Most economists are no longer predicting a 2020 recession. HousingWire has covered this here and here. However, many first-time homebuyers may still be tentative from the last recession; our own Brena Nath discusses in this HW+ premium article.

This month, the United States set a record for the longest economic expansion, but this is forecasted to end in 2020.

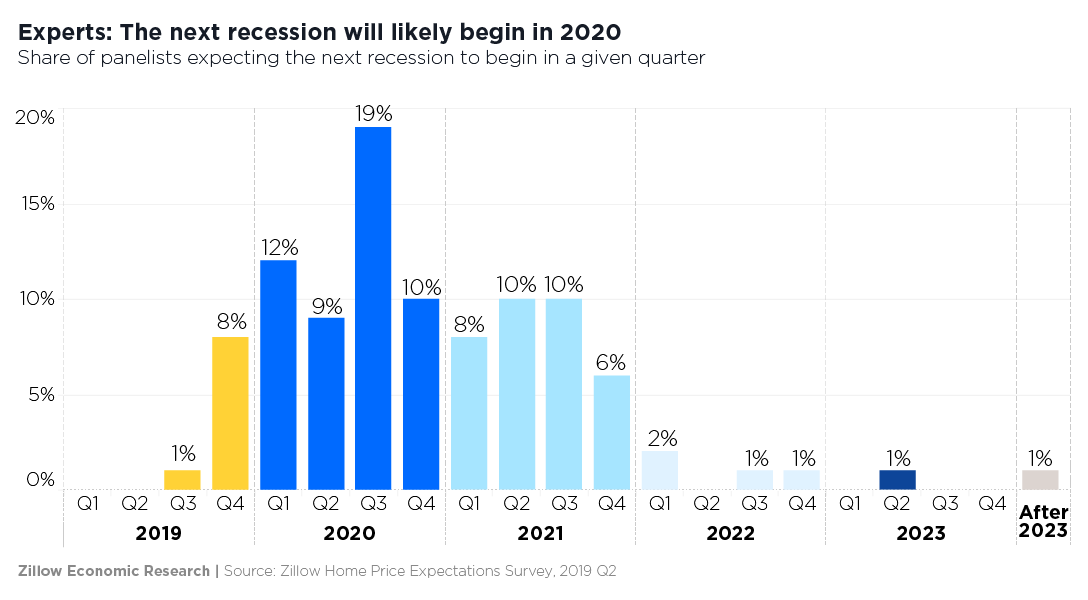

According to a panel of more than 100 housing experts and economists, the next recession is expected to hit in 2020. A few even said it may begin later in 2019, while another substantial portion predicts that a recession will occur in 2021. But unlike last time, the housing market won’t be the cause.

Trade policy, a geopolitical crisis and/or a stock market correction were the identifying factors found by the panelists to cause the recession. But that doesn’t mean that housing will be immune to the effects of a recession.

“Housing slowdowns have been a major component, if not catalyst, for economic recessions in the past, but that won’t be the case the next time around, primarily because housing will have worked out its kinks ahead of time,” said Skylar Olsen, Zillow director of economic research.

Even if a housing slowdown won’t be a contributing factor to the cause of the recession, 51% of the panelists expect that home buying will be lower in 2020, while 17% think home buying will increase.

“Housing markets across the country are already heading into a potential correction a solid year before the overall economy is expected to experience the same,” Olsen said. “The current housing slowdown is in some ways a return to balance that will help increase the resiliency of the housing market when the next recession does arrive.”

This means homes will stay on the market longer, and bidding wars will be less common.

The current expansion has broken the record of the previous one, 120 months, between 1990 and 2001.

Beginning in 2009, this expansion sent the unemployment rate to a half-century low and subdued inflation.

In June, Bloomberg reported in the first 39 quarters of the record expansion of 1991-2001, gross domestic product increased 43%. In the 39 quarters through March 2019, U.S. GDP grew just 22%.

“More than any other factor with the potential to impact home-buying demand through 2020, mortgage rates are viewed by our expert panel to be most significant,” said Pulsenomics Founder Terry Loebs, whose company conducted the survey.

“The data suggest that most experts believe the recent rate move is a temporary dip, and that home-buying demand through next year will be dampened by other, more persistent factors that affect affordability, such as constrained inventory and the growth of house prices relative to wages,” he added.