Analysts at Janney Capital Markets are maintaining a positive outlook on Ally Financial, citing expectations the lender’s performance will improve as the Treasury’s stake in the business is greatly reduced. The Treasury Department said earlier in the year it would sell $2.7 billion in trust-preferred securities that it holds in Ally Financial (GJM) to cut its stake in the former lending arm of General Motors (GM). The government bailed out the lender during the financial crisis. By the onset of 2011, the Treasury owned 74% of outstanding common Ally stock, and an additional $5.9 billion in mandatory convertible preferred stock. In March, Ally launched an initial public offering, announcing plans for the federal government to raise at least $100 million in proceeds, thereby reducing the fed’s stake in the company. News reports suggest the $100 million figure is just a place holder and the government intends to sell as much as $5 billion when it comes to its stake in Ally, according to the Wall Street Journal. Janney Capital said Wednesday Ally’s asset quality is improving, with net charge-off rates falling 80 basis points over last year to 0.7%. Analysts at Janney said this drop is tied to “more stringent origination requirements and the burnout of legacy mortgages.” Meanwhile, Ally’s subsidiary Ally Bank noted that deposits are growing and increased to $40.7 billion by the end of the first quarter. Even though the bank experienced a minor decline in the availability of liquidity, Janney Capital said: “Ally Bank showed good cash levels, attributable to the growth in deposits and an asset-backed securities sale.” Write to Kerri Panchuk.

Janney Capital maintains positive outlook for Ally Financial

Most Popular Articles

Latest Articles

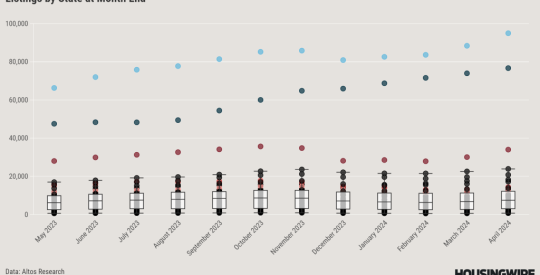

The Texas-size problem with housing inventory figures

National listings growth isn’t necessarily a boon to all housing professionals: after all, the growth is highly concentrated in Texas and Florida.