Despite a harsh housing landscape, Rocket Companies, the parent of Rocket Mortgage, performed better than expected in the second quarter of 2022.

When mortgage rates started climbing in the spring of 2022, Rocket, America’s largest mortgage originator as recently as a year ago, was forced to target the purchase market – not the lender’s traditional strength. And a larger challenge for Rocket has been proving itself as a fintech, building a funnel and growing far beyond mortgage.

Executives touched on Rocket’s progress in its earnings call. Here are the three biggest takeaways from the Q2 2023 earnings call with analysts on Thursday.

1. Growth in purchase mortgage origination

Analysts were particularly interested in seeing how much purchase mortgage origination/ market share the lender achieved in Q2 2023. Rocket has been on a local loan officer hiring spree, an initiative that the company has accelerated this year with refis drying up.

Bill Emerson, the interim CEO of Rocket Companies, mentioned that its purchase market share grew on both a year-over-year and quarter-over-quarter basis but didn’t disclose further details.

Rocket has never provided a breakdown of its purchase business versus refis in its earnings reports. What Rocket did say is that purchase market share gains came from both the direct-to-consumer and Rocket Pro TPO channels.

“We’ve seen growth in both channels. It’s not specific or exclusive to one or the other and we’re actually happy about the growth in both,” Emerson said.

While more than 80% of Rocket’s volume in 2020 and 2021 came from refinancings, the lender is making progress in its transition from refi to purchase, according to data from Inside Mortgage Finance (IMF).

Rocket’s share of purchase business jumped to 55% in the first three months of 2023, data showed. That share lags behind the top 50 mortgage lenders of 84.7% but Rocket’s purchase volume in the first quarter came in at $9.4 billion, ranking third on IMF’s rankings.

Emerson also affirmed that its overall mortgage strategy has not changed – perhaps a response to HousingWire’s feature on whether Rocket hiring local loan officers represents a potential move to a more distributed retail model.

Buy+ and Sell+ products that allow consumers to save when partnering up with a Rocket Homes partner agent have helped in achieving purchase market gains, the company noted.

“We’re seeing referral numbers to Rocket Homes up significantly. So that indicates to us that realtors are interested in what we have to offer and passing that on to their clients (…) We have been excited to see that increase. I know Rocket Homes has been happy to see it. So it seems like the real estate community is reacting positively to this particular program,” Emerson told analysts.

While demand for new homes for sale have been on the rise due to a rate lock-in effect, most home sales – roughly between 70-75% – are going to be existing home sales. Rocket is set on going after that market.

“Eventually the market will be efficient. The home builders are doing great and they’re striking while the iron is hot, which is great for them but existing home sales in every market still are going to be the lion’s share of all home sales,” Brian Brown, CFO, told analysts when asked about Rocket’s potential partnerships with homebuilders.

“We are constantly working with builders on that, but that’s not going to show any short-term positive impact for us from a closed loan perspective along the line,” Emerson said.

2. Rocket wants to take off as a fintech company

Executives mentioned the words “platform” and “ecosystem” about 10 times during the earnings call to emphasize Rocket’s aims to engage clients ranging from personal loans, financial wellness, home searching and home financing.

“We’re upending the traditional mortgage business model by diversifying client acquisition channels, lowering client acquisition costs and engaging our clients throughout their lifetime thereby lifting conversion from lead to close. We’re dedicated to growing the business by significantly elevating the client experience through a comprehensive ecosystem,” Emerson said.

Rocket plans to double down on and invest in products including Buy+ and Rocket Rewards — products that are working, Emerson added.

Bringing Rocket’s long-term vision of becoming a financial tech company will be propelled with Varun Krishna – veteran in the fintech world – taking the helm as CEO of the company.

“We were looking for somebody who had great business acumen, somebody who had consumer product skill sets, somebody who was really good with people (…) someone that would be able to come in here and paint a great strategic vision for the organization, someone who had alignment with us in the fintech space and the abilities that we have in the things that we’re looking to do as it relates to expanding our business and our platform and our ecosystem,” Emerson explained on the reasons why Rocket brought in Varun.

3. Making the hard choices

Prioritizing on what Rocket does best and cutting the rest is what the company is focused on.

In Q2, Rocket pivoted to only offering solar financing through Rocket Loans, shedding a sales platform for solar. It also sunset operations on Rocket Auto.

“Solar sales arm and Rocket Auto businesses were good things at the time and showed some success but aren’t meeting our return thresholds,” Brown told analysts.

These measures are expected to save costs between $150 million and $200 million on an annualized basis. Rocket expects a full quarter of cost saving to begin in Q4.

Rocket offered its third round of voluntary buyouts in Q2, in which a one-time cost of about $50 to $60 million related to the voluntary career transition program will occur in the third quarter.

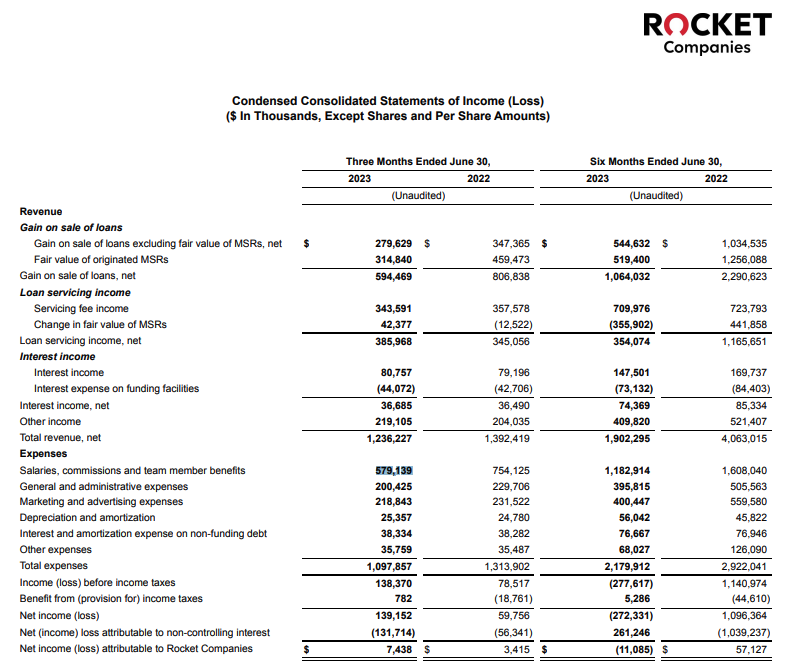

Of the $1.1 billion expenses posted for Q2, almost half of that cost came from salaries/commissions, which dropped to $579.1 million in Q2 from $603.8 million in Q1. Expenses for salaries and commissions also dropped from $ 754.1 million in Q2 2022.

Meanwhile, marketing/advertising rose to $218.8 million in Q2 from $181.6 million in Q1. Expenses for marketing and advertising, however, dropped from $231.5 million in Q2 2022.

Executives previously said in the company’s Q1 earnings that Rocket expects increased marketing spend for the launch of its signature Rocket credit card and nationwide Buy+ campaign.

Rocket expects expenses for Q3 to be roughly flat compared to Q2, excluding the $50 million to $60 million in a one-time charge related to the voluntary career transition program.

“As we have consistently demonstrated over the last 18 months we are committed to operating an efficient business with continued focus on profitability,” Brown said.