Frank W. Abagnale, Jr. — a former fraudster and con man who famously assisted the Federal Bureau of Investigation (FBI) on fraud crimes before starting his own consultancy firm — has found a role as the subject of a new reverse mortgage advertising campaign and educational video series designed to help seniors spot when they’re being scammed.

Abagnale — whose life was dramatized in the 2002 Steven Spielberg film Catch Me If You Can where he was played by Leonardo DiCaprio, and which was based on his book of the same name — has been enlisted by leading Canadian reverse mortgage lender HomeEquity Bank (HEB) in a new campaign called “Catch the Scam,” which was created in response to a recent survey in which older Canadians expressed that they feel especially vulnerable to fraud.

The series is designed to highlight some of the ways in which fraudsters have become more sophisticated, offering tools and information in order to assist seniors in discerning situations in which they may be targeted by illegitimate actors and entities.

What motivated the new campaign

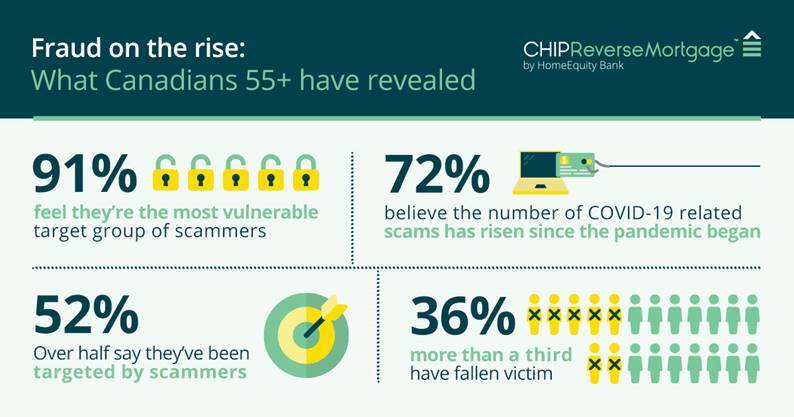

Earlier this year, Toronto-based HEB enlisted multinational market research firm Ipsos to create a survey designed to gauge the anxiety of older Canadians in relation to their vulnerability to financial scams. The results found that an overwhelming majority of Canadians aged 55 and above — 91% of respondents — feel they are more vulnerable to fraud. Over half of those respondents also revealed that they have already been targeted by scammers in some form or fashion.

Additionally, the COVID-19 coronavirus pandemic has only exacerbated this vulnerability, according to respondents. 72% of those surveyed report that the number of pandemic-related efforts to scam seniors has increased since the pandemic began, while over a third of respondents — 36% — say that they have actually fallen victim to a scam.

“It’s alarming when you hear one in three Canadians 55+ say they’ve fallen victim to a scam,” says HEB President and CEO Steven Ranson in the announcement of the new campaign. “We know this demographic better than anyone, and we felt we could make a meaningful difference by helping educate them on how to spot a scam, and properly report it.”

How HEB enlisted Abagnale

Because the pandemic has only seemed to make seniors feel more vulnerable to financial scammers, HEB saw a unique opportunity to help spread the word about the primary CHIP reverse mortgage offering while also making an effort to help arm seniors with good information related to ways they can spot potential instances of fraud.

“There’s very little out there in terms of engaging educational resources, and we thought there’s no better person than Frank, who has advised the FBI for over 40 years now, to teach people how to catch the scam,” Ranson said.

For Abagnale’s part, he relates that he is encouraged by HEB’s efforts to focus seniors on how they may be victimized, and in his experience the approach the bank is taking is unique.

“I can’t tell you how many speeches and seminars I’ve given over the years on financial fraud, but what I can tell is that ‘Catch the Scam’ is the first of its kind that I’m aware of,” Abagnale said. “I’ll be honest, it didn’t take much convincing from HomeEquity Bank for me to get involved. if I can help teach older Canadians how to be vigilant and stay safe from scammers, then that’s something I want to be a part of.”

The high percentage of survey respondents who’ve reported increased scamming activity since the onset of the pandemic has only made the situation worse, which was also a motivator for his involvement, Abagnale said.

“The COVID-19 global pandemic has proven to be fertile ground for scammers to grow their criminal activities, at a time when older Canadians are suffering disproportionately,” he said. “By partnering with HomeEquity Bank for ‘Catch the Scam,’ we have an opportunity to fight back by giving Canadians insights into how these fraudsters think and operate — and beat them at their own game.”

The video series

HEB and Abagnale have created a series of four short videos all touching on a different scam-related topic. The first video, “The CRA Scam,” details how Canadians can spot a scam related to a fraudster posing as a representative of the Canada Revenue Agency (CRA). In the next video, “The Romance Scam,” Abagnale explains how someone may attempt to pose as a potential romantic partner in an effort to swindle a senior out of their money.

In “The Lottery Scam,” Abagnale details how a scammer attempts to convince someone that a stroke of luck has led a victim to win a large sum of cash, but which often requires the “winner” to pay an “upfront fee” to access “winnings.”

“The scam caller will keep your emotions running high, so you ignore the fact that you never even entered a lottery,” Abagnale explains in the third video. “[Which makes] you lawfully entitled to absolutely nothing.”

The final video, “The Grandparent Scam,” is based on a caller posing as the grandchild of the scam victim, asking for sensitive personal information or financial “assistance.” Sometimes the call can come in a hurried fashion which may prompt the victim to reveal some semblance of personal information, such as the name of a grandchild that the scammer can assume in his or her interactions with the victim.

“While it’s impossible to prevent all scams from taking place, what we can do is educate older Canadians on what to watch out for and to provide them with the right tools to make the right decisions,” Abagnale said about the campaign. “No matter how educated or tech savvy you may be, anyone can be scammed. Fact is, scammers steal over $100 million (CAD) from Canadians every year and with ‘Catch the Scam,’ we’re aiming to put a stop to that through a series of educational videos that will empower you to protect yourself and the ones you love.“

A universal problem

Pandemic-related fraud is also unsurprisingly a growing problem in the United States. Earlier this month, the National Credit Union Administration (NCUA) issued a risk alert advising that fraudsters are actively attempting to take advantage of relief programs instituted by the federal government since the pandemic began, particularly as it relates to provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The U.S. Department of Housing and Urban Development (HUD) Office of the Inspector General (OIG) also issued a fraud bulletin aiming to warn American seniors about reverse mortgage scams, noting that interest in the product category has risen due to the ongoing economic impacts of the pandemic.

The full series can be viewed either at HEB’s dedicated website for the campaign, or at the bank’s YouTube channel. Yvonne Ziomecki, HEB EVP of marketing and sales, is scheduled to speak at RMD’s upcoming virtual HEQ event where she will discuss marketing practices and how HEB’s efforts have expanded the bank’s reverse mortgage business.