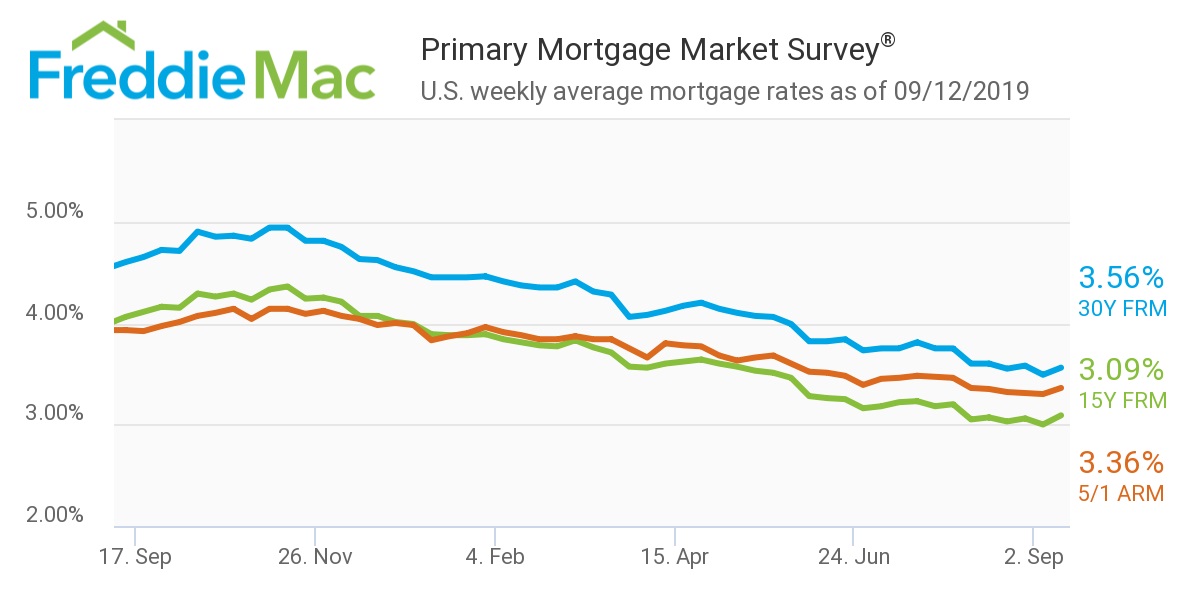

This week, the average U.S. fixed rate for a 30-year mortgage reversed course, averaging 3.56%. That's seven basis points above last week’s three-year low of 3.49% but more than a percentage point lower than the 4.6% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“Pipeline purchase demand continues to improve heading into the late fall as purchase mortgage applications are up 9% from a year ago,” Freddie Mac Chief Economist Sam Khater said. “The improved demand reflects the still healthy underlying consumer economic fundamentals such as a low unemployment rate, solid wage growth and low mortgage rates.”

While there has been a material weakness in manufacturing and consistent trade uncertainty, Khater says so far, the American consumer has proved to be resilient with solid home purchase demand.

The 15-year FRM averaged 3.09% this week, ticking up from last week’s 3%. This time last year, the 15-year FRM came in at 4.06%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.36%, slightly up from last week’s rate of 3.3%. This rate is still a large decline from the same week in 2018 when it averaged 3.93%.

The image below highlights this week's changes: