As the mortgage business continues to try to deal with the repercussions of interest rates hitting an all-time low last week, it appears that some lenders are inflating their advertised mortgage rates to try to stem the tidal wave of mortgage applications they’re receiving.

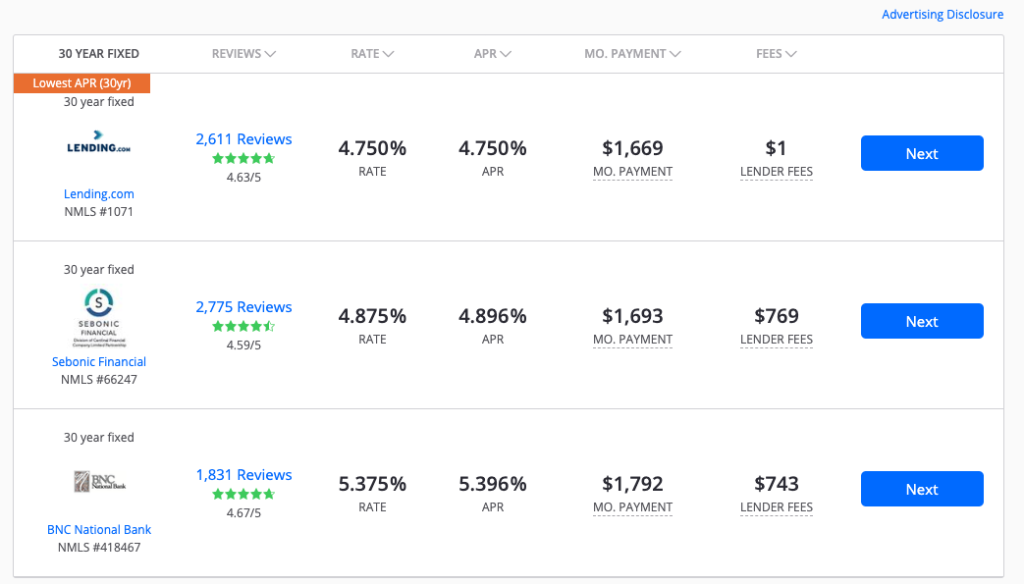

A review of the top mortgage rate comparison sites (LendingTree, Bankrate, Zillow, Credit Karma and several others) shows lenders advertising rates well above the all-time low that rates fell to just last week.

On several sites, there appear to be far fewer quotes from lenders than there typically are. Beyond that, the rate quotes that do appear are, in some cases, more than a full percentage point above the record low of 3.29%.

So, why are the rates so high? Last week, HousingWire spoke to numerous lenders, mortgage brokers and other mortgage professionals who hinted that some lenders may be keeping their mortgage rates above where they could be in an effort to control the demand for mortgages.

Put simply, many lenders are so busy right now trying to process the loan applications they’ve already received that they’re pushing their interest rates well above the prevailing market rate so they can actually deliver on the loans they already have in their pipeline.

HousingWire searched many of these mortgage comparison sites on Tuesday, using identical financial information to try to ascertain an apples-to-apples comparison of the different sites.

On Bankrate, for example, the advertised rates that showed up when HousingWire searched Tuesday ranged from 4.75% all the way up to 6% for a refinance. Even Bankrate itself is acknowledging that those rates are well beyond the expected level.

After searching for a mortgage rate, the following message appears in a pop-up on the site:

You may find that advertised mortgage rates are higher than expected right now. Market factors have caused a surge in applications, which has exceeded lenders’ capacity levels and therefore impacted displayed rates.

Mortgage rate searchers are then encouraged to sign up for an email update when the displayed rates are “back to market levels.”

It’s much the same on Zillow, where interest rates for a 30-year refi varied from 4.75% to 5.375%. And it was the same on Trulia, which pulls its mortgage data from the same place Zillow does.

