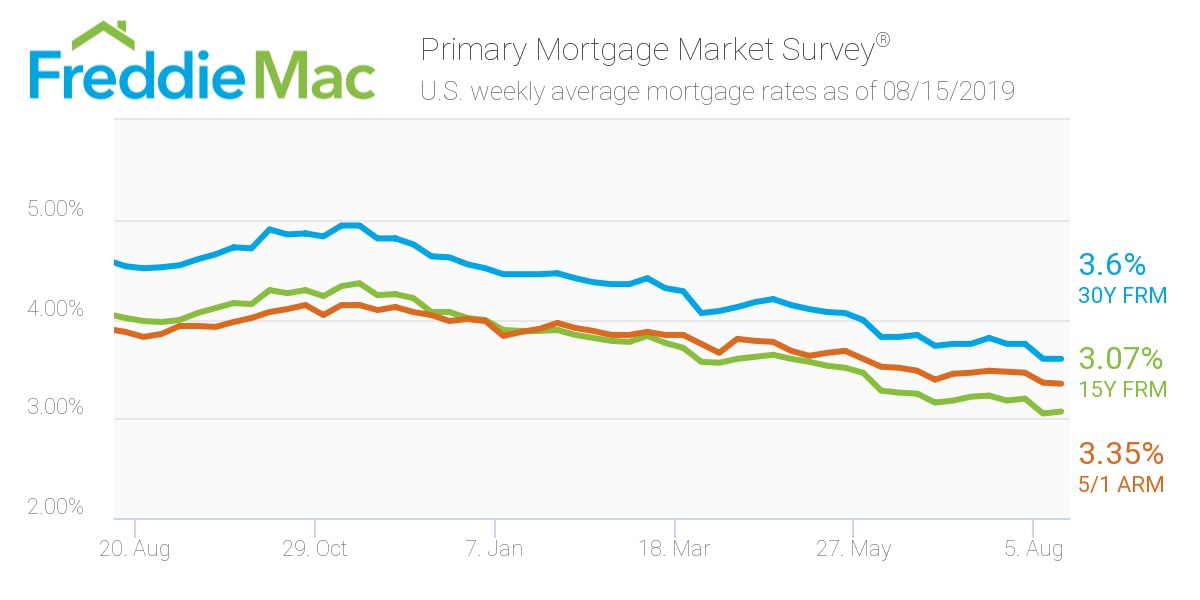

This week, the 30-year, fixed-rate mortgage held steady from one week prior, averaging 3.6%. This rate sits significantly lower than its 2018 average of 4.53%, according to the Freddie Mac Primary Mortgage Market Survey.

Freddie Mac Chief Economist Sam Khater said the sound and fury of the financial markets continue to warn of an impending recession, however, the silver lining is that mortgage demand reached a three-year high this week.

“The decline in mortgage rates over the last month is causing a spike in refinancing activity – as homeowners currently have $2 trillion in conventional mortgage loans that are in the money – which will help support consumer balance sheets and increase household cash flow,” Khater said. “On top of that, purchase demand is up 7% from a year ago.”

The 15-year FRM averaged 3.07% this week, inching forward from last week’s 3.05%. This time last year, the 15-year FRM came in at 4.01%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.35%, sliding from last week’s rate of 3.36%. This rate is much lower than the same week in 2018 when it averaged 3.87%.

The image below highlights this week’s changes: