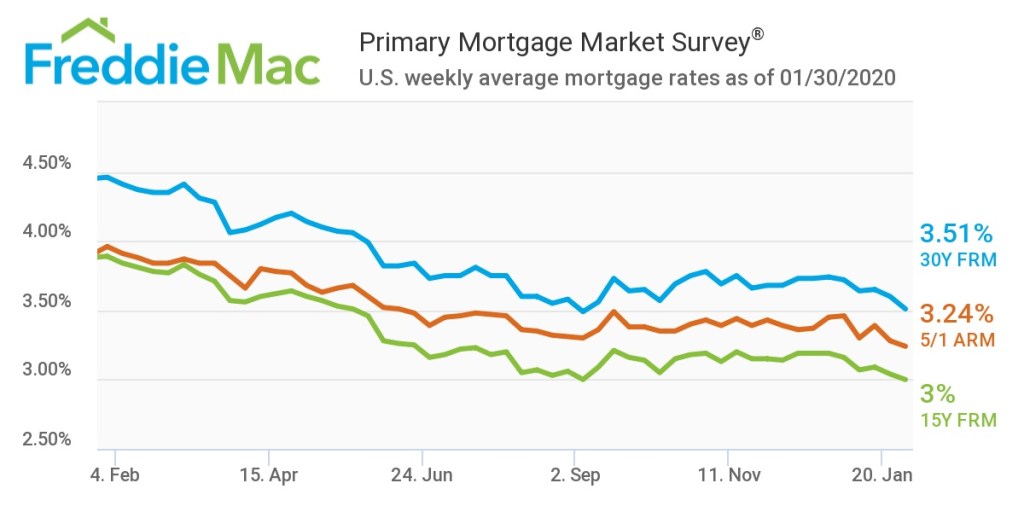

This week, the average U.S. fixed rate for a 30-year mortgage averaged 3.51%, dropping to the second-lowest level in three years.

The pace is now 95 basis points below the 4.46% rate of the same week last year, according to the Freddie Mac Primary Mortgage Market Survey.

“This week’s mortgage rates were the second-lowest in three years, supporting homebuyer demand and leading to higher refinancing activity,” said Sam Khater, Freddie Mac’s chief economist. “Borrowers who take advantage of these low rates can improve their cash flow by lowering their monthly mortgage payments, giving them more money to spend or save.”

According to the survey, the 15-year FRM averaged 3% this week, sliding from last week’s rate of 3.04%. During the same time period in 2019, the 15-year FRM came in at 3.89%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.24% this week, falling from last week’s rate of 3.28%. This time last year, the 5-year ARM averaged 3.96%.

The image below highlights this week’s changes: