many landlords offer perks like a free month’s rent or discounted parking, which tends to be less of a hit to profits.”

Marr added: “The steep slowdown in rent growth over the last year is providing some relief for renters, who now have more room to negotiate as their landlords grapple with rising vacancies. But with rents near their record high, most renters still aren’t finding big bargains.”

Though the $24 decline in rent growth from August 2022 isn’t much solace to renters, it has helped ease the inflation, according to Bureau of Labor Statistics data released Wednesday.

Consumer prices were up 3% this year through June, a deceleration from the 4% level reported in May and the peak of about 9% last summer. The cost of shelter, with rent being 70% of the indexes weight, rose 0.4% from a month earlier in June on a seasonally adjusted basis—a significant cooling from 0.8% at the end of last year. The slowdown in inflation reported Wednesday is in large part due to the deceleration in rent growth over the past year.

“Inflation should continue easing this year and into 2024, partly because the recent slowdown in rent growth isn’t fully baked into inflation data yet, and partly because rents have room to fall,” said Chen Zhao, an economist at Redfin. “Rents have room to come down because there remains a backlog of under-construction rentals that have yet to hit the market, which means landlords will continue grappling with vacancies and won’t be able to hike rents as rapidly.”

Economic uncertainties and surging options for renters kept rent growth under control

A year ago, most of the nation’s 150 largest markets were seeing asking rent growth north of 6% but in June only 18 were, noted Jay Parsons, rental housing economist at RealPage.

“And it’s definitely not the institutionally favored markets right now,” he said in a LinkedIn post. “The list is dominated by a mix of a) college towns, b) energy markets, and c) metros in the Northeast or Midwest.”

Per RealPage, the top asking rent growth leaders year-over-year in June were Midland/Odessa, Texas at 18%, followed by Madison, Wisconsin (10%), Champaign, Urbana, Illinois (8.6%), Springfield, Massachusetts (8.3%) and Knoxville, Tennessee (8.2%). Meanwhile, the metros with the biggest rent growth declines were Boise (-6.2%), Phoenix, Arizona (-4.7%), Las Vegas, Nevada (-4.0%), Vallejo/Fairfield/Napa, California (-3.9%), Fort Walton Beach, Florida (-3.5%).

Rent growth has cooled from its 2022 high partly because fewer people are moving due to economic uncertainty and slowing household formation, and partly because the number of options for renters has surged. Completed residential projects in buildings with five or more units rose 23.9% year over year to 493,000 on a seasonally adjusted basis in May. This means landlords have more vacancies to fill and less leeway to raise prices, according to the report.

While a homebuilding boom has led to more multifamily rentals on the market, it is letting up. The number of permitted residential projects in buildings with five or more units fell 12.2% year over year to 540,000 on a seasonally-adjusted basis in May.

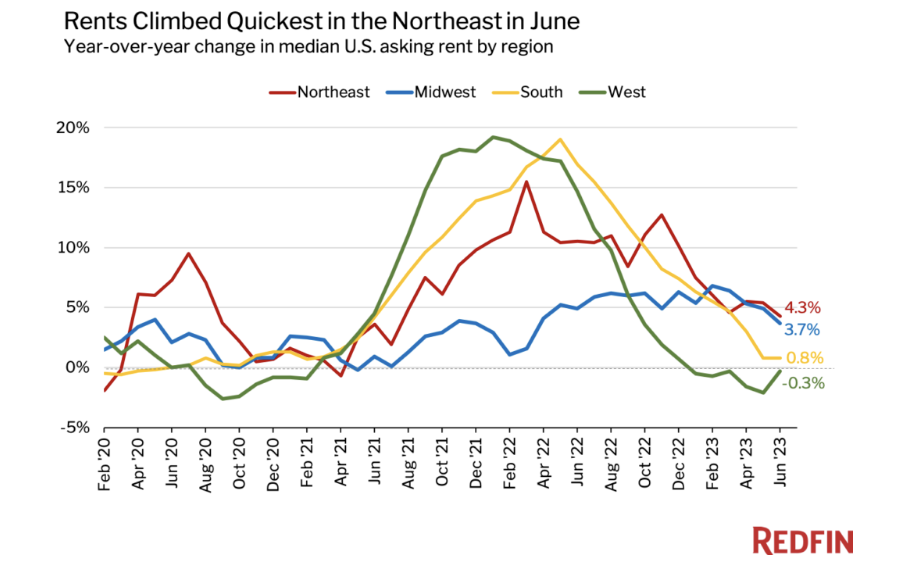

Median asking rents were highest in the Northeast

In the Northeast, the median asking rent rose 4.3% year over year to a record $2,503 in June, according to Redfin. By comparison, asking rents rose 3.7% to $1,396 in the Midwest, 0.8% to $1,670 in the South, and fell 0.3% to $2,452 in the West. Rent growth has been slowing fastest in the West and South in part because it exploded so quickly during the pandemic, with renters scooping up apartments in Sun Belt cities like Phoenix, Miami and Dallas.