Mortgage credit in August was the tightest in more than six years as a weak economy prompted lenders to tighten standards, the Mortgage Bankers Association said in a report on Thursday.

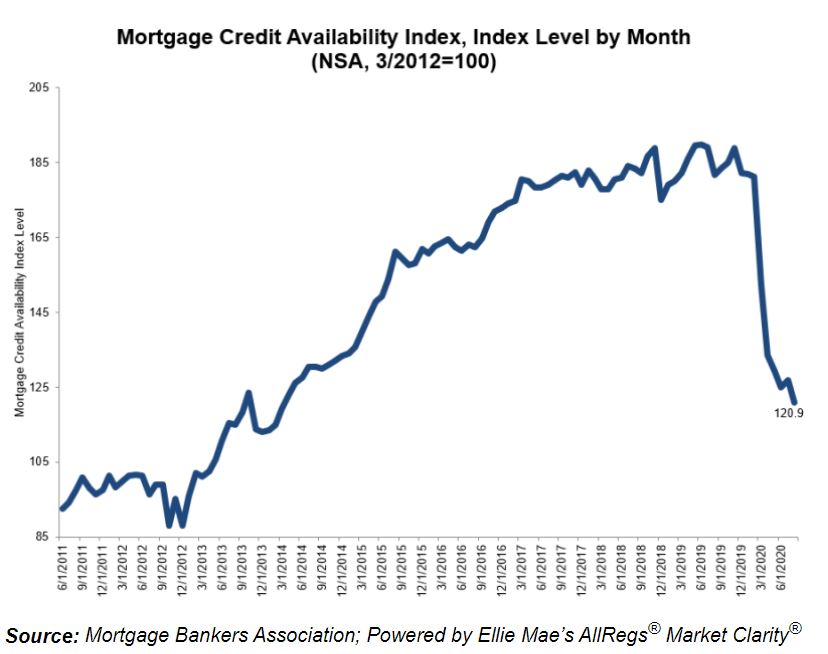

The group’s Mortgage Credit Availability Index fell 4.7% to 120.9 last month, the lowest since March 2014, indicating stricter requirements to get loans. The index plunged from record highs seen in late 2019 after the COVID-19 pandemic caused the worst economic contraction since the Great Depression.

The drop in the availability of credit was “driven by a reduction in supply from both conventional and government segments of the market,” said Joel Kan, an MBA associate vice president.

Measuring credit availability by loan type, the Conforming MCAI that tracks loans backed by Fannie Mae and Freddie Mac fell 8.6% to the lowest in the data series that goes back to 2011, the report said. The Jumbo MCAI measuring high-balance loans fell 8.9%, and the Conventional MCAI that measures loans not backed by the government fell 8.7%.

The Government MCAI that includes mortgages backed by the Federal Housing Administration, the Veterans Administration and the U.S. Department of Agriculture fell by 1.4%, MBA said.

“Credit continues to tighten because of uncertainty still looming around the health of the job market,” Kan said. “A further reduction in loan programs with low credit scores, high LTVs, and reduced documentation requirements also continued to drive the overall decline in credit availability.”

The MBA’s credit availability indices analyze data from Ellie Mae’s AllRegs Market Clarity covering several factors related to borrower eligibility such as credit scores, loan type, and loan-to-value ratios. The data comes from about 95 lenders and investors, MBA said.

Even with tighter standards, the lowest mortgage rates on record will push home lending this year to a 15-year high of $3 trillion, MBA said in an Aug. 20 forecast. Refinancing probably will reach $1.7 trillion, the most since 2003, MBA said.