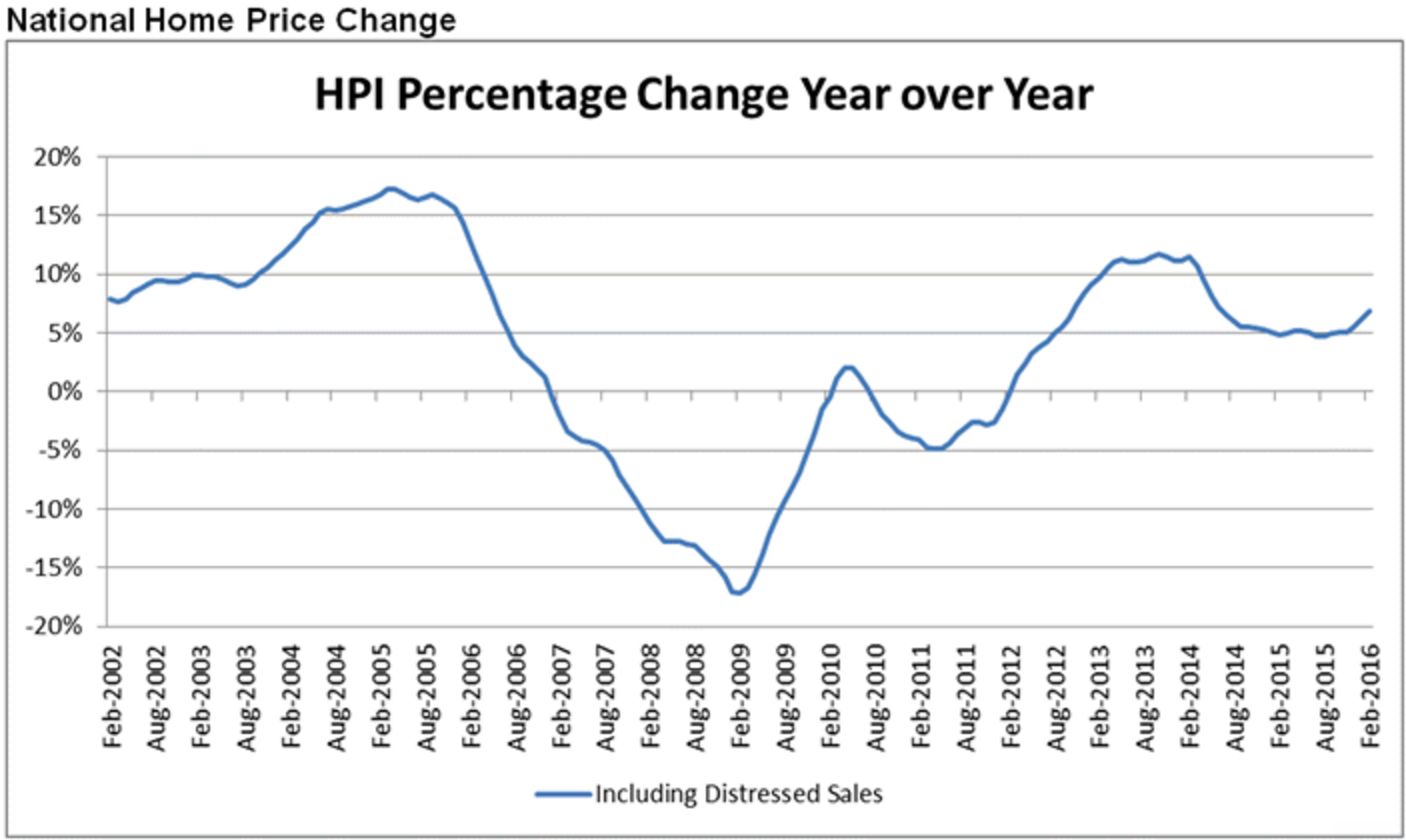

Home prices nationwide, including distressed sales, increased year over year by 6.8% in February 2016 compared with February 2015 and increased month over month by 1.1% in February 2016 compared with January 2016, according to the most recent report from housing data services provider, CoreLogic.

Click to enlarge

(Source: CoreLogic)

"Fixed-rate mortgage rates dropped more than one-quarter of a percentage point in the first three months of 2016, and job creation averaged 209,000 over the same period," said Dr. Frank Nothaft, chief economist for CoreLogic.

"These economic forces will sustain home purchases during the spring and support the 5.2% home price appreciation CoreLogic has projected for the next year," added Nothaft.

CoreLogic noted the sizable drop in mortgage rates in the first quarter alongside continued employment gains, most likely supporting the pace of home purchases this spring and continued price appreciation.

According to the report, two states topped the list for the biggest yearly price gains in February. Washington exceeded with 12.4% and Colorado at 10.5%.

For states such as Louisiana, West Virginia and New Jersey, home prices declined. New Jersey brought in 1.6%, Louisiana 0.5% and West Virginia 0.5% respectfully.

"Home prices continue to rise across the U.S. with every state posting year-over-year gains during the last 12 months," said Anand Nallathambi, president and CEO of CoreLogic. "Improved economic conditions and tight inventories continue to drive exceptionally strong gains in many markets, especially for homes priced below $500,000."