Mortgage credit is still the tightest it has been in more than six years, but an unwavering February may be the calm before the purchase storm as lenders prepare for a revitalized economy, the Mortgage Bankers Association said in a report on Tuesday.

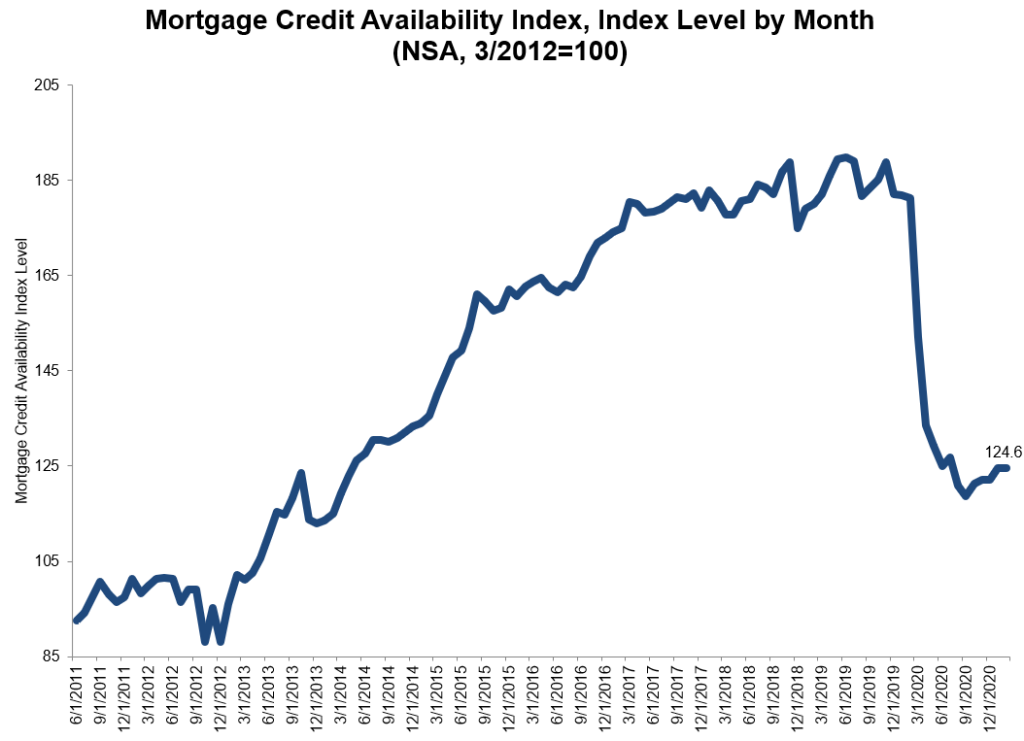

The group’s Mortgage Credit Availability Index remained unchanged at 124.6 last month, still hovering near levels previously seen in 2014. The index plunged from record highs seen in late 2019 after the COVID-19 pandemic resulted in the worst economic contraction since the Great Depression.

Measuring credit availability by loan type, the Conforming MCAI that tracks loans backed by Fannie Mae and Freddie Mac fell .7% while the Jumbo MCAI measuring high-balance loans rose .2%, and the Conventional MCAI that measures loans not backed by the government fell .3%.

The Government MCAI that includes mortgages backed by the Federal Housing Administration, the Veterans Administration and the U.S. Department of Agriculture rose .3%, MBA said.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

Community lenders will thrive in 2021’s purchase market

Powered by Maxwell and its digital mortgage platform, community lenders are poised to continue their growth path in 2021.

Presented by: Maxwell

According to Joel Kan, MBA’s associate vice president of economic and industry forecasting, despite a virtually unaltered February, the housing market is in strong shape heading into the spring, with robust growth in purchase applications, home sales and new residential construction.

“Expected home sales growth this year is still likely to be driven by first-time buyers, spurred by millennials reaching peak first-time homebuyer age,” Kan said. “Many of these potential buyers will likely utilize FHA and other low down payment loans to purchase a home.”

However, government credit supply has increased in five of the past six months, albeit in small increments, but remains tight by historical standards. This adds another obstacle for many aspiring first-time buyers who are already navigating supply and affordability constraints, Kan noted.

But the MBA is expecting big things from first-time homebuyers in 2021. The trade organization’s chief economist, Mike Fratantoni, said that the rebounding economy and rising buyer demand dovetails with most millennials approaching peak first-time homebuyer age.

“The largest cohort of millennials are now 29, and historically, peak first-time homebuyer age is 32 or 33. The MBA is forecasting that this wave of young homebuyers will support the purchase market for at least the next few years,” Fratantoni said.

The National Association of Home Builders’ fourth quarter 2020 survey of prospective homebuyers also showed that 27% of millennial respondents planned to buy a home in the next 12 months, up from 19% in the prior year’s survey.