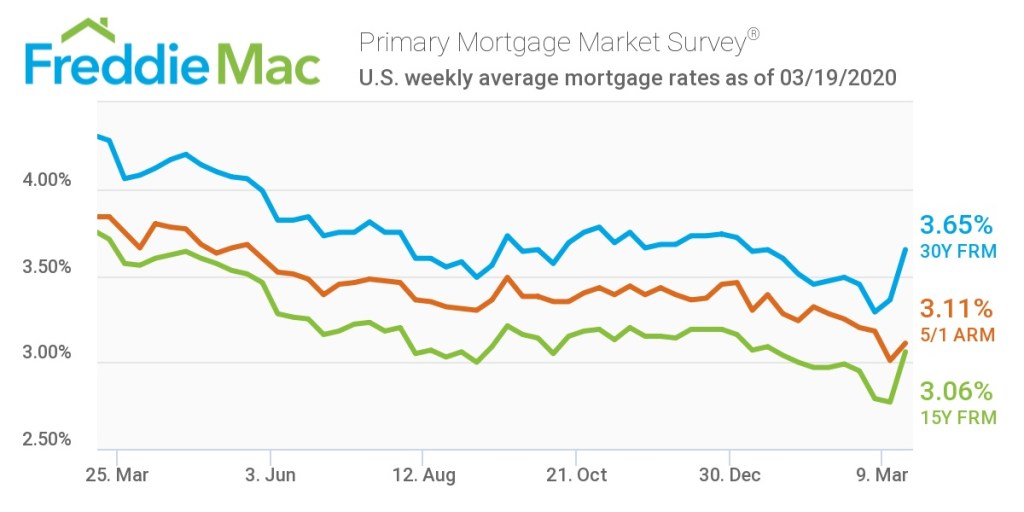

The average U.S. fixed rate for a 30-year mortgage increased to 3.65% this week, as lenders seemingly inflated prices in an effort to deal with a surge in both refinance and purchase demand.

While the rate sits 29 basis points above last week’s level of 3.36%, it’s still much lower than the 4.28% of the same week in 2019, according to Freddie Mac.

Regardless, the record low interest rates of a few weeks ago are now a thing of the past. But that doesn’t mean they may not come back again.

“Mortgage rates rose again this week as lenders increased prices to help manage skyrocketing refinance demand. This is expected to be a short-term phenomenon as lenders work through their backlog,” said Sam Khater, Freddie Mac’s chief economist. “On the purchase front, daily loan purchase applications were rising as of mid-February but started to decline last Friday.”

The Mortgage Bankers Association reported Wednesday morning that mortgage applications fell 8.4% in the week ending March 13, 2020, compared to the week prior.

“The ongoing situation around the coronavirus led to further stress in the financial markets late last week, with unprecedented volatility and widening spreads,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “This drove mortgage rates back up to their highest levels since mid-February and led to a 10% decrease in refinance applications. However, refinance activity remains very high.”

According to Freddie Mac’s survey, the 15-year FRM averaged 3.06% this week, increasing from last week’s rate of 2.77%. This time last year, the 15-year FRM averaged 3.71%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.11% this week, up from last week’s rate of 3.01%. Last year, the 5-year ARM averaged 3.84%.

Kan also said that the recent actions by the Federal Reserve and others should calm things down a bit from an interest rate perspective, which could lead to even more refis.

“The Federal Reserve’s rate cut and other monetary policy measures to help the economy should help to bring down mortgage rates in the coming weeks, spurring more refinancing,” Kan said. “Amidst these challenging times, the savings that households can gain from refinancing will help bolster their own financial circumstances and support the broader economy.”

The image below highlights this week’s changes: