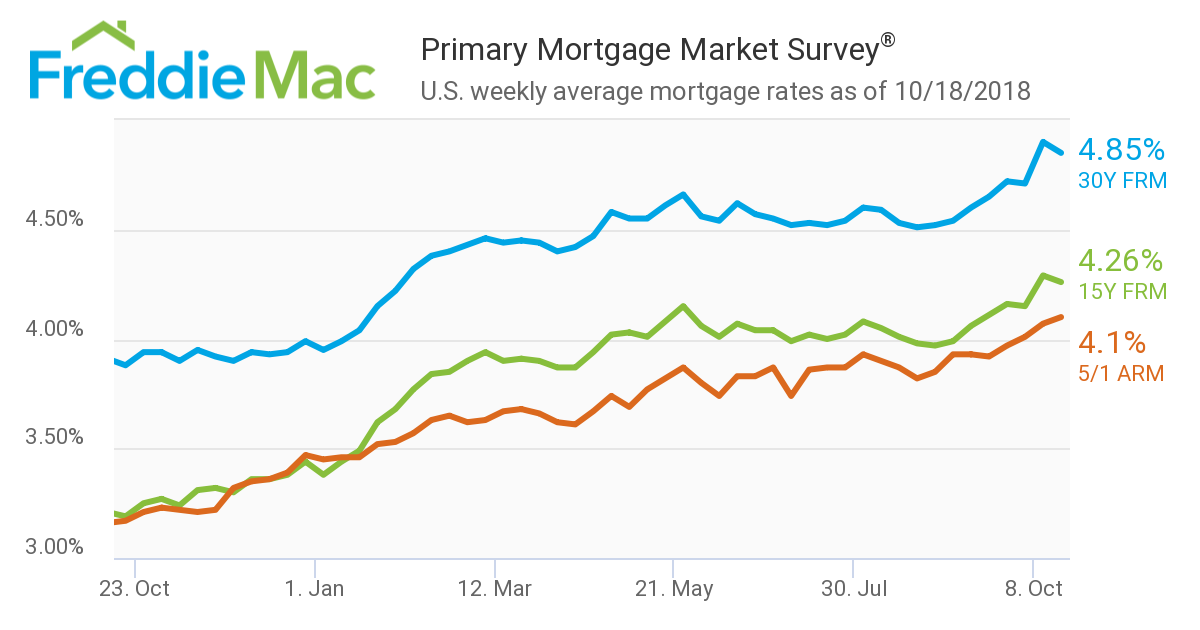

After weeks of continual increases, mortgage rates finally slowed down, according to Freddie Mac’s latest Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage averaged 4.85% for the week ending Oct. 18, 2018, falling from 4.9% last week, but still much higher than last year’s rate of 3.88%.

Freddie Mac Chief Economist Sam Khater said the modest decline in mortgage rates is a welcome respite from the rapid increase in rates the last few weeks.

“While the housing market has clearly softened in reaction to the rise in mortgage rates, the economy and consumer sentiment remain very robust and that will sustain purchase demand, particularly in affordable markets and neighborhoods,” Khater said.

(Source: Freddie Mac)

The 15-year FRM averaged 4.26% this week, sliding down from last week's 4.29%. This time last year, the 15-year FRM was 3.19%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.1% this week, moderately increasing from 4.07% last week. This is still significantly higher than this time last year when it averaged 3.17%.

NOTE: Freddie Mac surveys a mix of lenders, including thrifts, credit unions, commercial banks and mortgage lending companies. The survey is roughly proportional to the level of mortgage business that each type commands nationwide. The survey is based on first-lien prime conventional conforming home purchase mortgages with a loan-to-value of 80%.