There’s probably one thing that mortgage lenders want more than anything else when working with their borrowers: to make their borrowers happy.

Happy borrowers equal satisfied borrowers, and satisfied borrowers turn into repeat customers down the road when it’s time to refinance or buy a new house.

And despite some bumps in the road in the second quarter due to a drop in interest rates and issues of lenders being able to adequately manage the demand for mortgages, overall borrower satisfaction with their lender is on the uptick.

A new report from J.D. Power shows that borrower satisfaction with their lender improved through much of the year, leading to an overall increase in satisfaction over last year.

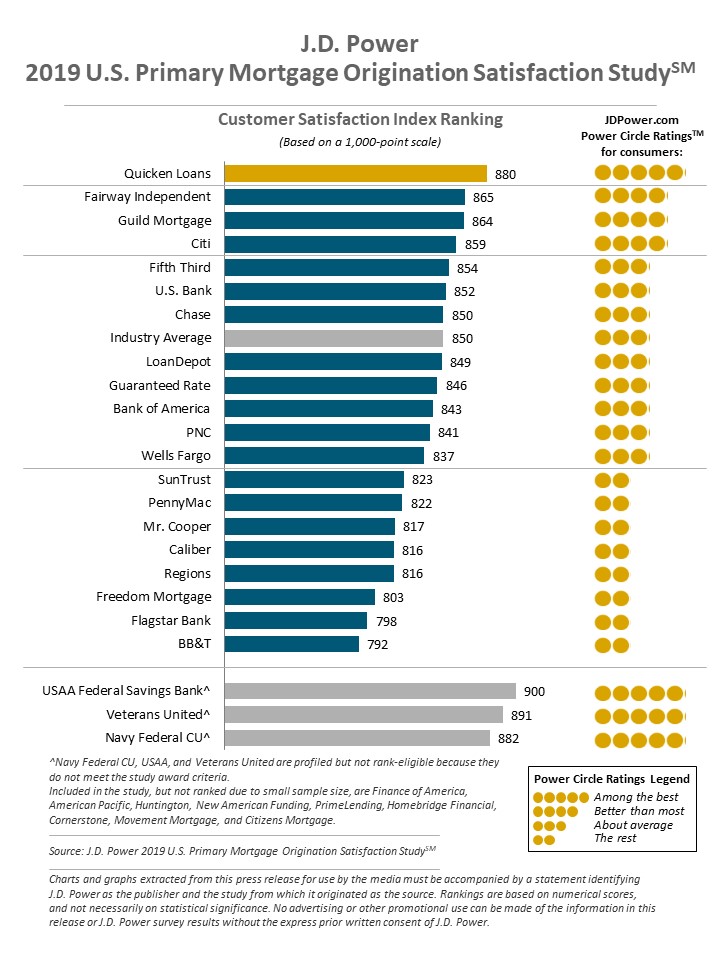

J.D. Power’s 2019 U.S. Primary Mortgage Origination Satisfaction Study, released Thursday morning, showed that overall borrower satisfaction now sits at 850 (on a 1,000-point scale), up from last year’s total of 836.

But there are some lenders that customers seem to love working with more than others, as several lenders have satisfaction scores that exceed the industry average.

Topping the list, as it has for the last 10 straight years, is Quicken Loans, with an overall satisfaction score of 880.

Fairway Independent Mortgage comes in at No. 2, with an overall satisfaction score of 865.

Those companies also topped the list last year, although the race for No. 1 was a little closer with Quicken’s 2018 score coming in at 876, while Fairway’s was 873.

But this year, Quicken’s score improved slightly while Fairway’s went down, but despite the decrease, Fairway is still the second-ranked lender.

Trailing just behind Fairway in 2019’s top lender list is Guild Mortgage, with an overall score of 864. Guild was third last year as well, but improved from its 2018 score of 857.

Leapfrogging several companies to jump into the top four was Citi, which had a borrower rating of 859 this year. Last year, Citi came in eighth with a score of 840.

Rounding out the top five is Fifth Third, which has a score of 854, which is up from last year’s total of 843.

Also exceeding the industry average was U.S. Bank, which has a rating of 852.

All of the other lenders cited in J.D. Power’s report had satisfaction scores below the industry average, except for Chase, which equaled the industry average of 850. That is an improvement for Chase, which last year had a score of 834.

Nearly reaching the industry average were loanDepot and Guaranteed Rate, which had scores of 849 and 846, respectively. Both lenders saw their scores improve in 2019, but loanDepot moved from above industry average in 2018 to slightly below average as the industry as a whole trended up.

Guaranteed Rate, meanwhile, rose from 812 last year to 846 this year.

Despite Quicken Loans’ reign at the top of the list, Navy Federal Credit Union, USAA Federal Savings Bank, and Veterans United would have all outranked Quicken were they able to meet the study criteria.

According to J.D. Power, USAA had a satisfaction score of 900, Veterans United had a score of 891, and Navy Federal had a score of 882, all more than Quicken Loans’ score of 880.

Click the image below to see the full list of mortgage lenders included in J.D. Power’s report. And for more on the overall state of the mortgage market, click here.

Note: The 2019 U.S. Primary Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in four factors (in alphabetical order): Application and Approval Process; Communication; Loan Closing; Loan Offerings. The study was fielded in July-August 2019 and is based on responses from 4,602 customers who originated a new mortgage or refinanced within the past 12 months.