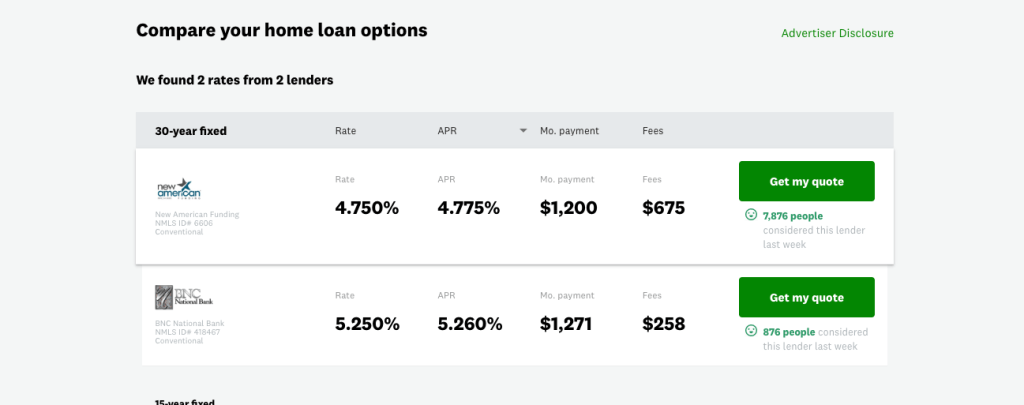

The story was the same on Credit Karma, where only two lenders appeared. The advertised interest rate from those lenders: 4.75% and 5.25%.

On Nerdwallet, meanwhile, a search only returned one lender: Rocket Mortgage by Quicken Loans. The quoted interest rate? 4.536%.

Nerdwallet’s site also noted that the prevailing interest rates rose by nearly 20 basis points (0.19%, to be exact) in the last 24 hours.

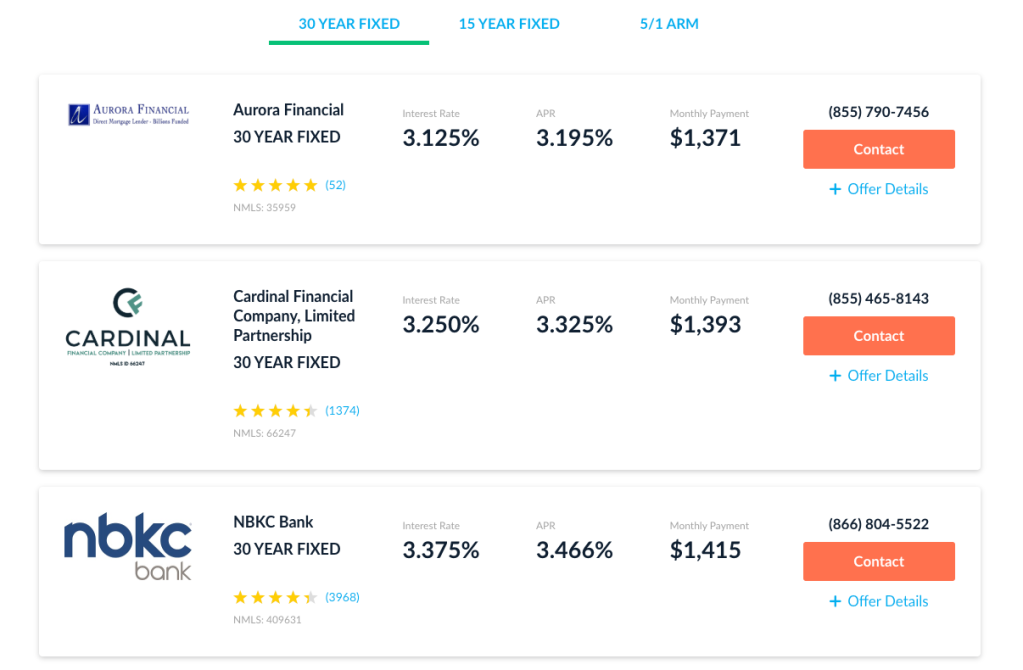

A similar jump is also shown at LendingTree, where its rate trend graph shows an increase from 3.35% on Thursday to 3.68% on Saturday. The advertised interest rates on LendingTree were a little closer to expected, with three lenders all below 3.375%.

The situation was far more dire on Redfin, where literally zero lenders appeared in a search for a 30-year refi. The page featured the following disclaimer at the top: “Quotes missing or too high? Our lenders are over capacity right now due to the latest interest rate cuts. We recommend checking back later.”

Over on Realtor.com, the mortgage search returned rates at big banks like Citibank, HSBC, and Bank of America that were at 3.3% or below. Credit.com showed no lenders when HousingWire attempted to search its site for mortgage options, while Smartasset only showed one lender advertiser, which did not display an advertised rate.

Wallethub showed a number of mortgage options, with an available interest rate of 3% for 30-year refi, but all of the larger lenders, including Citi, Wells Fargo, and JPMorgan Chase showed rates well above the presumptive market rate. Chase was more than a full percentage point above the record low of last week, displaying an advertised rate of 4.375%.

While it appears that some lenders are marking up their rates to try to deal with their capacity issues, the next question is how long will this phenomenon last? Will lenders move rates back down once they return to a manageable workload? Or will it end up that the record lows in interest rates were just a fleeting moment? We’ll see soon enough.