We know that eight out of 10 seniors would prefer to retire in their home, but enabling older adults to age in place requires more than a reverse mortgage. Seniors must have access to all the support services they need to accomplish this goal. The United States Government Accountability Office (GAO) recently recommended that a cross-agency, federal strategy—probably led by the Administration on Aging (AoA)—is needed to help ensure efficient and effective use of federal resources for the delivery of Home and Community-Based Services (HCBS). (To view the analysis, visit gao.gov/products/GAO-15-190.)

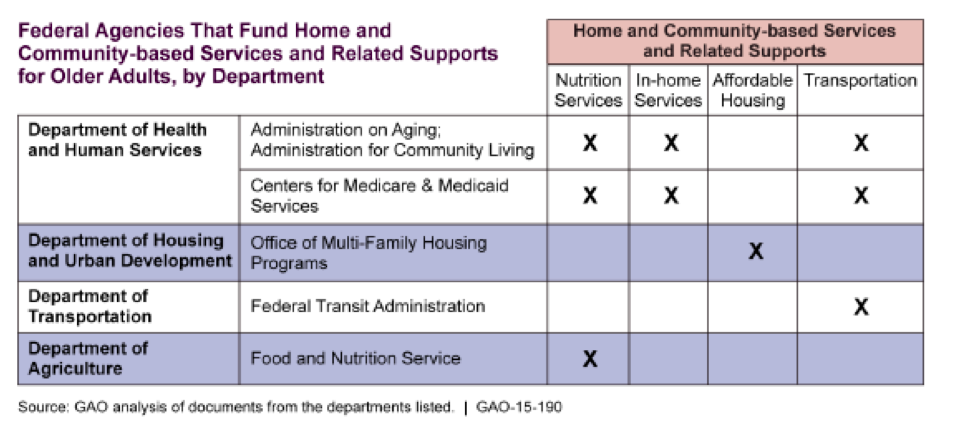

Five federal agencies within four departments currently fund HCBS that support seniors’ ability to live independently in their own homes.

The Older Americans Act (OAA) of 1965 was the first federal initative designed to address retirement issues. The OAA was passed as part of Lyndon Johnson’s “Great Society” reforms that promised to eliminate poverty and racial injustice, while providing new jobs and affordable health care for all. Sound familiar?

Why am I talking about a 50-year-old act? Because that structure is still the cornerstone of all federal HCBS systems that support older adults in 2015. I think that spells opportunity for progress.

The GAO stated that seven out of 10 Americans 65 and older will need long-term care services at some point in their lives for a period of at least three years. Twenty percent of those will need help for five years or more. Of course, as the senior population grows to more than

20 percent of the U.S. population by 2050, the need for long-term care will only increase, especially for those 85 and older.

The GAO report states that there is no plan for how the OAA is going to fund this growing need. In fact, it says the current multiple-federal-agency model is actually lowering the quality and increasing the cost of care, while causing the premature institutionalization of our seniors.

The GAO study offers few solutions but does highlight the “village models” that have popped up across the country, where senior members pay a monthly due of $400-$500, on average, typically to a nonprofit organization that serves as manager. These villages recruit volunteers and hire services for things like laundry, food delivery, medical care, entertainment, home repair and transportation.

The GAO is excited about the village model because it enables seniors to age in place as they desire, but more importantly, federal funding only accounts for 5 percent of these villages’ operating budgets on average. Most of the funding is member-provided, so these villages are enabling older adults to live independently and not drain federal funds.

So what does Uber have to do with this? Well, if I asked you a few years ago if a new cab service would outnumber yellow cabs in NYC in 2015, you’d probably have said it’s not likely. By leveraging technology, Uber is replacing service models that have been in place for decades. I believe Uber-type service models will open up new possibilities for HCBS.

Interestingly enough, transportation is cited as a top concern for older adults. Public transportation is not as suitable for older adults as it is for younger adults. It turns out the traditional kitchen-table conversation is exactly what seniors want. It also makes me want to ask those lawmakers who are trying to force seniors to drive to counseling, “Whose interests are you representing anyway? Are you that out of touch with seniors?”

The problem with villages—and why they mainly exist for middle- to higher-income members—is that older adults need to have income to pay dues and fund services. So given that home equity is the largest asset most older adults have, I bet more people could afford to join these villages if they used a reverse mortgage to turn that home equity into cash. It could be the key to funding Uber retirement.

This is also why homeownership is the best investment most younger adults can make, but that is another discussion for another day.