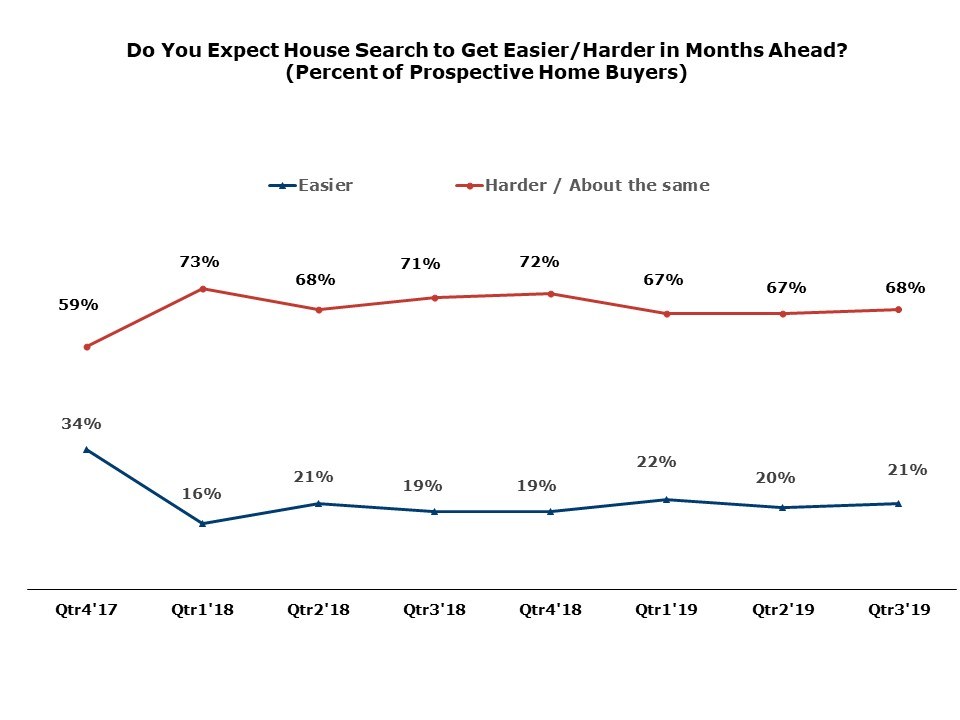

According to the National Association of Home Builders Housing Trend Report, only 21% of people planning to purchase a home think it’s getting easier to do so.

On the positive side, it’s an improvement from last year’s report, when 19% of the survey respondents said the same thing.

Conversely, 68% of homebuyers say they expect searching for a house to get harder or stay the same, which is less than the 71% who also thought so in 2018.

In the third quarter of this year, 29% of buyers said they saw more homes on the market compared to three months earlier.

This remains virtually unchanged from last year’s total when 30% reported seeing increasing housing availability.

The share of potential buyers who saw fewer or the same number of homes for sale was 59%, a small decline from last year’s 60%.

As we near the end of 2019, economists forecast that there will be less homes available on the market, and a recession is likely. However, homebuyers remain positive, yet wary.

Older buyers also say they expect a worsening housing availability. Recently, multi-generational homes have been on the rise, with the size of homes getting bigger and housing availability gets smaller.

Interestingly, the number of homebuyers who see homes they like and can afford declined as the buyers’ age increased.

Of those homebuyers, 41% of Gen Z, 32% of Millennials, 23% of Gen X, and 18% of Baby Boomer homebuyers said they can afford the house they like.

Regionally, buyers in the West are the most likely to report improving housing conditions, at 36%, while those in the Midwest are the least likely to report an improvement, at 23%.

Geographically, at least two-thirds of buyers in every region expect their search for a home to get harder or stay the same.