While it’s currently a great time to buy a home, there are certain cities that bode better than others when it comes to affordability.

Credit Karma gathered data from its portion of more than 40 million members that have a mortgage (used as a proxy for national property values) to find out where Millennials might be more likely to be able to afford homes.

To create its list of most affordable markets, Credit Karma compared how much a Millennial might expect to make if they work in a particular city and the current average dollar amount for a mortgage in the same area, in order to see how long it would take someone to pay off their mortgage.

As an added note from Credit Karma, the data assesses how quickly 18-34 year-olds could pay off their mortgages, presuming they paid 28% of their incomes (the bank recommended limit) toward them.

To help put this in perspective, Credit Karma added that the average Millennial in Buffalo, New York might expect to pay off their mortgage in 107.4 months (8.95 years), compared to those living in Los Angeles, where they could be paying theirs in as many as 534.2 months (44.5 years).

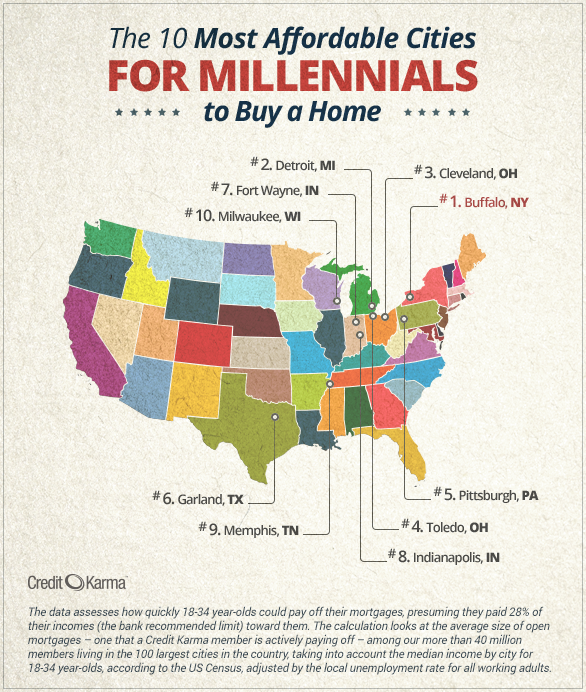

Here’s a chart of the 10 most affordable cities for Millennials looking to buy homes (by average months to pay off a mortgage in that city):

Click to enlarge

(Source: Credit Karma)